Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Sep, 2025

By Melissa Otto

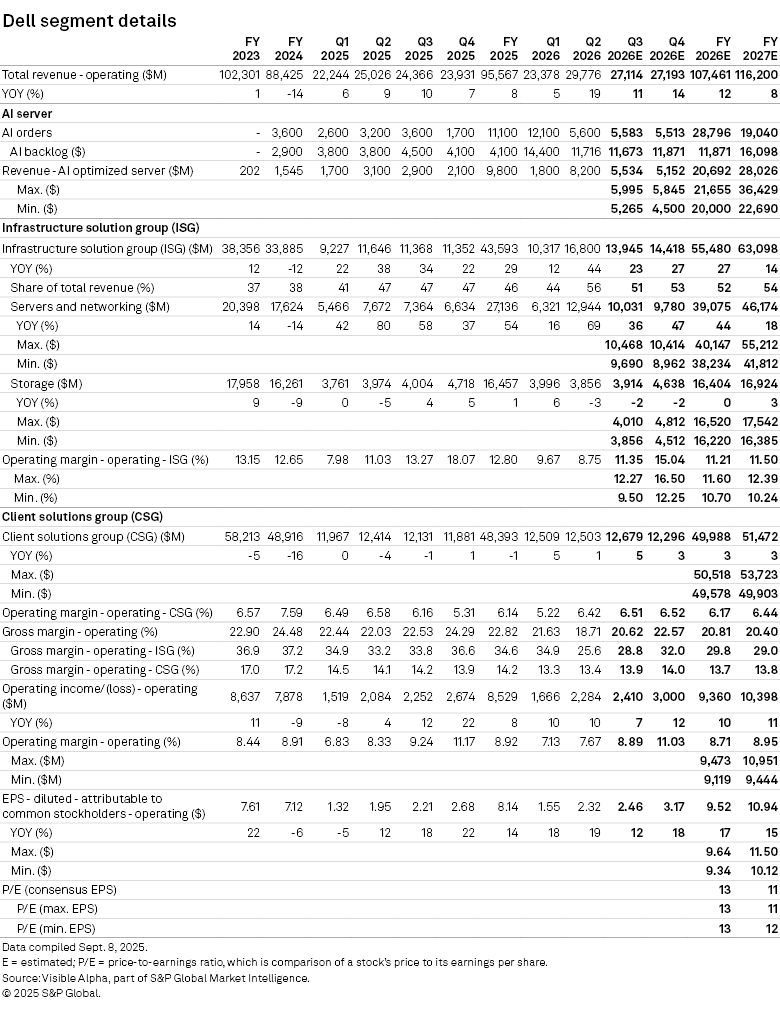

Dell Technologies Inc. delivered total revenues for the second fiscal quarter of 2026 of $29.8 billion, slightly above Visible Alpha's consensus estimate of $29.2 billion.

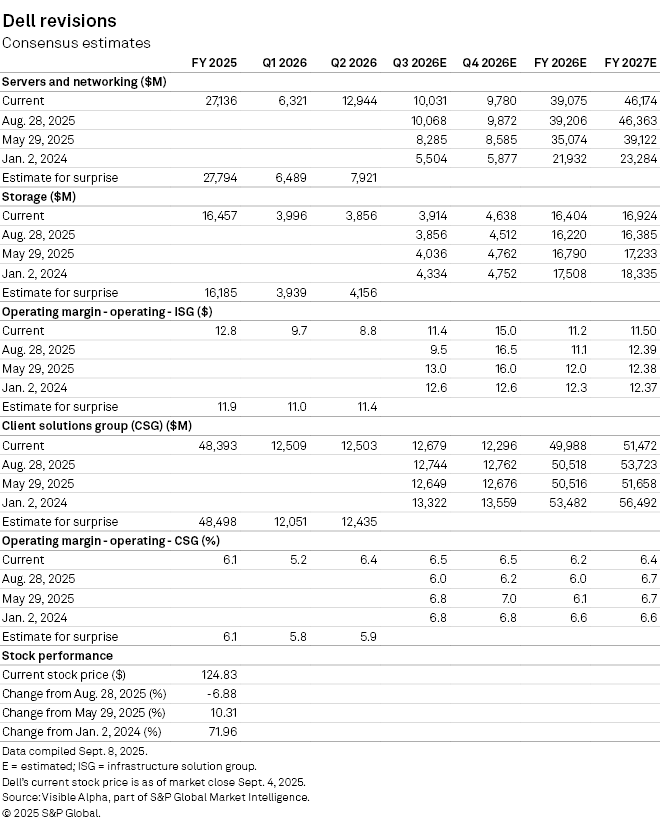

The infrastructure solutions group segment saw its revenue come in at $16.8 billion, above the consensus estimate of $15.4 billion. The group's results were driven by servers and networking exceeding revenue expectations by $1.6 billion. Storage came in slightly below estimates.

The company delivered a respectable AI server backlog of $11.7 billion in the period, which saw it ship $8.2 billion of AI servers. The AI server shipment guidance was raised $5 billion to $20 billion and is expected to more than double in the full fiscal year.

Due to a mix shift to AI servers, the infrastructure solutions group segment's non-GAAP gross margin came in 60 basis points lower than expectations, leading to the operating profit margin coming in at 8.7%, below the expected 9.8%. Dell anticipates profitability improving in the second half of the fiscal year.

For the full year, the projected operating margin for the infrastructure solutions group's fiscal 2026 has decreased 80 basis points since the May earnings release and tumbled 90 basis points for fiscal 2027.

After the closing bell on Sept. 8, Dell announced that CFO Yvonne McGill would leave the company and David Kennedy, senior vice president of global business operations, will step into the role. The company also reaffirmed its guidance for the upcoming quarter and full fiscal year.

Dell guided to $26.5 billion to $27.5 billion in total revenue for the next quarter, slightly ahead of expectations. The infrastructure solutions group segment's revenue is projected to make up $13.9 billion, but see its margin decline to 11.4% year over year, due to the larger mix of AI servers.

The longer view

Consensus for Dell's full-year revenues are currently at $107.5 billion, in line with guidance of $105 billion to $109 billion, though the infrastructure solutions group's margins are trending down. Currently, Visible Alpha consensus is projecting the segment's operating profit margin to finish the year at 11.2%. That figure is expected to increase 30 basis points to 11.5% in fiscal 2027.

Looking further out, analysts remain upbeat on the demand for AI servers. Analysts expect to see AI server revenue generate $20.7 billion in fiscal 2026, up from $9.8 billion in revenue in fiscal 2025. Infrastructure solutions revenue is expected to grow to $55.5 billion, with most of the year-over-year increase coming from AI servers. Profitability was previously expected to hit a 12.6% operating profit margin this year. However, the mix shift is pushing this segment's margin further from the historic 13% levels.

According to Visible Alpha consensus, EPS is expected to grow 17% to $9.52 in fiscal 2026 and another 15% in fiscal 2027 to $10.94. That would put the consensus price-to-earnings ratio for fiscal 2026 at 13x, and in the 11x-12x range for fiscal 2027, with a consensus implied return of 20% and target price of $150.

Dell's stock has traded down to around $125 since the August earnings release. Will infrastructure solutions profitability return to beat expectations and be a catalyst in the second half?

– Learn about Visible Alpha | S&P Global.

– Explore Visible Alpha Add-On for CapIQ Pro.

– Access Visible Alpha estimates on Dell.

– To receive email alerts for future Visible Alpha articles, select Melissa Otto under the Authors section.