Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

03 Sep, 2025

By Brian Scheid and Annie Sabater

Market enthusiasm for AI technology may be fading as the boom in related stocks, which helped push the broader equities market to all-time highs, stumbled in August, with short sellers boosting their bets against many of these companies.

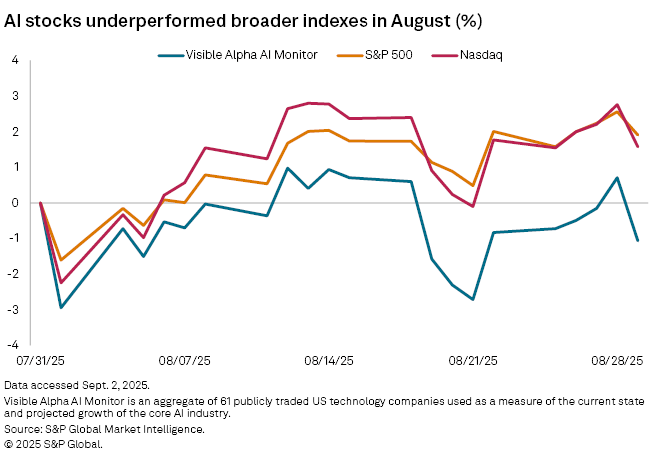

An index of 61 stocks identified by Visible Alpha as the publicly traded US tech companies that best reflect the current state and projected growth of the core AI industry fell by about 1% in August, outpaced by the Nasdaq and S&P 500.

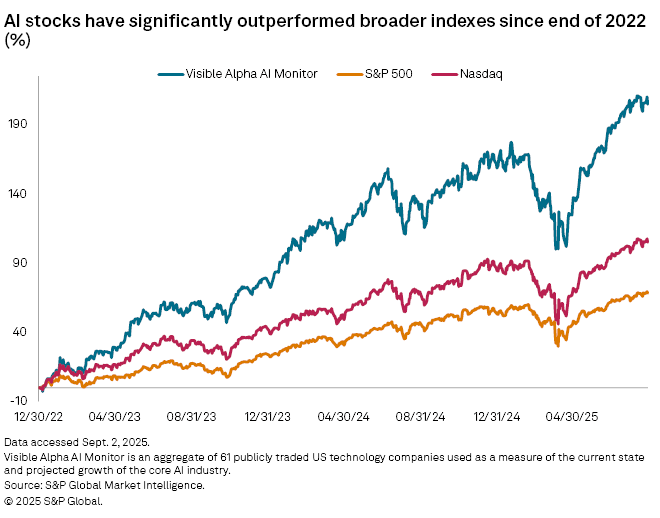

This decline marked a reversal of a yearslong trend. The AI index rose nearly 210% from the end of 2022 through the end of August 2025, about double the Nasdaq's rise over the same period and ahead of the S&P 500's 69% increase.

This stumble in AI stocks "highlights some degree of bearish exhaustion in the underlying AI narrative," said Tyler Richey, a co-editor with Sevens Report Research.

"There are signs the market is turning on AI stocks," Richey said.

Like all high-growth industries, company fundamentals may now be weighted more than sector momentum for AI stocks, said Shawn Severson, CEO and founding partner of Water Tower Research. Severson does not see signs of a significant reversal in optimism for AI stocks.

"For investors, it's getting close to making bets on winners and shedding or reducing exposure to those outside the top picks," Severson said. "Investors will begin to concentrate on those viewed as having the best business models, tech, scale and application."

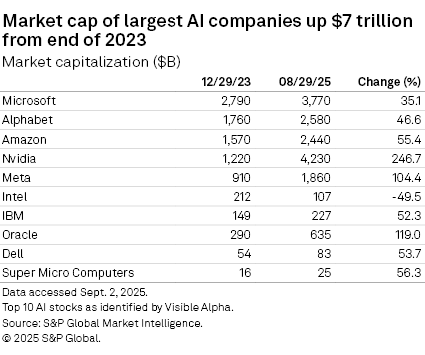

Yet if there is a significant and lasting rethinking among investors toward AI, the risk to the broader equity market could be huge due to the concentration of weight that mega-cap tech stocks such as NVIDIA Corp., Microsoft Corp. and Meta Platforms Inc. have on the S&P 500 and other indexes, Richey with Sevens Report Research said.

"This could be extremely detrimental to even the most vanilla index strategies," Richey said. "With a record amount of US personal wealth as a proportion of total net worth in the stock market right now, such a drawdown could have a negative and compounding wealth effect that has the potential to trigger both a bear market in stocks and other risks assets amid a flight to safety and an economic downturn as sentiment deteriorates with personal wealth perceptions across income and net worth tiers."

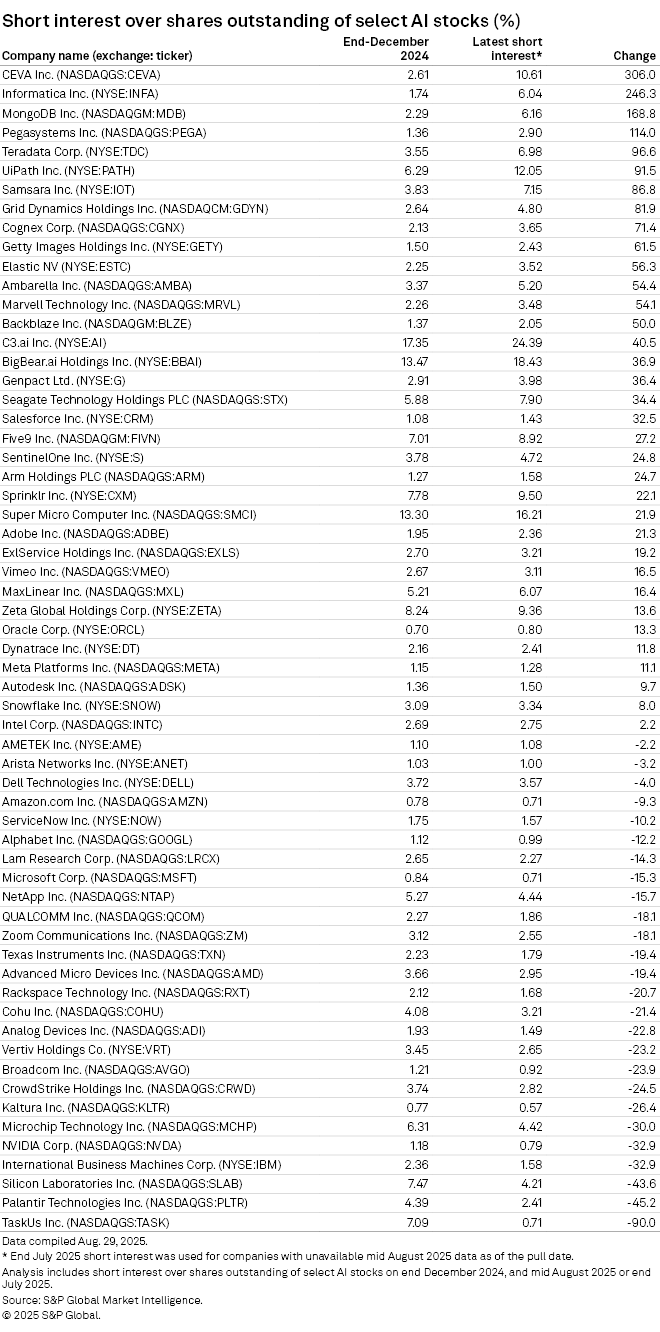

Meanwhile, short interest is climbing within AI stocks. Of the 61 stocks in the Visible Alpha monitor, short interest has increased for 35 since the end of December 2024, according to the latest S&P Global Market Intelligence data. For example, short interest in Ceva Inc. tripled from the end of last year, and bets against C3.ai Inc. jumped about 40% to 24.4%, the highest level of short interest of any of the 61 AI stocks.

"The market is exhausted by the AI theme," said Louis Navellier, founder and chief investment officer of asset manager Navellier & Associates.

The sector could overcome investors' current malaise, but for market psychology to turn, there will need to be more breakout "winners" than NVIDIA and Palantir Technologies Inc., Navellier said.

Narrative shift

The current downturn in AI stocks could be temporary, since investors do not seem to be presently questioning the viability of AI, said Sonu Varghese, a global macro strategist with Carson Wealth.

"The big hyperscalers are continuing to spend enormous capex, and more investment by the corporate sector is good for aggregate profits as well," Varghese said. "It's likely a narrative shift rather than a broad shift away from AI."

While the AI rally could be running out of steam and may not soon be replicated, growth and volatility are likely to persist, said Severson with Water Tower Research.

"I don't think the broader investor base is doubting the fundamentals of the sector," Severson said. "Still, with such strong share price appreciation and high valuations, there are now lots of trigger-happy buyers and sellers looking for anything that gives cause for concern or confidence— trying to read a lot into very little new information."

Visible Alpha is a part of S&P Global Market Intelligence.