Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Aug, 2025

By Nick Lazzaro

Traders work on the floor of the NYSE in New York City on July 30, 2025. Stock indexes have continued to record gains through July, with benchmarks such as the S&P 500 hitting record highs multiple times. Source: Spencer Platt/Getty Images News via Getty Images. |

Equity markets are booming through the summer despite slower economic growth expectations, boosted in part by resilient corporate earnings and consumer spending.

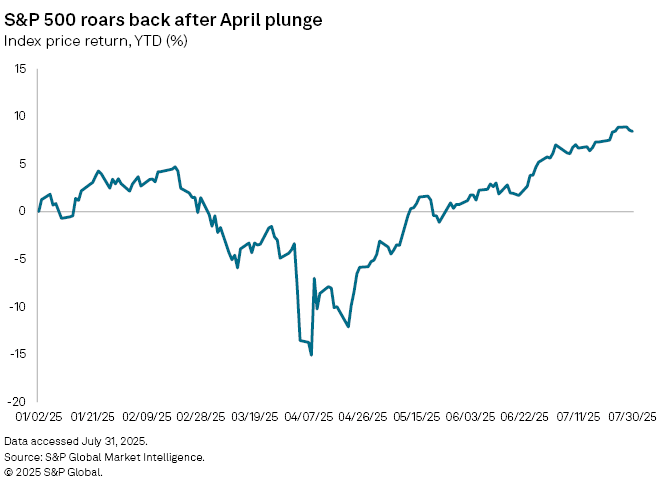

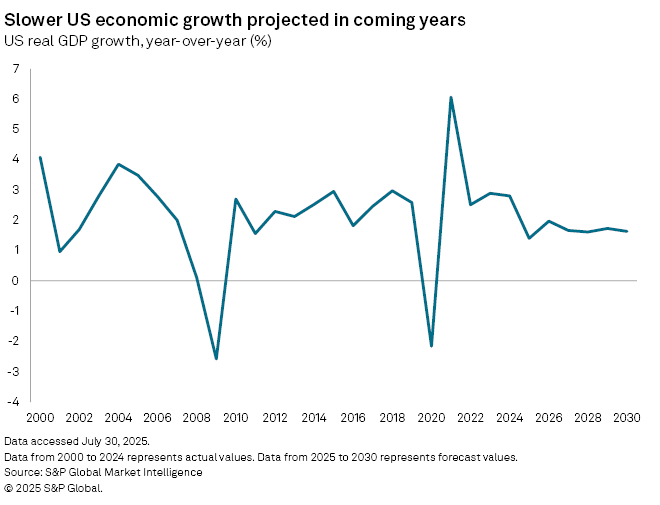

The S&P 500 hit record highs in July and finished the month up over 8% since the start of the year, according to S&P Global Market Intelligence data. Meanwhile, Market Intelligence forecasts US real GDP to grow 1.40% this year, marking the fifth-slowest rate of growth since 2000.

The S&P Global Investment Manager Index survey in July showed that investor risk appetite returned following months of caution. Within the survey's Equity Returns Index, a measure of factors that investors believe could either boost or drag market performance in the near term, sentiment toward equity fundamentals registered a bullish 28% index reading. This outweighed a bearish reading of negative 14% for the US macroeconomic environment, indicating milder concern over slowing growth.

"It's not unusual to have sentiment and reality traveling on different paths," said Gary Pzegeo, co-chief investment officer for CIBC Private Wealth, in an interview. "The markets and the economy both took a shock to the system back in March and April with the announcement of tariffs, and the sentiment probably overshot to the downside."

Economic forecasts began warning of worst-case scenarios after the Trump administration proposed tariff rates of 20% or higher on most countries in April, with potential rates on China escalating to over 100%. The announcement triggered a weeklong stock sell-off. Tariff rates and enforcement timelines have since fluctuated while the US has instead pursued negotiations with trading partners, allowing bearish market sentiment to ease.

"You've had a dialing back of those worst-case scenario expectations," Pzegeo said. "Now, it's an adjustment of sentiment into a more realistic set of outcomes that feels very bullish. The expectations are for slower growth, but it's not recessionary."

Markets received another cautionary jolt Aug. 1, when the US Bureau of Labor Statistics' monthly labor report issued revised data for previous months on total nonfarm payroll employment growth, slashing the original May job growth total to 19,000 from 144,000 and the June total to 14,000 from 147,000. Bureau of Labor Statistics data now shows that 597,000 jobs have been added through the first seven months of this year, a slower rate of job growth than the 1.07 million jobs recorded for the same period in 2024 and 1.68 million jobs in 2023.

The S&P 500 sank 1.60% on the same day as the Friday labor report release, signaling that the stock market's bull run had reached a crossroads in response to the bearish employment data. However, the index bounced back the following Monday with a 1.47% gain on Aug. 4.

Corporate earnings, consumer spending fuel sentiment

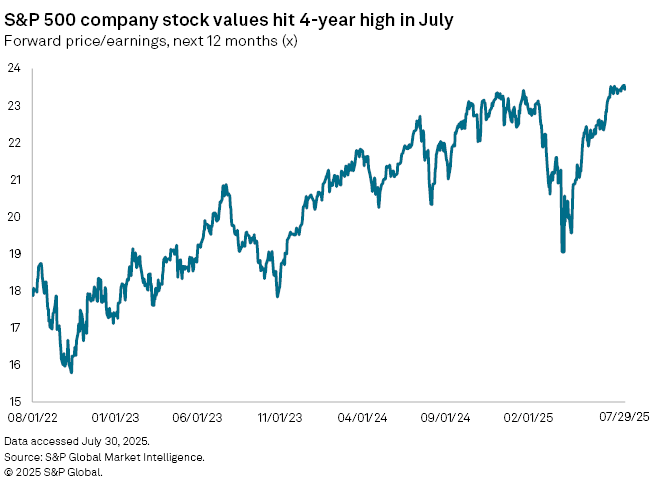

Investor confidence firmed through July as many S&P 500 company earnings results exceeded expectations in July, pushing stock valuations up and providing further justification for the stock market's hot streak.

Through the end of July, 313 S&P 500 companies reported second-quarter earnings, with more than 81% of these companies beating estimates so far, according to Market Intelligence data.

As earnings were reported in July, the constituent stocks of the S&P 500 index on July 28 traded at a four-year high of 23.55 times their forward earnings estimates for the next 12 months. This has rebounded from a year-to-date low of 19.04x on April 7.

The uptake of AI technologies has, in part, enabled earnings to follow a different trajectory from economic forecasts.

"Investors are projecting major efficiency gains and cost cutting from AI adoption, which could boost company earnings, but that does not automatically translate into higher GDP growth," Stephan Shipe, founder and CEO of Scholar Financial Advising and finance professor at Wake Forest University, told Market Intelligence.

The divergent trends can coexist as they are impacted by different factors. For instance, higher margins can lift earnings and stock valuations, while lower public and private spending can constrain overall economic growth, Shipe said.

"If government spending slows or uncertainty rises, that could dampen GDP even if certain sectors are thriving," Shipe said. "In essence, the market on the one side sees margin growth and is optimistic, but GDP on the other side reflects a broader and more cautious view of economic output."

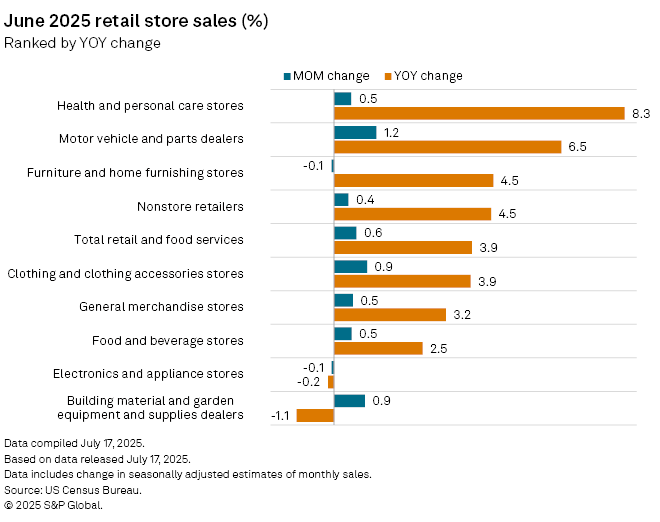

Strong corporate earnings have been complemented by resilient consumer spending, which has yet to feel inflation-related pressure from tariff policy.

The consumer price index, a key inflation measure, increased 2.7% year over year in June, according to data from the Bureau of Labor Statistics. Year-over-year increases in the monthly data have remained below 3% since February.

Meanwhile, US Census Bureau advance estimate data in July showed that domestic retail and food services sales rose by 0.6% month over month in June after declines in April and May. The sales numbers beat consensus expectations of a milder 0.1% rise, based on economist forecast data compiled by Econoday.

"Investors' worst fears from the April tariff-related sell-off have not been realized, in part due to ongoing negotiation progress and clarity provided through a narrowing of the range of outcomes," Jeff Wilson, portfolio manager at Jensen Investment Management, told Market Intelligence. "This, coupled with fairly benign inflation data to date, has provided fuel for the risk-on environment we've seen over the past several months."

Risks simmer under headline data

Many key economic indicators have mostly shown stability or recovery since May, including data related to stock indexes, the labor market, consumer confidence and inflation. But market observers should not ignore finer details that reflect potential headwinds.

"The issue right now is 'tell me what story you want the data to tell, and I'll tell you that story with data,'" Rebecca Homkes, lecturer at the London Business School and faculty member at Duke Corporate Executive Education, told Market Intelligence. "Headlines look okay-to-good ... one layer deeper in the data, though, we are seeing more shakiness."

For example, low unemployment rates in labor data have garnered positive attention. However, the concentration of hiring in local government and healthcare and a declining labor participation rate signal unsustainable trends, Homkes said.

Market watchers should also not disregard the lingering threats that tariffs still pose. Though trade deals between the US and its trading partners have alleviated the heightened fears associated with the original tariff proposals of the US, tariff rates will ultimately be higher than they were at the beginning of the year.

Additionally, product-specific tariffs remain on imported products such as steel, aluminum and automobiles. Similar levies could still be applied to other products.

"We sense that equity investors are too complacent on where tariff levels could ultimately end up, especially if the administration is emboldened by stock market resilience," Lisa Shalett, chief investment officer of wealth management for Morgan Stanley, said in a July 23 commentary.