Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

03 Sep, 2025

By John Wu and Beenish Bashir

Mergers and acquisitions activity in the Asia-Pacific region was subdued in July, hanging on some transactions in the industrial sector.

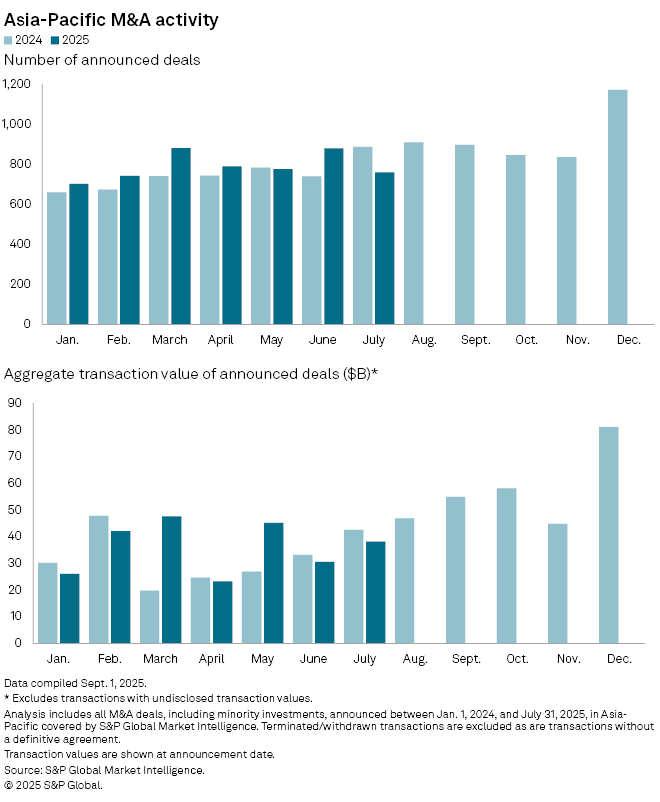

The aggregate value of M&A deals in the region declined 10.3% year over year to $38.13 billion in July, according to S&P Global Market Intelligence data compiled on a best-effort basis. The number of deals fell 14.3% year over year to 759, the lowest count since February.

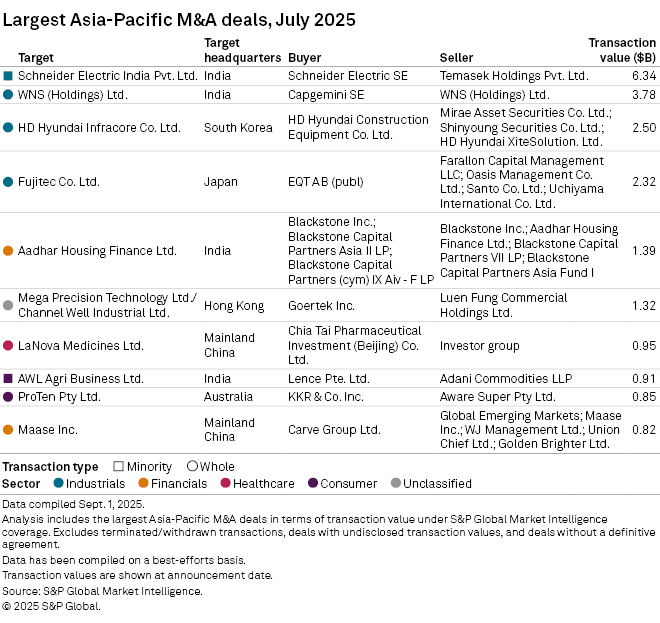

Singapore's state investment company Temasek Holdings (Pvt.) Ltd. sold its minority stake in Schneider Electric India Pvt. Ltd. to the energy management and industrial automation company's European parent, Schneider Electric SE, for $6.34 billion, the biggest deal in the region in July.

That was followed by the $3.78 billion acquisition of Mumbai-based WNS (Holdings) Ltd., a multinational business process management firm, by French consulting firm Capgemini SE.

The M&A landscape in India has been stable despite macroeconomic headwinds and policy uncertainty, according to an Aug. 14 report by EY. "However, the recent announcement of fresh tariffs on Indian exports, in effect since early August, has reintroduced uncertainty into the trade environment," EY said. "The industry awaits clarity on tariff structures, regulatory frameworks and market access, which will decide the fate of transactions, especially in businesses which have US exposure."

In early August, US President Donald Trump announced a 25% additional tariff on Indian export goods for continued purchase of Russian oil, effectively bringing the total tariff to 50% from Aug. 27. The move is expected to impact India's exports and drag on the world's fastest-growing major economy. GDP grew an estimated 7.8% year over year in the April-to-June quarter, accelerating from 6.5% expansion in the same period of 2024, the government said Aug. 30.

HD Hyundai Construction Equipment Co. Ltd.'s purchase of HD Hyundai Infracore Co. Ltd. from financial institutions for $2.50 billion was the third-biggest M&A deal recorded in the region in July, the data shows. Private equity and venture capital firm EQT AB (publ)'s offer for Japanese elevator and escalator maker Fujitec Co. Ltd. for $2.32 billion was the fourth.

The data shows that, measured month to month, the aggregate deal value in the Asia-Pacific region increased 24.9% in July, though the number of deals was smaller than the 879 recorded in June.