Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Sep, 2025

Global private equity and venture capital deal value in August grew 10% year-over-year to $58.22 billion from $52.74 billion, according to S&P Global Market Intelligence data.

The number of deals dropped to 827 from 927 in August 2024.

In 2025, total deal value between January and August 31 climbed to $479.76 billion from $450.22 billion in the first eight months of 2024. Deal count dropped to 8,327 from 8,810 in the same period a year earlier.

– Download a spreadsheet with data in this story.

– Read about global private equity entries in July.

– Explore more private equity coverage.

Top sectors

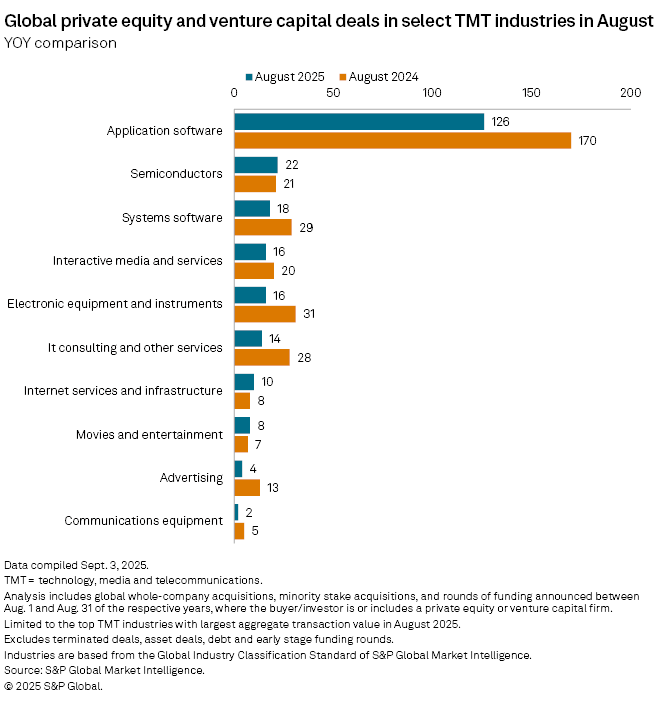

Technology, media and telecommunications remained the most active sector in August, with 261 private equity-backed announced transactions, more than a third of all deals during the month.

Application software led the sector with 126 deals, although the total count decreased from 170 in August 2024. Semiconductors followed with 22, and systems software with 18 deals.

Largest deals

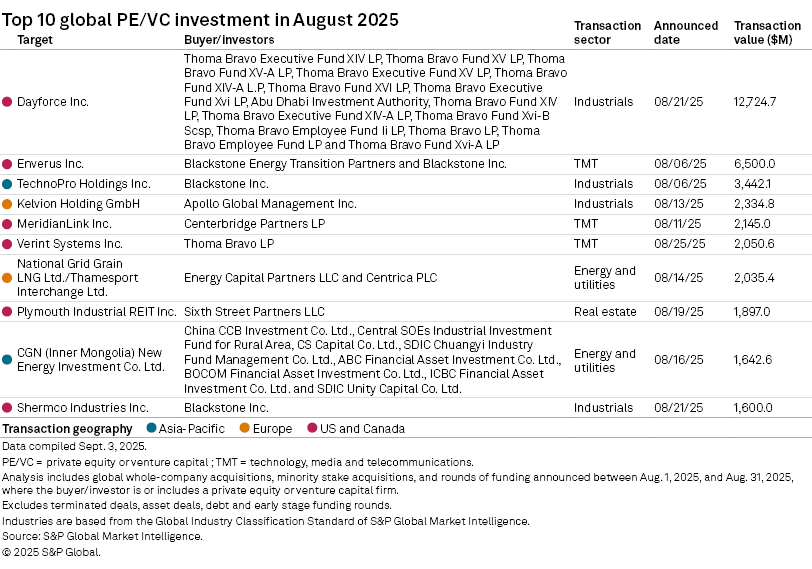

Fourteen deals with transaction values of at least $1 billion were announced in August.

In the largest transaction of the month, human capital management software company Dayforce Inc. agreed to be taken private by Thoma Bravo LP for $12.72 billion in transaction value.

The second-largest deal was Blackstone Inc. and Blackstone Energy Transition Partners's announced purchase of data and analytics firm Enverus Inc. from Hellman & Friedman LLC and Genstar Capital LLC for $6.5 billion.

Blackstone also sought to take human resource outsourcing company TechnoPro Holdings Inc. private for $3.44 billion, and agreed to acquire electrical maintenance company Shermco Industries Inc. for $1.6 billion.