Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Sep, 2025

By Nick Lazzaro

US President Donald Trump signs the "Big Beautiful Bill Act," a government tax and spending package, July 4 at the White House in Washington, DC. Expectations for fiscal policy have been a key driver for rising long-dated US Treasury yields this year. Source: Brendan Smialowski/AFP via Getty Images. |

Persistently high yields on longer-dated US Treasurys could challenge an ongoing stock market rally.

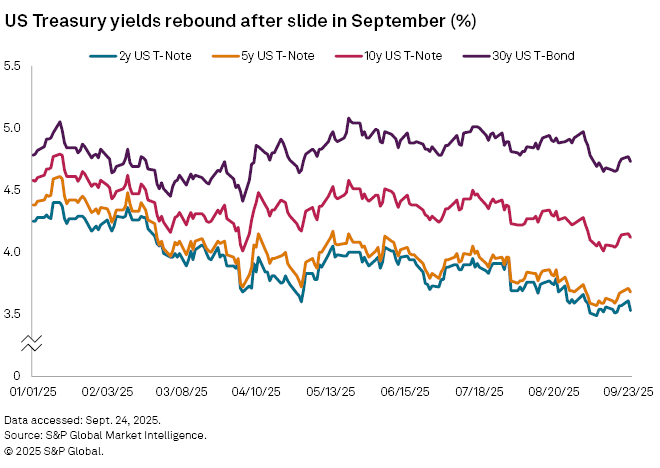

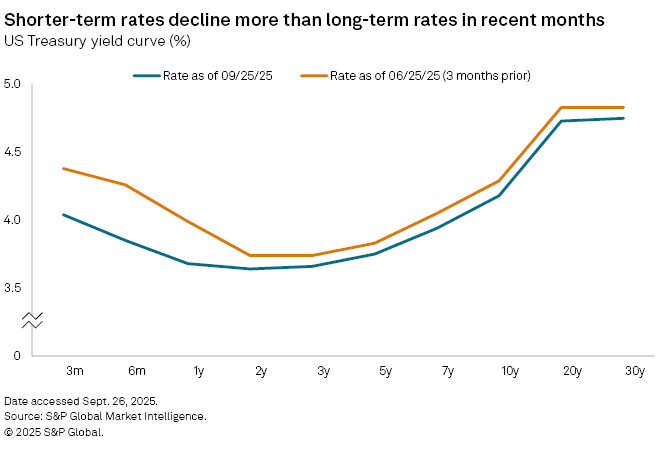

The 30-year Treasury bond yield hit or exceeded 5% several times since late 2023, after a decade of lower rates, according to S&P Global Market Intelligence data. The yield tested the 5% level early in September before falling to 4.65% by mid-month as the US Federal Reserve prepared to cut its benchmark short-term interest rate. The decline was brief; the yield rose again to 4.77% by September 22.

Yields on medium-term and long-term securities, from the 5-year Treasury note to the 30-year Treasury bond, more strongly influence consumer and corporate interest rates than do yields for shorter-term Treasurys, which generally move with the Fed's benchmark interest rate. As a result, consumer and business interest rates could remain high even if the Fed reduces short-term rates, and these higher borrowing costs are likely to challenge the current stock market momentum and prompt investors to reevaluate their strategies. The S&P 500 is up more than 12% so far in 2025.

"Higher long-term yields increase the cost of capital, so it could translate to less investment and lower growth," Karen Manna, fixed income investment director and portfolio manager at Federated Hermes, told Market Intelligence. "The stock market could read this as a negative sign, which would lead to a less-favorable outlook and ultimately lower returns."

Still, if equity returns decline, this could reduce overall risk appetite and prompt investors to increase fixed income holdings, Manna said. Increased demand would raise bond prices and temper yields, as bond prices and yields are inversely correlated.

Assessing drivers

Sovereign yields have been rising, reflecting higher government spending and increasing debt and deficits, Manna said.

"The long-run structural implications stretch to reducing spending or raising revenues, two areas that most governments do not like to address," Manna said.

The US federal deficit was $1.83 trillion in 2024, the highest on record, excluding 2020 and 2021 when spending surged during the COVID-19 pandemic.

Other drivers may also be influencing higher long-dated yields. The investment outlook may depend on which of those are perceived as the most significant in keeping yields elevated.

"How fast and why long yields are rising matters more than the level," Niladri Mukherjee, chief investment officer at TIAA Wealth Management, told Market Intelligence. "If long yields settle at structurally higher levels because productivity growth is stepping up thanks to AI, elevated yields will likely not materially change stock market sentiment and would instead boost the diversifying and income-generation power of bonds within multi-strategy portfolios."

In contrast, if investors determine that yields are elevated due to escalating fiscal concerns, risk aversion would likely increase across asset classes, leading to lower stock multiples and a preference for shorter-duration fixed income securities, Mukherjee said.

Several other factors have also pushed long-dated yields up, including concerns over the Fed's independence, government policy uncertainty and clouded expectations for long-term inflation, according to analysts.

Taken together, these market factors could alter supply and demand dynamics in the Treasury market to the same extent as in the equity market.

"The driver matters. If higher yields stem from policy uncertainty or concerns about debt sustainability, bond demand could weaken as institutional investors reassess risks," Tomas Williams, associate professor of economics and international affairs and director of The Center for Economic Research at George Washington University, told Market Intelligence. "If they reflect expectations of tighter monetary policy, demand could rise as returns on long bonds improve."

Yield impact on currency exchange

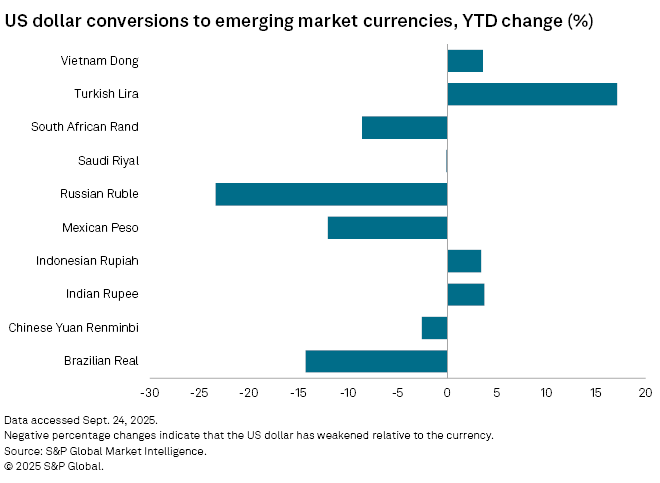

The upside pressure on long-dated Treasury yields has persisted this year while the US dollar has weakened.

"Higher US yields often attract capital and strengthen the dollar," Williams told Market Intelligence. "Yet in 2025, many emerging market currencies appreciated despite rising US yields, suggesting that policy uncertainty is reshaping flows, with some investors diversifying toward other markets."

The US dollar index, which tracks the dollar against a basket of its currency peers, fell more than 10% from the end of 2024 through Sept. 23, according to Market Intelligence data. Amid this slide, the dollar has lost ground to emerging market currencies such as the Brazilian real, the Mexican peso, the South African rand and the Chinese yuan.

The Trump administration has repeatedly discussed its desire for a weaker dollar, which can strengthen domestic companies' exports and international sales due to more favorable currency exchange rates. Many administration policy proposals, such as tariffs, have been geared toward achieving this goal, but they could also influence inflation and present secondary effects for higher long-dated Treasury yields, causing a disconnect for the traditional relationship between yields and currency strength.

"A weaker dollar is going to push up inflation expectations," said Donald Calcagni, chief investment advisor at Mercer Advisors, in an interview. "That's the market determining what we think inflation is going to look like."

Consumers' year-ahead inflation rate expectations rose to 4.8% in September from 3.3% in January, according to the most recent preliminary results of the University of Michigan Survey of Consumers.

The increased inflation expectations could reduce investor demand for long-dated Treasurys, particularly from foreign buyers, Calcagni said. Foreign investors owned about 30% of US publicly held debt at the end of 2024, according to a Congressional Research Service report.

"If you're going to have fewer and fewer buyers, that is a recipe for higher rates as you go out to the 10-year Treasury, the 20-year Treasury and beyond," Calcagni said.