Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Sep, 2025

By Tyler Hammel

As a government shutdown hinging on Affordable Care Act tax credits looms, most managed care insurers have already priced in the potential loss of the subsidies, according to analysts.

The US federal government could face a shutdown Oct. 1 as lawmakers attempt to pass a budget bill and debate whether to extend pandemic-era increases to ACA subsidies.

The enhancements, including broadened eligibility for the ACA tax credits, expire on Dec. 31 and, absent an extension by Congress, enrollees will see significant premium hikes when open enrollment for 2026 begins Nov. 1. The ACA, known colloquially as Obamacare, also allows individuals to enroll in plans via a state-based marketplace rather than through an employer.

While Democrats in Congress have argued that the extensions are necessary to offset rising costs for lower-income Americans, the tax credits have become the latest target of broad cuts pushed by the Republican majority.

"Unless Congress acts within the next few weeks, millions of Americans will collectively pay an estimated $23 billion more next year just to maintain the same level of coverage they currently rely on," Sen. Maria Cantwell (D-Wash.), senior member of the Senate Finance Committee, said in a news release detailing the potential financial impact of not extending the tax credits.

Rates already rising

Due to the uncertainty, most managed care insurers have already filed rates with the government for materially higher premiums, according to Leerink analyst Whit Mayo.

Comparing it to the recent spate of Medicaid redeterminations — during which states decided who met qualifications for government subsidized Medicaid health plans after years of COVID-related delays — Mayo said millions of people could either lose their health insurance or face much higher premiums.

"It's a very similar population [to Medicaid], the healthy people that probably could go without health insurance decide not to keep it and then the sick people and those that need health care will retain it," Mayo said. "Therefore you see a deterioration in your risk pool and more volatility in your cost trends."

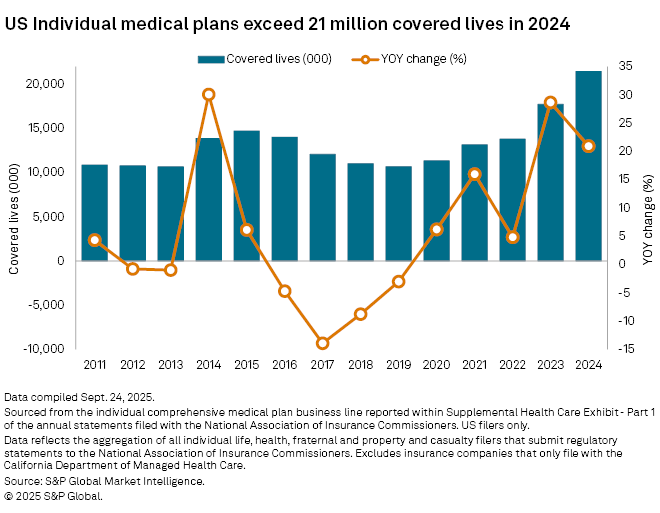

Individual medical plans, which include ACA plans and plans off exchanges, have seen significant growth since 2020, reaching 21.5 million covered lives in 2024, according to an analysis of regulatory documents by S&P Global Market Intelligence. Individual plans increased 28.7% from 2022 to 2023, coinciding with the resumption of Medicaid redeterminations. Growth continued from 2023 to 2024, with total covered lives rising 20.9%.

It is very difficult for actuaries to predict the consumer response to government funding shifts, presenting a significant challenge for the plans and leading insurers to materially increase premiums by 20%-30%, Mayo said. However, the possibility of a deal before enrollment begins for 2026 and refiled rates remain on the table, according to Mayo.

"I think that there are enough Republicans that are going to break and cross the line and strike a deal," Mayo said. "There are just too many people who will lose health insurance otherwise and there are midterm implications, it's a very complicated policy topic."

Not all exposure is created equal

Some insurers are likely to be more impacted by the lack of extended ACA tax credits than others simply due to their exposure.

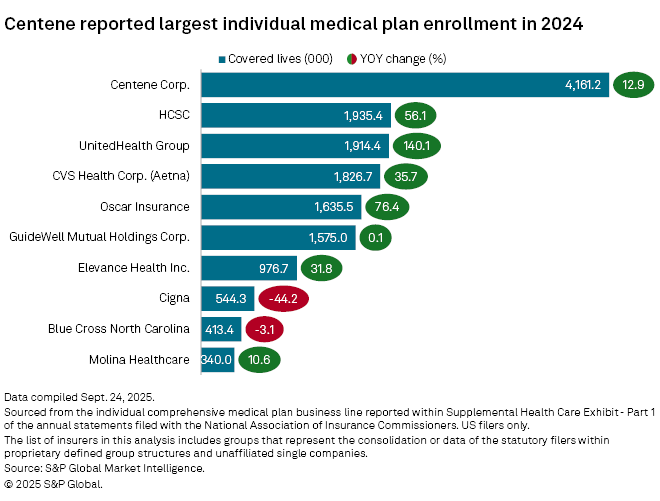

Centene Corp. was by far the leader in individual plans in 2024, with 4.16 million members enrolled in individual plans, a rise of 12.9% from the prior year, according to an analysis by S&P Global Market Intelligence. Health Care Service Corp. had the second largest individual plan membership in 2024 with 1.9 million, followed by UnitedHealth Group Inc. also with 1.9 million members.

Many of the insurers with the largest population of individual plan members saw significant year-over-year growth in 2024, with United's membership rising the most by 140.1%, followed by Oscar Health Inc., which grew by 76.4%.

Most managed care insurers have some presence in the ACA marketplace and will feel impacts of the rate changes and any ACA credit changes, according to James Sung, director of insurance ratings for S&P Global Ratings.

However, some companies like Humana Inc. and CVS Health Corp., will fare well due to their lack of or shrinking presence in the marketplace. This may prompt some players to be less involved in ACA plans, Sung said.

A marketplace reset

Another factor at play is that the US saw a post-COVID rise in individual plans, according to Sung.

"The regular subsidies are remaining in place and these enhanced subsidies helped grow the market during the pandemic," Sung said. "At the end of the day, it might just shrink to closer to the size it was prior to the subsidies. So it's just kind of a resetting of expectations for the marketplace."

The base case assumption is that the subsidies will expire, and insurers have already filed rate increases based on that expectation and on higher acuity seen in 2025, Sung said. But more ACA rule changes loom, including stricter income verification and a narrowing of enrollment period extensions, creating more uncertainty, according to Sung.

"We think their premium rate increases reflect the fact that they understand the risk pool deterioration and so they're trying to get around that," Sung said. "But it's very uncertain how the enhanced updates will play out and then what happens to the risk pool, who actually signs up [for ACA plans] and then retains membership."