Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Sep, 2025

By Yuzo Yamaguchi and Beenish Bashir

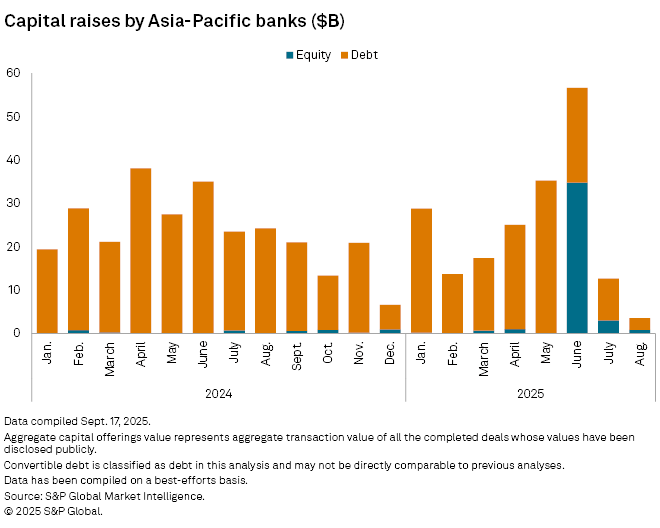

Capital raised by banks in the Asia-Pacific region fell to a new low of $3.58 billion in August, according to S&P Global Market Intelligence data.

This is less than half of the $12.68 billion raised in July and a significant drop from the $56.63 billion raised in the previous month. The June surge, which was the highest since at least April 2024, was largely driven by Chinese banks bolstering their balance sheets amid global economic uncertainty.

In August, market participants were uncertain about the US Federal Reserve's potential interest rate cut, as concerns about high US inflation and a stalling labor market raised questions about the impact on Asia's economies.

"Interest rate environment drives capital raising," said Hideo Oshima, a senior economist at the Japan Research Institute, suggesting banks may have "sat on the sidelines before the Fed takes action."

The Fed later reduced its policy rate by 0.25 percentage point to a range of 4.0% to 4.25% during its Sept. 17 policy meeting, its first cut of the year.

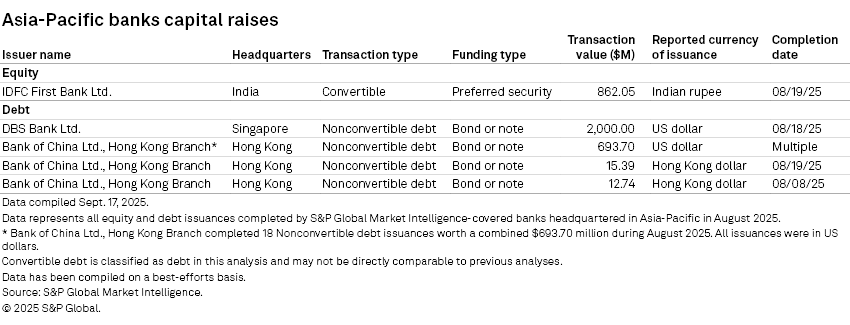

The total capital raised in August comprised $2.72 billion in debt by two lenders and about $862.1 million in equity sales by India's IDFC First Bank Ltd. through a convertible preferred stock sale.

Singapore's DBS Bank Ltd. raised $2 billion through a nonconvertible debt issuance, while Bank of China Ltd.'s Hong Kong branch raised about $721.8 million via 20 debt transactions, according to Market Intelligence data.