Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Sep, 2025

By Allison Good

Despite US electric utilities announcing significant capex plans during second-quarter earnings to accommodate rapid load growth, generalist investors have rotated out of the sector in favor of industries with bigger upside, according to analysts.

But unlike previous so-called "risk-on" cycles when defensive sectors such as utilities fell out of favor among investors, the sector is "attractively valued" this time around, thanks to anticipated industry-wide gains from data-center-driven electricity demand, Jefferies wrote in a Sept. 12 note to investors.

"The outperformance earlier this year into April in response to tariff concerns and broader budget deficits (since resolved/moderated) has reversed," the analysts noted.

"If it weren't for datacenter opportunities contributing to [independent power producer] performance and improved utility EPS we would expect the current environment to argue for a steep discount to historical relative valuations," Jefferies analysts added.

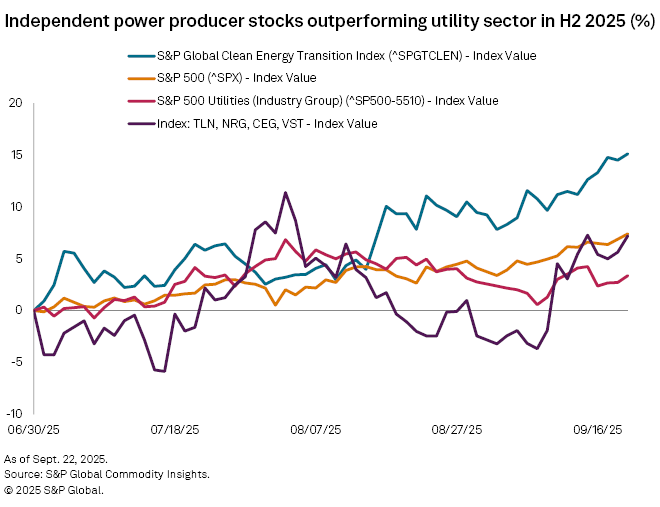

The S&P Global Utilities index has increased 5% since mid-June, compared to an 11% gain for the S&P 500. The utilities index was also up 9% year-over-year as of the end of trading on Sept. 19, but it is still lagging the S&P 500's 17% growth.

Analysts at Scotiabank agreed that a flight to risk is to blame for recent utility sector underperformance, but they added in a Sept. 2 report that marginal sector investors may also not be "patient enough" to wait for earnings to materialize from contracts with hyperscalers.

In a Sept. 22 note to clients, Scotiabank initiated coverage of IPPs Talen Energy Corp., Constellation Energy Corp., Vistra Corp. and NRG Energy Inc. as a way to "add some risk exposure to our portfolio."

"We prefer IPPs over regulated utilities, but suggest a barbell approach" that also includes utility stocks with "above-average growth," the analysts wrote.

Companies like NextEra Energy Inc. and CenterPoint Energy Inc. have outsized exposure to data centers, while WEC Energy Group Inc., CMS Energy Corp., DTE Energy Co. and Southern Co. have "below-average risks that let investors sleep well at night," according to Scotiabank analysts.

Among IPPs, Scotiabank prefers Constellation and Vistra over Talen, which "faces unique concentration risk and competitive challenges" in Pennsylvania.

Since mid-June, the S&P 500 utilities index has underperformed all four independent power producers' share prices.

Scotiabank also acknowledged in a separate Sept. 22 note that IPP "stocks no doubt whipsaw (up and down) around [data center] announcements versus sentiment/expectations."

In a Sept. 22 note to clients, however, Jefferies lowered Vistra's unit price target to $230 from $241, noting that the lack of a data center deal announcement for the 2,460-MW Comanche Peak nuclear plant in Texas "gives us a pause."

Any agreement would have to go through a process for connecting large colocated load in the Electric Reliability Council of Texas Inc. market established by Senate Bill 6, which passed in May, including a minimum $100,000 flat fee for interconnection, the analysts noted.

Jefferies said ERCOT reliability issues and a need for more gas-fired generation could also be obstacles to a deal.

"Although we see all those potential issues as process-related, they are weighing on the confidence that Vistra can get Comanche and other deals done on a timely basis," according to the report.

For utility stocks, Jefferies analysts prefer Entergy Corp., Xcel Energy Inc., Ameren Corp., Alliant Energy Corp., Evergy Inc. and PPL Corp. "ahead of the catalyst-heavy [third-quarter] earnings season."

Jefferies analysts added that they are "admittedly somewhat surprised that utilities have underperformed so starkly in the face of renewable/clean energy stocks performing well out of the [One Big Beautiful Bill Act] reforms."

An index of select solar companies compiled by Platts, part of S&P Global Commodity Insights, was up 15.26% year to date as of Sept. 12. Just three months ago, the select index was nearly 50% lower than a year earlier.