Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

08 Sep, 2025

By Yuvraj Singh and Marissa Ramos

Indian banks will likely reduce dividend payments in the fiscal year ending March 2026, as profitability comes under pressure amid slowing loans.

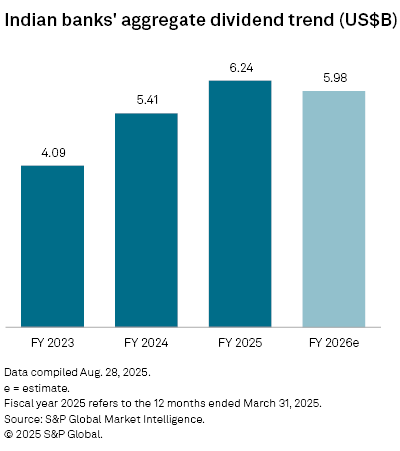

The aggregate dividend of 12 large banks included in an analysis by S&P Global Market Intelligence is projected to decline by about 4.2% to $5.98 billion in the current fiscal year ending March 31, 2026. This follows an aggregate payout of $6.24 billion by the banks in the fiscal year ended March 31, 2025, a 15.3% increase over the previous fiscal year.

The expected decline in dividend payouts "is rooted in a confluence of margin and profitability headwinds," said Tusharika Aggarwal, equity analyst at Market Intelligence.

Net interest margins are compressed due to rate cuts, while elevated competition for deposit funds is pushing funding costs higher. Additionally, weaker credit growth amid subdued demand, the Reserve Bank of India's checks on unsecured lending and a cautious economic backdrop are likely to reduce earnings momentum, Aggarwal said.

"It's shaping up to be another challenging yet intriguing year for forecasting payouts in the Indian banking sector, given the shifting momentum in the credit system," Aggarwal wrote in a July 24 research note.

India's biggest banks reported slower profit growth in the April–June quarter, indicating that lenders may struggle to maintain earnings momentum during the rest of the fiscal year.

Falling profits

Indian lenders reported robust net profits in the year ended March 31, supported by double-digit credit demand. Loan books of the six largest banks expanded by an average of 11.3%. Net income at State Bank of India, India's largest lender by assets, rose 16.1% to 709.01 billion Indian rupees, while top private sector lender HDFC Bank Ltd. posted a 10.7% increase in net income.

Credit growth at scheduled commercial banks slowed noticeably this year, with personal loans being the primary driver, according to the Reserve Bank of India's monthly bulletin.

"With faster monetary policy transmission to money markets, large corporates have increasingly turned to market-based instruments such as commercial paper and corporate bonds for funding, thereby reducing the demand for bank credit," the central bank noted. The central bank has reduced its key policy repurchase rate by 100 basis points since February.

Bank profitability expectations have also been dampened by trade uncertainties. The US imposed an effective 50% tariff on Indian goods, the highest among major global economies. India slashed its Goods and Services Tax on most commodities on Sept. 4, seeking to simplify the complex tax structure and boost domestic consumption.

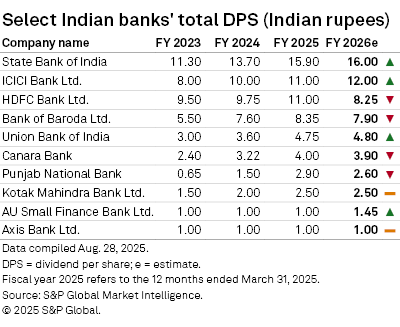

Major banks, including HDFC Bank and Bank of Baroda Ltd., are expected to cut dividend per share for the first time in at least four years. HDFC Bank's dividend per share is projected to fall to 8.25 rupees in the fiscal year ending March 31, 2026, from 11 rupees in the previous year, according to Market Intelligence estimates. Bank of Baroda may cut its dividend to 7.90 rupees per share from 8.35 rupees.

State Bank of India may keep its dividend per share nearly unchanged at 16 rupees, compared with 15.90 rupees, while ICICI Bank may raise it to 12 rupees in the fiscal year ending March 31, 2026, from 11 rupees, according to the estimates.

As of Sept. 8, US$1 was equivalent to 87.97 Indian rupees.