Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Aug, 2025

Westrock Coffee Co. (NASDAQ: WEST) reported a 35% year-on-year rise in second-quarter net sales to $280 million. The strong growth momentum comes after a difficult 2024, when revenue slipped 2% as the company absorbed heavy upfront costs from its new manufacturing facility in Conway, Arkansas.

The Conway site, designed to expand production of coffee extracts and ready-to-drink beverages, carried nearly $13 million in scale-up operating costs last year while running below capacity. That, coupled with higher green coffee prices and shipping disruptions, eroded margins and weighed on results.

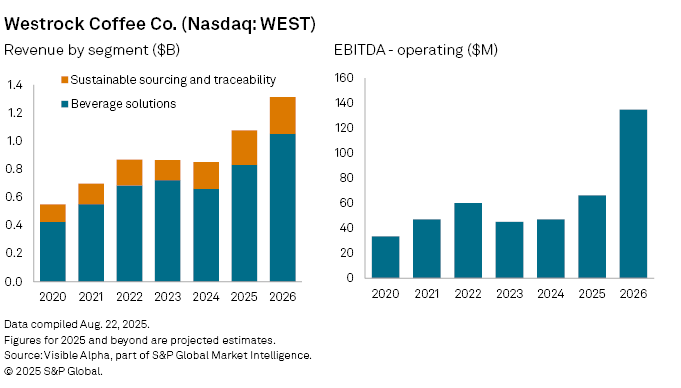

Now, with the plant producing at scale, analysts expect 2025 to mark a turning point. Visible Alpha consensus points to a 26% rise in Westrock’s net sales. Beverage Solutions — Westrock’s core division supplying extracts and RTD products — is forecast to climb 28% to $830 million, recovering from a 9% decline in 2024. Its Sustainable Sourcing & Traceability business is expected to grow 26% to $245 million. On profitability, operating EBITDA is forecast to rise to $66 million in 2025 and more than double to $135 million in 2026.

Rising commodity costs remain a risk, but with capacity investment largely behind it, the company is positioned to capture a growing share of the North American coffee and tea market.

– Learn about Visible Alpha | S&P Global.

– Explore Visible Alpha Add-On for Cap IQ Pro.

– Access Visible Alpha estimates on Westrock Coffee.

– To receive email alerts for future Visible Alpha articles, select Visible Alpha Data Snapshots under the Authors section.