Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Sep, 2025

By Brian Scheid

US consumers continue to spend, but are increasingly digging into savings to cover rising costs, a sign that the persistently robust domestic economy could be on shaky ground as the impacts of tariffs take root.

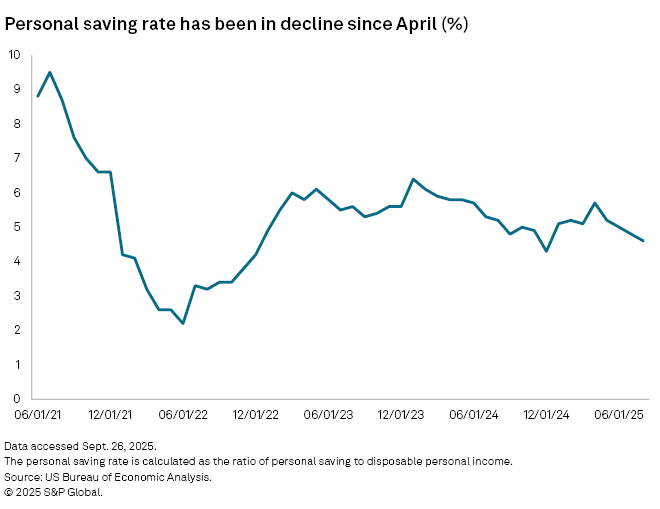

The personal saving rate in August dipped to 4.6%, its fourth decline in as many months and its lowest level since December 2024, the US Bureau of Economic Analysis reported Sept. 26. The saving rate reached 5.7% in April, but has fallen steadily since President Donald Trump introduced higher tariffs on nearly all US trading partners, pushing up inflation and increasing costs on a broad range of goods and services.

"Lower saving rates indicate a more stretched consumer, potentially from compounding price gains and less reliance on credit," said Shannon Grein, an economist with Wells Fargo.

The rate for past months was revised higher, a signal that there may be more of a financial cushion in the household sector than previously indicated, but the declining saving rate suggests that Americans are simply spending larger chunks of their income each month, Grein said.

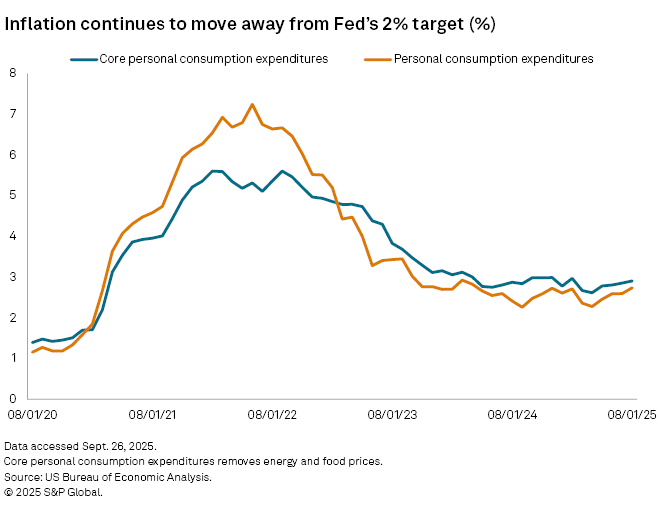

The core personal consumption expenditures (PCE) index, an inflation measure that strips out volatile energy and food prices, increased 2.9% from August 2024 to August 2025, up about 5 basis points from July and the highest annual rate since February.

The US Federal Reserve wants annualized inflation growth to fall to 2%, but core PCE growth has increased for four straight months.

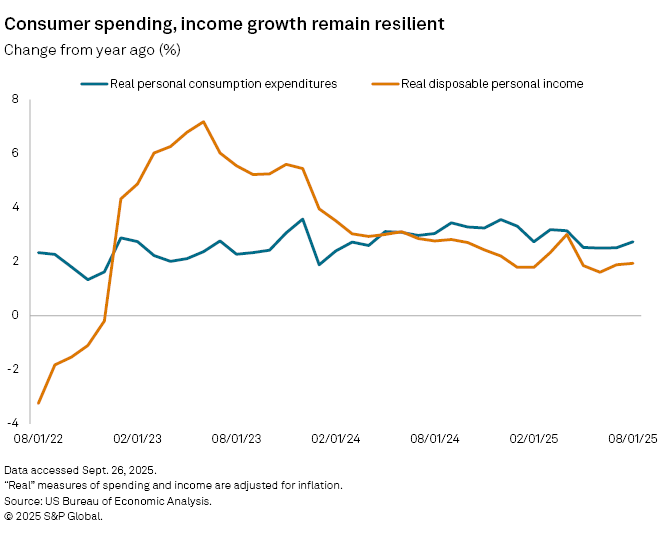

"Many consumers are increasingly feeling the strain of elevated prices and slowing income growth, prompting them to draw down savings and rely more heavily on credit to sustain their spending," Gregory Daco, chief economist at EY-Parthenon, wrote in a Sept. 26 note.

The strain is uneven, however, as higher-income households have boosted spending thanks to larger income gains and the effects of record highs in equity markets, Daco wrote.

Moderating spending

While the saving rate is falling, it remains within the 4% to 5% range that it has been in for much of 2024 and 2025, said Daniela Sabin Hathorn, a senior market analyst with Capital.com.

This meets the Fed's assessment that consumer spending has been "moderating, not collapsing," Hathorn said.

"A low but steady saving rate reinforces the Fed's 'slower, not broken' view of the consumer rather than forcing a new narrative," Hathorn said.

The saving rate will likely continue to decline as long as spending growth outpaces income growth, said Gus Faucher, chief economist with PNC Financial Services Group.

And while the saving rate is low there are factors offsetting it, Faucher said.

"Credit quality is generally good and household wealth is very high thanks to the strong stock market and big gains in house prices since the pandemic," Faucher said. "Most importantly, the debt service ratio is very low."

Household debt service payments as a percent of disposable income was at 11.25% in the second quarter this year, the Fed reported Sept. 19, roughly flat from the first quarter and below pre-pandemic rates. This measure was at 11.6% in the second quarter of 2019.

"Households paid off high interest rate debt with stimulus payments and refinanced their mortgages during and after the pandemic when rates were very low," Faucher said. "Given all this, I don't think the Fed is worried about aggregate consumer balance sheets."