Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Sep, 2025

By Tyler Hammel and RJ Dumaual

The planned sale of Aspen Insurance Holdings Ltd. to Japan-based Sompo Holdings Inc. just months after its IPO was likely motivated more by Japanese demand than the Bermuda-based specialty insurer's performance.

Sompo Holdings, through its Sompo International Holdings Ltd. subsidiary, agreed Aug. 27 to acquire 100% of Aspen Insurance from asset manager Apollo Global Management Inc. for an aggregate cash consideration of about US$3.5 billion, or US$37.50 per share. The deal was unanimously approved by the companies' boards and is expected to close in the first half of 2026.

Sompo's proposed acquisition of Aspen came amid a trend of Japanese insurers expanding into the US market.

Selling Aspen so soon after its IPO may appear unusual, but it is likely motivated more by Sompo's interest than Aspen's performance, Piper Sandler analyst Paul Newsome said.

"It doesn't make a lot of sense to go through all the steps and the IPO process if the seller already has a private buyer in mind," Newsome said. "Basically, the buyer was likely not around during the IPO process and recently showed up and decided they wanted to spend the money."

Apollo's motivation

The deal came less than six months after Aspen launched its IPO at the end of April, raising US$397.5 million for the company.

Apollo Global Management sold 13,250,000 shares at US$30 apiece, compared with its targeted range of US$29 per share to US$31 per share. At the time, the move was considered to be a litmus test for the IPO resiliency of specialty insurers.

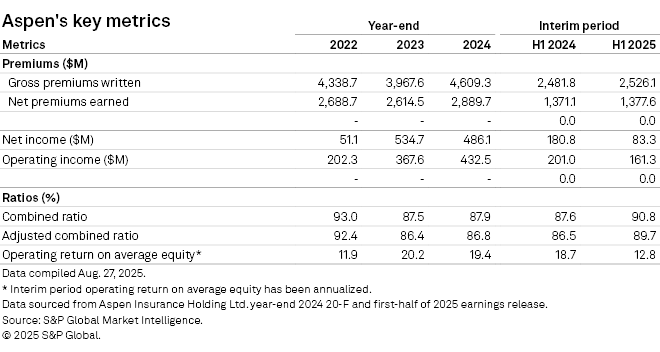

Aspen's key metrics have grown in recent years, according to an S&P Global Market Intelligence analysis. After dipping in 2023, gross premiums written rose to US$4.6 billion in 2024, up from 2023 and 2022. Net premiums written also exceeded 2023 and 2022 totals, hitting US$2.9 billion in 2024.

Newsome described Apollo's decision to sell as a choice between immediate and potential gains, saying that Apollo may have been more interested in selling Aspen than investing time in the company and waiting for it to perform well.

"Apollo would have had to wait, and Aspen would have to deliver results over time, similar to how Palm or Skyward or some of these other companies that were private equity-owned and fixed up and then went public," Newsome said. "It took time to get the value up, but the multiples were ultimately much higher."

Japan's growing interest in outside insurers

Sompo's purchase came amid growing interest in Western insurers and changes to solvency regulations in Japan. The solvency changes, set to go into effect in fiscal 2025, are not expected to affect the capital allocation plans of the country's largest property and casualty insurers, even as they prepare to divest their cross-shareholdings in the coming years, analysts told Market Intelligence.

Japanese insurers will remain intent on expanding business overseas, even amid increasing geopolitical uncertainty, according to a June 30 report from S&P Global Ratings.

"This is because they feel there is little growth potential in the domestic insurance business amid Japan's declining birthrate and aging society," the Ratings analysts wrote. "The differences between the risk reduction and capital strategies of listed and mutual insurers have become clear."

The pending purchase of Aspen was motivated by Sompo's M&A strategy, Sompo Holdings CEO Mikio Okumura said on an Aug. 28 investor call. When considering the risk appetite for overseas M&A, Okumura said the company is not done expanding.

"We are strengthening our structure, and we have a long list there as well. And there, we have a very strong appetite," Okumura said.

The move is also not expected to impact the company's economic solvency ratio, which Okumura said remains within Sompo's target range.

"We have assets with low capital efficiencies. We want to shrink them, and we want to reallocate those capitals into a higher profitability, and we want to accumulate profit," Okumura said. "If we have accumulated profit then we will be having capital. And from that perspective, if we are over [economic solvency ratio] range, then we would have to make some adjustments with discipline."

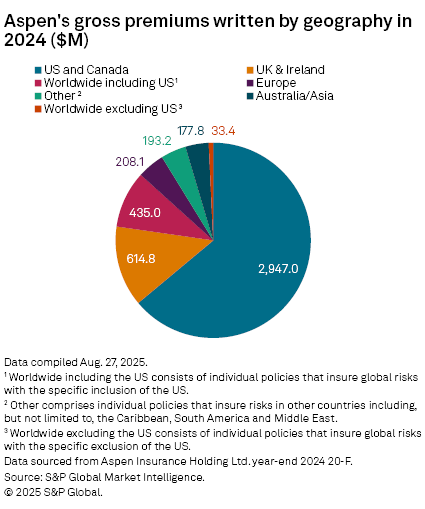

The majority of Aspen's gross premiums written in 2024 were in the US and Canada, accounting for US$2.9 billion, considerably more than in the UK and Ireland, which had the second-largest total at US$614.8 million. Gross premiums in Asia and Australia accounted for just US$177.8 million of Aspen's business.

The Sompo Group has a relatively strong appetite for strategic investments and has been looking for M&A opportunities, according to a research note from Japan Credit Rating Agency, which highlighted Aspen's presence in the US, UK and Bermuda.

"The Sompo Group has been operating the overseas insurance/reinsurance business by positioning Sompo International ... as its global platform," Japan Credit Rating Agency wrote.

"This acquisition can expand the Group's business area, further diversify insurance lines and geographic reach, and contribute to the Group's overall risk diversification and revenue source diversification."