Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 Sep, 2025

By Yuzo Yamaguchi and Cheska Lozano

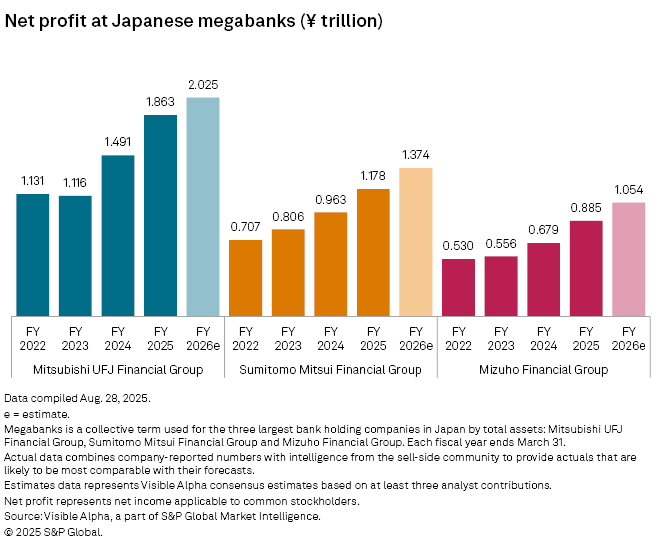

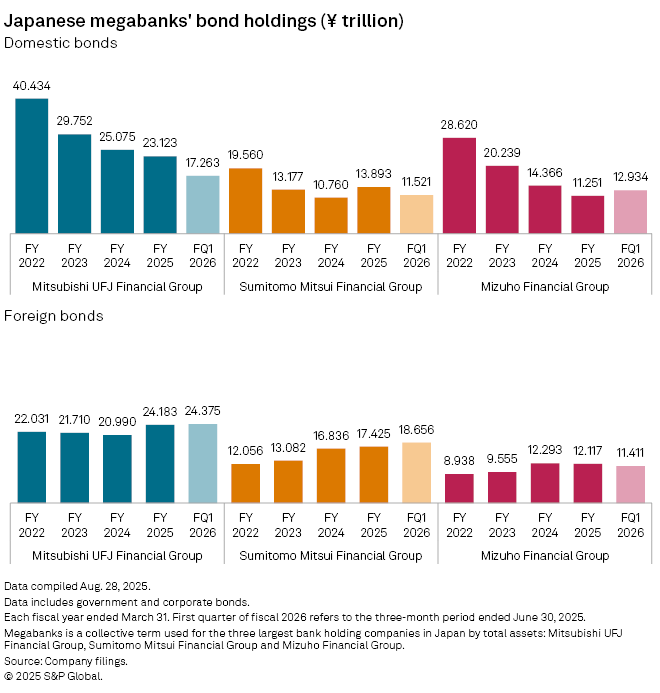

Three Japanese megabanks are likely to increase their foreign bond purchases and scale back on local government bonds, aiming to take advantage of the contrary interest rate cycles in both economies.

Mitsubishi UFJ Financial Group Inc., Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. have increased their holdings of foreign bonds, including US Treasurys, over the past several years, in a shift away from yen bonds with rising yields, according to data from the megabanks. This is expected to support the banks' earnings and could help achieve income targets in the current fiscal year ending March 31, 2026.

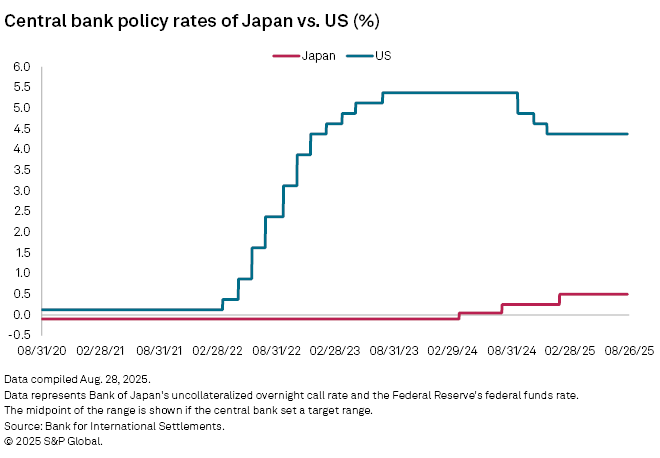

"Putting money into Japanese government bonds would be riskier as interest rates in Japan are moving up," said Hideo Oshima, a senior economist at the Japan Research Institute. "US interest rates are on a downward trend ... that would make it easier for them to raise [dollar-denominated] funds and invest them into less-risky foreign bonds." Prices of existing bonds move inversely with interest rates.

Many economists expect the US Federal Reserve to resume rate cuts, with the first reduction likely in September. They expect the US central bank to cut rates two times in 2025, increasing the urgency for Japanese banks to buy US Treasurys as prices may rise. The Fed maintained its policy rate between 4.25% to 4.5% at its July policy meeting after its last cut in December 2024.

"The stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance. Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance," Fed Chair Jerome Powell said at the annual Jackson Hole conference in Wyoming on Aug. 22.

Economists took Powell's remarks as an indication of a possible rate cut at a policy meeting on Sept. 16-17. "Powell showered a clear assessment that the downside risk to unemployment is growing," Takahide Kiuchi, executive economist at Nomura Research Institute, said in a note on Aug. 25.

"The tone of the US market suggests a rate cut," said Toyoki Sameshima, a senior analyst at SBI Securities Co. "So they [the megabanks] may be thinking they'll go ahead and buy more [foreign bonds] with higher yields."

The US 10-year yields declined to 4.217% on Aug. 28 from 4.556% at the beginning of the year, pushing up prices. The same yields of the Japanese government bonds shot up to 1.611% from 1.114% during the same period, causing some unrealized losses for investors. Bond yields move inversely to their prices.

"The financial markets are factoring rate cuts in the US, preventing the Japanese yen from spiking against the dollar and Japan's exports from tumbling," said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management. "The US rate cuts are unlikely to affect Japan's monetary policy shift."

Rate hikes in Japan would also be supported by the US-Japan trade deal that alleviates the uncertainties for the Japanese economy. Some economists forecast another 25-basis-point hike as soon as October. The Bank of Japan left its policy rate at 0.5% at its policy meeting on July 31, the fourth consecutive stand-pat call. The Bank of Japan last raised its rate by 25 basis points to the current level in January after abandoning its negative rate policy in March 2024.

Mitsubishi UFJ Financial Group said it increased its outstanding holdings of foreign bonds, including US Treasurys, to ¥24.375 trillion at the end of its fiscal first quarter in June 2025 from ¥22.03 trillion in March 2022, the end of the fiscal year. Japan's biggest lender by assets cut back on its Japanese bond investments, including government bonds, by more than half to ¥17.263 trillion from ¥40.434 trillion during the same period.

Sumitomo Mitsui Financial Group lifted its foreign bond holdings to ¥18.656 trillion from ¥12.056 trillion during the same time frame, data from the lender shows. In Japan, the bank curtailed its holdings of yen bonds to ¥11.521 trillion from ¥19.56 trillion. Mizuho boosted its overseas bond purchase to ¥11.411 trillion from ¥8.938 trillion while slashing its domestic bonds to ¥12.934 trillion from ¥28.62 trillion.

Spokespeople at the three banks declined to discuss their asset allocation strategy.

"They won't make big bets on the Japanese bonds before rates move up," said SBI Securities' Sameshima.

The Japanese megabanks were mired in bloated unrealized losses from their foreign bond investments after the collapse of US regional lender Silicon Valley Bank in March 2023 roiled the US financial market. Mitsubishi UFJ Financial Group, for example, posted a latent loss of nearly ¥1 trillion in the following year before reducing it to ¥70 billion in June 2025.