Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Sep, 2025

By Brian Scheid

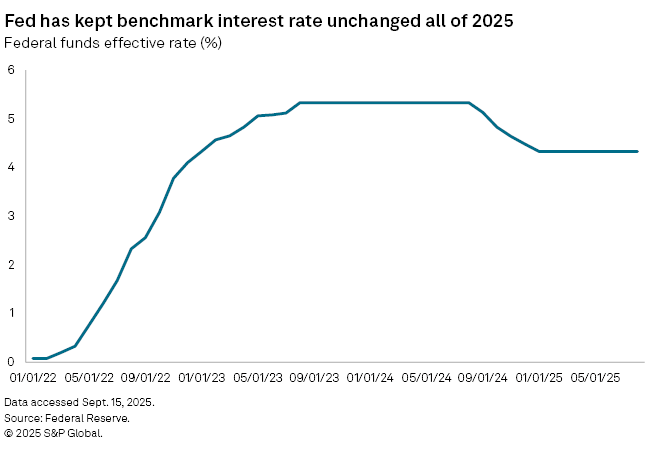

The Federal Reserve this week is widely expected to announce a 25-basis-point interest rate cut, its first change to its benchmark rate since December 2024, but where US monetary policy may be headed next is far from certain.

Mounting weakness in the US labor market and growing fears of a domestic economic slowdown have pushed expectations that the Fed will be more aggressive in rate cuts than forecast just a few weeks ago, but rising inflation is complicating the policy path forward.

"It's an unclear path for sure," said Luke Tilley, chief economist of Wilmington Trust.

About 96% of the futures market expects the Fed's rate-setting Federal Open Market Committee (FOMC) on Sept. 17 to lower its federal funds rate target by 25 bps from 4.25-4.5%, where it has been since December 2024, with about 4% betting on a supersized 50 bps cut, according to CME FedWatch. Close to 75% of the market expects the rate to be cut by at least 75 bps by year-end, meaning one 25 bps cut at each of the three committee meetings remaining this year.

Soaring inflation expectations, however, present a major hurdle for Fed officials keen to cut rates in order to keep domestic joblessness low and prevent the broader economy from eroding further.

"Subsequent policy rate easing is not automatic," said Satyam Panday, chief US economist at S&P Global Ratings.

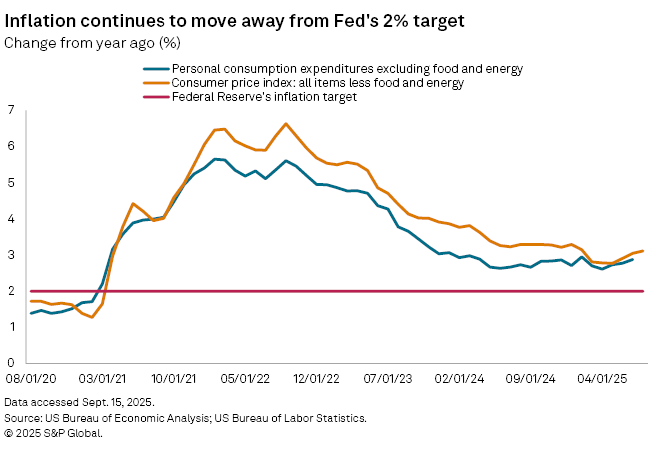

Since falling to 2.6% in April, its lowest level since March 2021, annualized growth in core personal consumption expenditures, the Fed's preferred inflation metric, which strips out volatile food and energy prices, has risen close to 30 bps, with expectations of continued increases as President Donald Trump's tariffs take root.

Annualized growth in the core consumer price index, the market's preferred measure of inflation, climbed to 3.1% in August, its fifth straight monthly increase since bottoming at 2.8% in March.

Fed officials still want inflation to return to a target of 2%, a goal now complicated by the need to counter a weakening economy with lower rates.

"Rising core inflation rate will keep the Fed from big cuts," Panday with S&P Global Ratings said. "There is no good option for the Fed given the evolution of risks surrounding their dual mandate. They are likely to lean toward ensuring the labor market doesn't weaken further as long as inflation expectations are fairly anchored."

Panday forecasts two 25 bps cuts this year, three more 25 bps cuts in 2026 with the benchmark rate likely to end up at 3.1%, which is about the midway point for FOMC estimates of a neutral range.

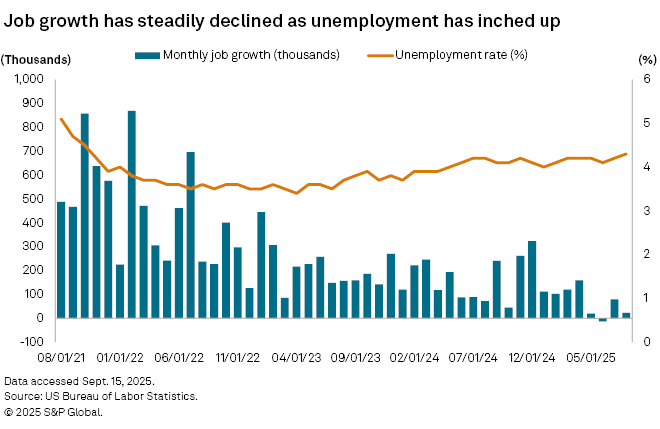

The rise in inflation has come as the unemployment rate inched up to 4.3% in August, its highest level since October 2021, as employment data was revised lower with just 88,000 jobs added over the past three months, compared to 246,000 over the same three-month stretch in summer 2024.

Annual revisions to jobs data released last week showed that job growth for the year prior to March 2025 was 911,000 less than initial estimates, the Bureau of Labor Statistics said in a preliminary report.

These revisions and ongoing small business survey data show that weakness in the labor market actually began far earlier than Fed officials previously believed, said Pat Reily, an economist and co-founder of Upling, a global credit assessment platform.

"While the inflated initial BLS data may have given the FOMC a more positive view than reality, other data sources like tax reporting, business performance data and business credit reporting, signaling real concern, were largely ignored," Reily said. "Now, the FOMC appears to recognize the value of monitoring a broader range of metrics and a willingness to take a more balanced approach with regard to tension between inflation controls and economic stimulus."

Economy and inflation

As their meeting closes Sept. 17, the Fed will release its latest quarterly economic projections, which includes inflation and unemployment forecasts and future rate expectations. Those forecasts are unlikely to hold as the changing jobs picture and course of inflation continue to evolve.

"It all depends on the economy and inflation," said Kathy Jones, chief fixed income strategist at the Schwab Center for Financial Research.

Jones expects two 25 bps cuts before the end of this year, but there could be more if the economy and job market show signs of weakening further into the fourth quarter.

"The Fed has to be constrained to some extent, by the current inflation readings near 3% and rising," Jones said. "They can justify a few rate cuts as 'returning to neutral' from 'restrictive,' but there's a limit to how far rates can fall without risking higher inflation and inflation expectations."