Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Sep, 2025

By Julia Reign Reyes and Shambhavi Gupta

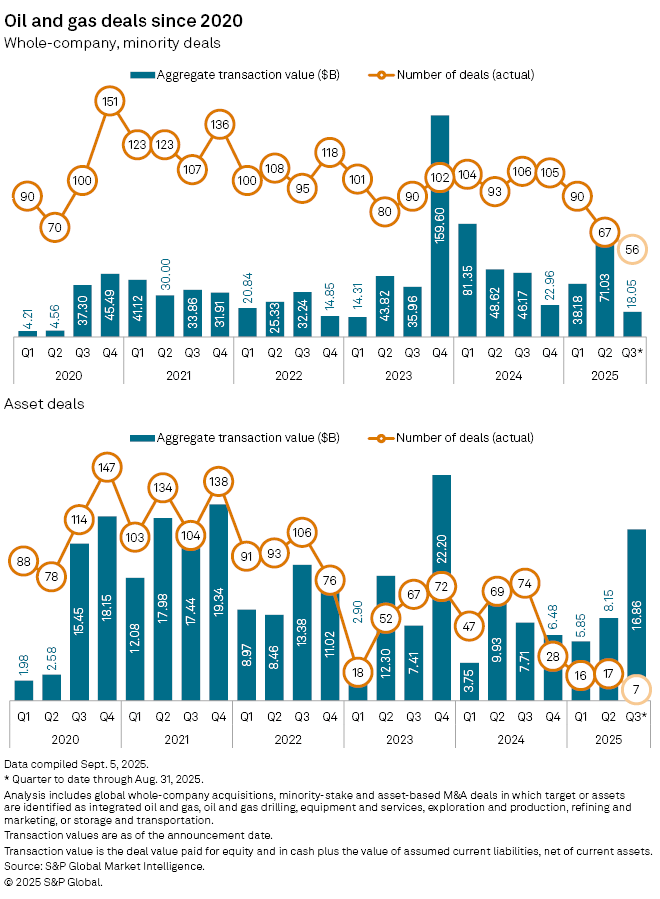

The oil and gas sector witnessed a significant surge in merger-and-acquisition activity in August, led by an $11 billion deal to acquire a stake in a Saudi Arabian gas processing facility.

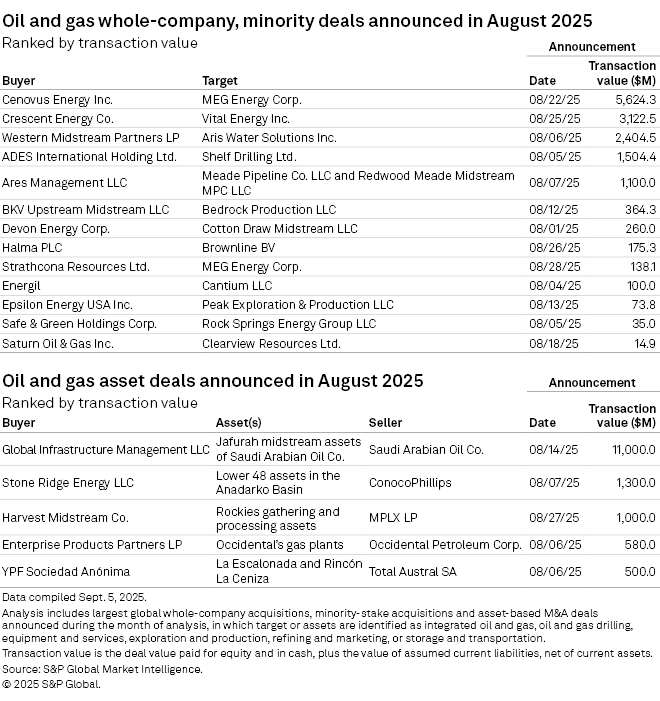

This transaction was one of 35 deals that generated a total transaction value of $29.3 billion, according to data compiled by S&P Global Market Intelligence. This valuation marked an increase from both July's 24 deals worth a total of $5.3 billion and August 2024's 50 deals worth a total of $25.17 billion.

Largest asset deal in August

A consortium of international investors, led by BlackRock Inc.'s Global Infrastructure Management LLC, also known as Global Infrastructure Partners (GIP), signed a deal to acquire a 49% stake in Saudi Arabian Oil Co.'s Jafurah gas processing facilities for $11 billion.

Jafurah is touted as the largest non-associated gas development in the Kingdom of Saudi Arabia, estimated to contain 229 trillion standard cubic feet of raw gas, Saudi Aramco said in an Aug. 14 news release. Jafurah is a key component in the company's plans to increase gas production capacity by 60% between 2021 and 2030 to meet rising demand.

"Jafurah is a cornerstone of our ambitious gas expansion program, and the GIP-led consortium's participation as investors in a key component of our unconventional gas operations demonstrates the attractive value proposition of the project," Amin Nasser, Saudi Aramco president and CEO, said in a statement. "We look forward to Jafurah playing a major role as a feedstock provider to the petrochemicals sector, and supplying energy required to power new growth sectors, such as AI data centers, in the Kingdom."

– Use our Transactions Statistics page to run a custom screen of M&A transactions.

– Visit our M&A Replay page to view more data on other M&A deals.

Top whole-company and minority-stake deals

The month saw five whole-company and minority-stake deals that surpassed the $1 billion valuation.

Cenovus Energy Inc.'s planned acquisition of MEG Energy Corp., with a total transaction value of $5.62 billion, topped the list. The deal is expected to close by the end of the fourth quarter, subject to customary approvals. When completed, it would bring together two producers with combined oil sands production of over 720,000 b/d.

Crescent Energy Co. acquired fellow producer Vital Energy Inc. in a $3.1 billion deal that would provide Crescent with access to shale oil resources in the Permian Basin in Southern Texas. Together, the combined company produces about 400,000 b/d of oil equivalent and will hold nearly 1 million net acres of land positions.