Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

03 Sep, 2025

| A hydropower plant in Norway. Questions over power prices and the export of electricity to central Europe are on voters' minds ahead of the general election. Source: Sorbyphoto/iStock via Getty Images. |

Concerns around power prices and electricity exports are high on the agenda as Norwegians head to the polls Sept. 8 to elect a new government.

An oil and gas powerhouse with abundant hydropower resources, the Nordic country has traditionally offered low-cost energy for consumers and industry.

However, soaring power prices in southern Norway last winter have ignited a political debate over future planned export cables into continental Europe.

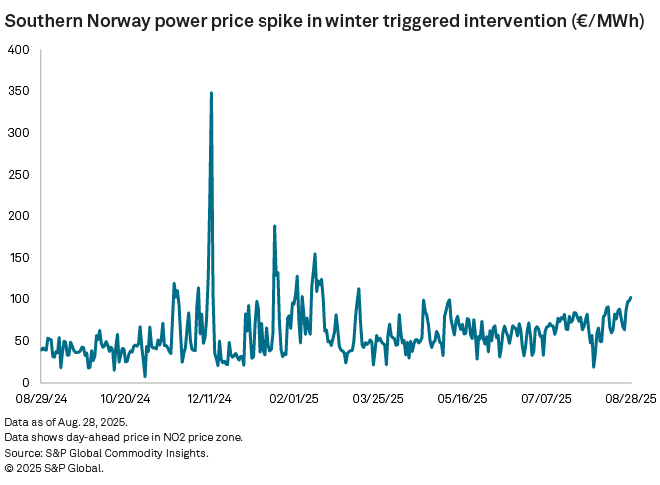

Amid high demand from central Europe during cold, dark and still conditions, the southern Norway NO2 power price briefly surged to nearly €350/MWh around the end of 2024 after averaging €49.60/MWh since the start of the year.

Many Norwegians are concerned that increased exports, particularly during periods of high demand, may lead to higher domestic prices.

"Norwegians are used to having cheap electricity, and that has colored the debate," said Jørgen Wettestad, research professor with a focus on energy and climate policy at Norway's Fridtjof Nansen Institute.

The governing center-left Labor Party is leading the polls at 28%, according to the Politico Poll of Polls on Sept. 2, and a center-left coalition is deemed the most likely outcome of the vote.

However, in second place is the far-right Progress Party, which is polling at 20%, and a right-wing-conservative coalition may also come together, observers said.

Power cables

The debate over energy exports not only reflects immediate concerns about pricing but also highlights the broader implications for Norway's energy future and its relationship with neighboring countries.

A net electricity exporter, Norway has interconnections with Denmark, Germany and the Netherlands to the south, Sweden and Finland to the east, and Great Britain to the west.

The Labor Party has pledged not to allow any new export cables during the upcoming legislative period, writing in its election manifesto that Norway is independent in its decision on future interconnector projects.

Meanwhile, the Progress Party said foreign cables "link us closely to countries that pursue irresponsible energy policies."

Parties across the political spectrum have also signaled that they may not renew two of the seven connections with Denmark, which is a key transit state to central Europe.

Portraying interconnectors as cause for any domestic price increases "would appear to be populist rhetoric, and it is questionable if there will in fact be follow-through," said Daniel Muir, senior power analyst at S&P Global Commodity Insights, noting that Norwegian system operators have long highlighted the risk that future increases in domestic power demands will lift the volumes Norway imports from neighbors.

Indeed, the Norwegian system is becoming more weather-dependent and edging closer to an annual deficit, according to Tor Håkon Jackson Inderberg, research professor with a focus on energy transition at the Fridtjof Nansen Institute.

Still, "In the current state of things, I'd be surprised if new interconnectors would be constructed," Inderberg said.

Meanwhile, upcoming interventions into the consumer price for electricity and district heating are likely to raise consumption by households, Inderberg added.

'Norway Price'

From Oct. 1, power prices will be fixed at 40 Norwegian øre per kilowatt-hour for primary residences and holiday homes, in a policy known as the "Norway Price."

The policy was created after the agrarian Center Party abandoned the Labor-led government on Jan. 30 in protest over high energy bills, withdrawing its ministers from their posts.

As it stands, more than three-quarters of Norwegian end-users are on a variable tariff, analysts at Commodity Insights said, adding that the capped price dampens signals for flexible consumer behavior.

"The timing is poor, given southern Norway in particular is showing early signals of a marked hydro deficit," Muir said. "Removing the price signals informing consumers of this fact potentially facilitates an unnecessary tightening of domestic supplies."

Grid taxes will also be reduced from Oct. 1, the Labor Party said, with a total annual relief of 3 billion Norwegian kroner across households and businesses.

EU diplomacy

As part of the measures meant to contain prices, the Labor Party — under pressure from the Center Party — earlier this year pledged not to implement some or all of the EU regulations on renewables, market integration and energy efficiency.

While not a member of the EU, Norway is part of the European Economic Area, and thereby required to comply with power market regulations.

Yet, its position as a key gas supplier to the EU gives it diplomatic power that has only strengthened during the energy crisis as Russian gas fell away from the EU market.

"That leeway is not indefinite," said Wettestad, adding that there are strong forces within the Labor party who are concerned over a lack of compliance with EU rules.

Norway

Clean power as an asset

Elsewhere, the Labor Party, if elected, pledges to push ahead with renewables capacity expansion in Norway.

"Clean electricity is one of Norway's biggest competitive advantages. We believe it must continue to be so," the party said in its election pledge.

The party plans to enable the upgrade of hydropower assets and construction of more solar, onshore wind and bioenergy. It also aims to set out areas for the construction of 50 GW of offshore wind by 2050.

The Progress Party, meanwhile, mostly rejects new onshore wind, supporting instead the exploration of new nuclear power via small modular reactors.

Oil, gas and climate change

The Labor Party, the Conservative Party and the Progress Party continue to support oil and gas licensing rounds and new production, and frame the sector as central to Norway's economic security.

This position is "at odds with the urgency of climate science," Oil Change International, a nongovernmental organization, said Aug. 26.

As in other high-income, fossil fuel-producing countries, the dominance of industry narratives and the influence of the petroleum sector remain major barriers to progress in decarbonization, the organization said.

"But this election offers voters and policymakers an opportunity to shift course. A science-based, equitable transition away from oil and gas is not only necessary for global climate goals — it is possible, if political will can overcome vested interests," Oil Change International argued.

Inderberg agreed that the petroleum industry remains powerful and that mainstream parties are not pushing back on a continuation of extraction. According to Inderberg, the focus instead lies on reducing the emissions associated with extraction, for instance via carbon capture and blue hydrogen.

"[Foreign] observers find it puzzling that these climate issues have lower salience in Norway," Inderberg said, explaining that the view in Norway is largely that reduction of oil and gas exploitation needs to come from a decline in demand from abroad.

Otherwise, the modus operandi is "keep going," Inderberg said.

As of Sept. 2, US$1 was equivalent to 10.03 Norwegian kroner.