Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Sep, 2025

By Yuzo Yamaguchi and Beenish Bashir

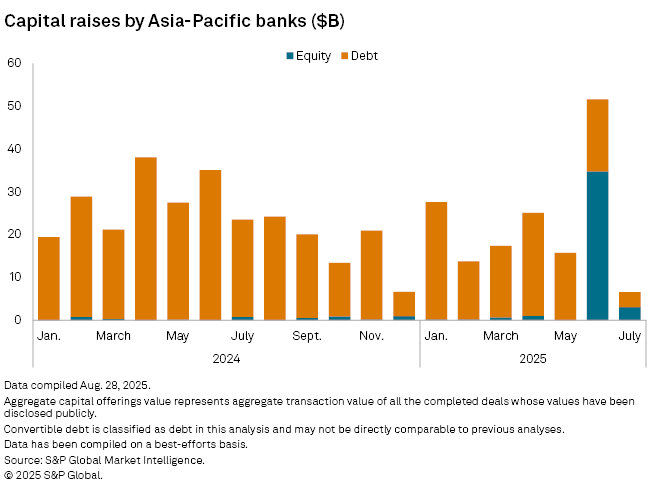

Capital raising by banks in the Asia-Pacific region in July hit its lowest level this year after a surge in the previous month, an indication of global economic uncertainties.

Banks in the Asia-Pacific region raised US$6.59 billion in July, the lowest monthly total in 2025 and a sharp drop from June's US$51.56 billion, according to S&P Global Market Intelligence data.

The decline follows a capital-raising surge in June, the highest since at least January 2024, when Chinese banks moved to strengthen their balance sheets amid global economic uncertainty.

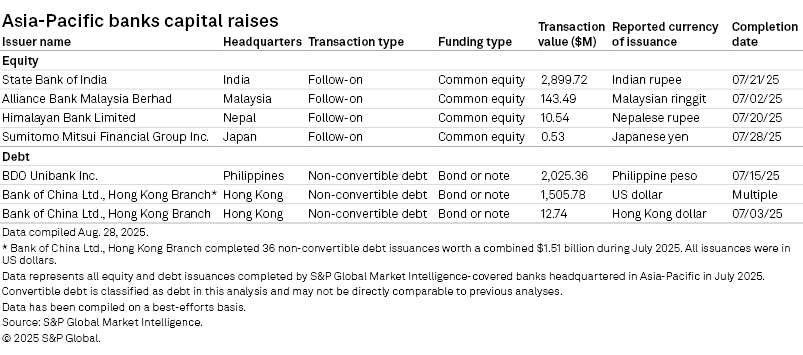

July's total included US$3.05 billion in equity issuances and US$3.54 billion in debt sales.

Economic uncertainty persists across Asia as the US maintains tariffs of 50% on Indian imports, 30% on Chinese goods and 15% on Japanese products, down from 25%.

Banks "may hesitate to raise funds when the outlook is shaky," said Takahide Kiuchi, executive economist at Nomura Research Institute. Institutions may have accelerated fundraising in June before a three-month US tariff pause announced in early April, Kiuchi noted.

Only seven transactions were recorded on the Market Intelligence platform in July, down from 21 in June.

State Bank of India (SBI) led with a US$2.90 billion equity offering.

"This landmark equity issue is a vote of confidence in SBI's strong fundamentals, potential risk management and customer centricity with the digital first approach," said Challa Sreenivasulu Setty, chairman of India's biggest lender by assets, at a July event.

Alliance Bank Malaysia Bhd. raised about US$143.5 million in equity, followed by Himalayan Bank Ltd. of Nepal with about US$10.5 million.

BDO Unibank Inc. of the Philippines issued US$2.03 billion in debt, the month's largest such transaction. Bank of China Ltd.'s Hong Kong branch completed two debt offerings of about US$1.51 billion and about US$12.7 million denominated in Hong Kong dollars.