Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Aug, 2025

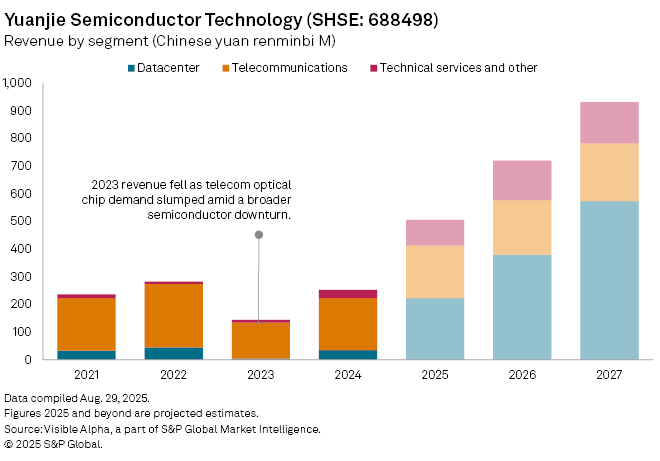

Yuanjie Semiconductor Technology Co. Ltd. (SHSE: 688498) is forecast to more than double its revenue in 2025 as it accelerates a strategic pivot from telecoms to fast-growing markets such as artificial intelligence and cloud infrastructure.

Visible Alpha consensus shows analysts expect the Shanghai-listed chipmaker’s revenue to climb 100% year-on-year to CN¥506 million in 2025, building on a 75% rebound last year that followed a sharp 49% drop in 2023. Analysts expect the shift towards indium phosphide (InP) laser chips—critical components in the 400G and 800G optical modules used by hyperscale data centers—to underpin the recovery.

The data center segment is projected to grow more than fivefold in 2025, rising 545% to CN¥223 million, and could become Yuanjie’s largest business line. Its share of group revenue is set to jump from 14% in 2024 to 44% in 2025, overtaking telecoms, where growth is expected to stagnate at just 0.4% to CN¥189 million amid a plateau in 5G network investment. Telecom’s contribution is set to fall to 37% of revenue, from 75% a year earlier. By 2027, analysts expect data centers to generate nearly two-thirds of group sales.

Profitability is also expected to recover in 2025, with net income projected at CN¥138 million, after a CN¥6 million loss last year. Yuanjie reports second-quarter results on Saturday, August 30.

– Learn about Visible Alpha | S&P Global.

– Explore Visible Alpha Add-On for Cap IQ Pro.

– Access Visible Alpha estimates on Yuanjie Semiconductor.

– To receive email alerts for future Visible Alpha articles, select Visible Alpha Data Snapshots under the Authors section.