Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

03 Sep, 2025

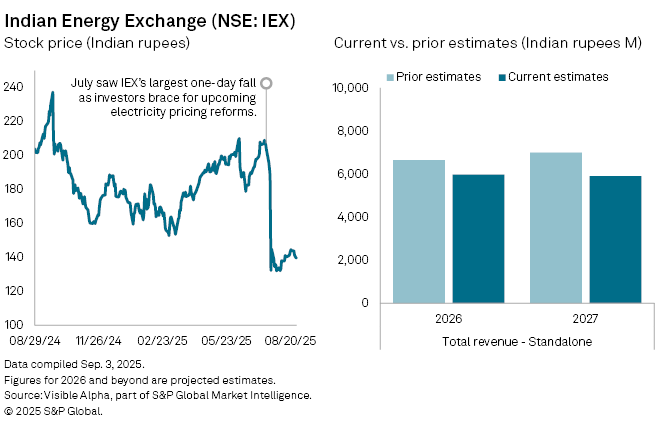

Shares in Indian Energy Exchange Ltd. (NSE: IEX) slumped 30% on July 24— the steepest one-day fall in the company’s history — after regulators announced plans to unify pricing across the country’s power bourses.

The Central Electricity Regulatory Commission has ordered that day-ahead markets be coupled from January 2026, a move aimed at eliminating tariff discrepancies between India’s three power trading exchanges: IEX, Power Exchange India and Hindustan Power Exchange. Currently, IEX dominates the day-ahead markets and often benefits from price differences in the bidding process. Analysts expect the reforms to erode IEX’s competitive advantage and compress margins.

Following the announcement, consensus forecasts for IEX’s revenues and profits have been sharply downgraded. Consensus forecasts for standalone revenues in fiscal 2026 have been cut to ₹6 billion, 14% lower than previous estimates, with a projected 11% year-on-year decline. Expectations for 2027 have been lowered even more sharply, by 24% to ₹5.7 billion, from earlier forecasts of ₹7 billion.

– Learn about Visible Alpha | S&P Global.

– Explore Visible Alpha Add-On for Cap IQ Pro.

– Access Visible Alpha estimates on Indian Energy Exchange.

– To receive email alerts for future Visible Alpha articles, select Visible Alpha Data Snapshots under the Authors section.