Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Sep, 2025

By Tom Jacobs and Jason Woleben

Property and casualty insurers' stocks limped to the finish line of an up-and-down third quarter in the market, despite some impressive gains recorded by large-cap insurers.

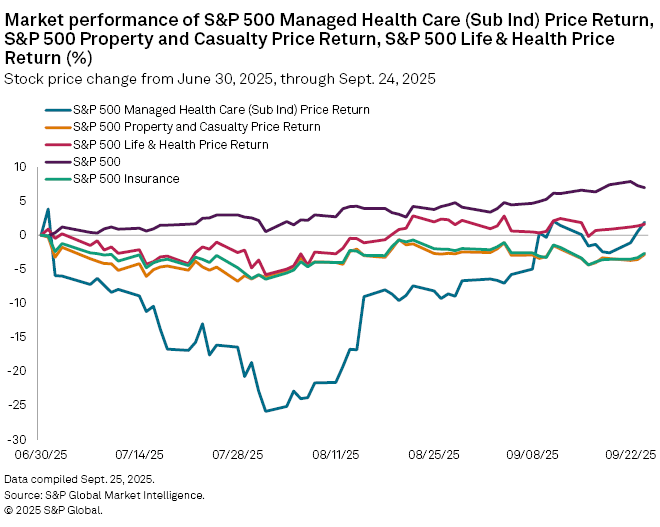

The S&P 500, up 6.98%, easily outpaced the S&P 500 Insurance Index, which was down 2.65% as of market close on Sept. 24. Meanwhile, the S&P 500 P&C Index was down 2.82%, while the S&P 500 Managed Health Care and Life and Health indexes were up 1.91% and 1.62%, respectively.

The negative numbers for the P&C companies, and the insurance sector as a whole, made for an "underwhelming" third quarter, said CFRA Research analyst Cathy Seifert. She said the results are a reversal of fortune compared to 2024.

"If you look at it against the backdrop of the broader financial sector or even the broader market, insurance stocks last year were one of the better performing financial groups," Seifert said in an interview. " This year, we've seen a turnaround, and they've been replaced by a lot of risk-on bets, such as investment banks, some large-cap banks, and a select number of asset managers."

Top 10 for the quarter

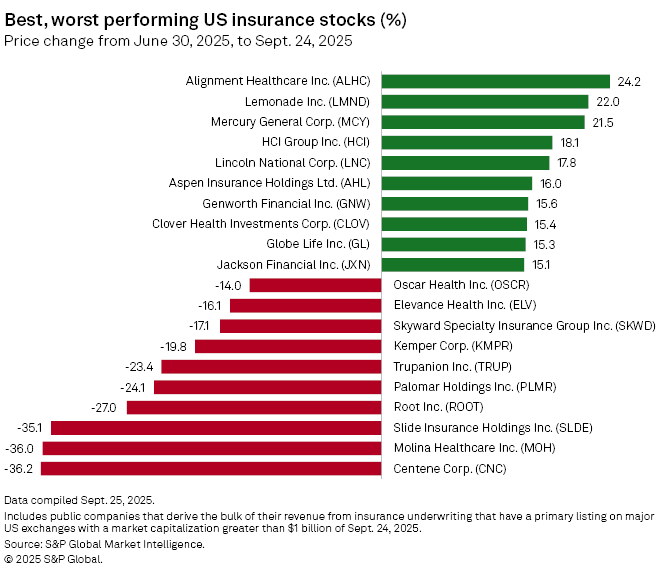

Life and health insurers had four companies among the top 10 performing insurance stocks in the quarter, according to an S&P Global Market Intelligence analysis of insurers with market caps in excess of $1 billion. Four P&C carriers and two managed care providers, including the company with the largest improvement, Alignment Healthcare Inc., rounded out the top 10.

Alignment Healthcare, based in Orange, Calif., saw its stock soar 24.2% in the quarter and gave a positive presentation at the Morgan Stanley Global Healthcare Conference, Leerink Partners analyst Whit Mayo said in a research note, adding that the company said it expects "100% retention" in its Medicare plans rated four stars or higher.

Founder and CEO John Kao said during Alignment's conference call on its second-quarter earnings call that health plan memberships in the quarter had increased 28% year over year and total revenue was $1.02 billion, up 49.0% from 2024.

P&C companies took the next three spots. Lemonade Inc.'s stock rose 22% in the quarter, while California-based Mercury General Corp. and HCI Group Inc. of Tampa, Fla., saw respective improvements of 21.5% and 18.1%.

Leading the life insurers in the analysis was Lincoln National Corp. at No. 5, up 17.8%, and Genworth Financial Inc., up 15.6%. In addition, Globe Life Inc. was up 15.3% while Jackson Financial Inc. rose 15.1%.

Seifert said that a number of companies in the life space took aggressive action to "manage the myriad of risks that these companies have to manage and many of whom struggle to manage."

"We saw investors taking note of some of the positive and aggressive restructuring moves that many of these companies have made," Seifert said.

P&C carrier Aspen Insurance Holdings Ltd. saw its stock jump 16% in the quarter, the sixth-best in the analysis. However, the big news for the Bermuda-based carrier was the announcement on Aug. 27 that it was being acquired by Japan-based Sompo Holdings Inc. for $3.5 billion. The deal is expected to close in the first half of 2026 and will lead to Aspen's delisting.

A bad quarter

Six insurers in the analysis saw their stocks sink at least 20% in the quarter, with managed care carriers Centene Corp. and Molina Healthcare, Inc. suffering the largest losses. Centene's stock plummeted 36.2%, while Molina's fell 36%.

The declines for Centene and Molina started during the second-quarter earnings season in July. Managed care companies have been hit with federal funding changes and rising costs associated with Medicaid, as well as issues left over from the COVID-19 pandemic.

Both companies rallied after reaching lows for the quarter on Aug. 6. Centene rose 36.4% to $34.39 on Sept. 24 from $25.21, while Molina went from $152.31 on Aug. 6 to $189.30, a 24.3% rise.

Slide Insurance Holdings Inc., down 35.1% for the quarter, has struggled since its June 18 IPO, while Root Inc., down 27%, saw its decline start after its second-quarter earnings conference call on Aug. 6.

Root reported its fourth straight profitable quarter, but executives cautioned during the call that the Columbus, Ohio-based insurer's plan to work on long-term goals could slow future growth. Investor reaction was negative, pushing Root's stock down 29.7% by the end of the week of Aug. 8.