Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Sep, 2025

By John Wu and Cheska Lozano

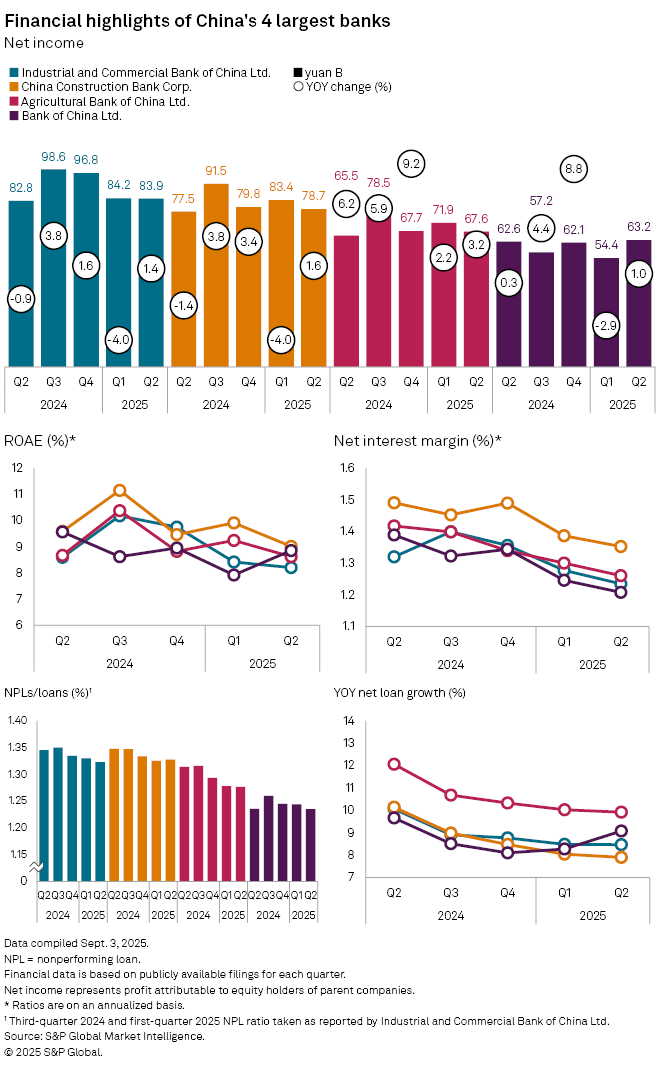

China's biggest state-owned banks will need to navigate margin pressures to maintain earnings growth in the second half of the year.

The four megabanks improved earnings in the April–June quarter, backed by stable loan growth and improved asset quality, according to their recent earnings statements. However, the continued compression in net interest margins will likely drag on earnings.

"Banks made great efforts to strengthen the asset and liability management, control funding costs and improve asset structure," said Effie Xin, Greater China COO and financial services managing partner at EY. "The big four banks have been focusing on stabilizing growth, making progress in optimizing credit structures and channeling more financing to the real economy. Loan growth in green, inclusive and tech finance outpaced overall lending expansion, underscoring their shift toward priority sectors.

Temporary bounce

Industrial and Commercial Bank of China Ltd., the world's largest lender by assets, reported that its net income grew by 1.4% year over year to 83.9 billion Chinese yuan in the second quarter. That compared with a 4.0% fall in the first quarter, according to data compiled by S&P Global Market Intelligence. China Construction Bank Corp. and Bank of China Ltd. also reversed their first-quarter declines into growth.

Agricultural Bank of China Ltd., the world's second-largest lender, saw its net income increase 3.2% to 67.6 billion yuan, accelerating from the 2.2% growth in the prior quarter, data show.

Still, the narrowing net interest margins put the growth of net interest income under pressure, Xin said, noting the decline in loan prime rates, adjustments in the rates on outstanding mortgages and low market interest rates as factors dragging the net interest margins lower at all four banks.

The People's Bank of China is expected to retain its easing bias after bringing benchmark loan prime rates to all-time lows in May. Analysts expect the world's second-biggest economy to achieve its 2025 GDP growth aim of about 5%. Still, a downturn in the real estate sector and global trade tensions remain key challenges.

"Although China will likely meet its official target, one problem is the sharp deceleration of nominal growth and sluggish inflation," said Gary Ng, senior economist at Natixis Corporate & Investment Banking. "There is a minimal chance that loan growth and interest rates can rebound sharply soon."

Caution ahead

The latest bank earnings show "that consumer and business sentiment remain cautious, and banks only rely on government-related activities," Ng said, adding that profitability is the number one concern among Chinese banks despite slower asset growth and net interest margins.

Nonperforming loan (NPL) ratios at China Construction Bank and Agricultural Bank were unchanged from the first quarter, while those of Industrial and Commercial Bank of China and Bank of China continued to edge lower, pointing to stable asset quality in all the big four lenders.

However, "retail credit asset quality may require close monitoring. Although all the big four banks reported a continuous decline in NPL ratio as of 30 June 2025, we saw a rise in NPL ratio of personal mortgage loans, consumer loans and credit card loans," said EY's Xin.

As of Sept. 9, US$1 was equivalent to 7.12 Chinese yuan.