Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Aug, 2025

By Tyler Hammel and Jason Woleben

Many of the largest publicly traded US health insurers had a difficult second quarter as rising costs associated with government-subsidized health plans exacerbated ongoing declines in earnings per share and income.

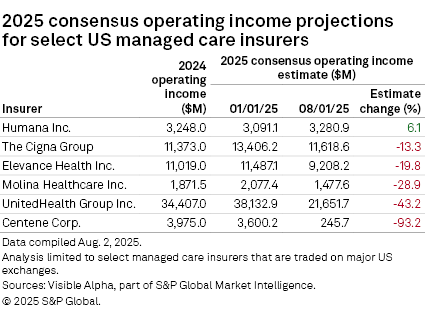

Of the six largest publicly traded US managed care insurers, all but Humana Inc. released operating income figures that fell below analyst consensus estimates.

A key factor behind this trend was rising medical costs, which resulted in decreased revenues and lower-than-anticipated EPS.

Humana outperforms peers

Humana, which raised its full-year earnings projections, bucked the trends that have dragged down the broader managed care sector. The company's operating income exceeded analyst consensus estimates by 6.1% from the start of the year through August, according to an analysis by S&P Global Market Intelligence.

"While we still have challenges to navigate, the external environment this year continues to evolve largely in line with our expectations, and we are executing against our plan," President and CEO James Rechtin said in a July 30 earnings call.

The quarter's results were buoyed by growth in Humana's Medicaid and pharmacy business, CenterWell, Rechtin said, as well as a smaller-than-anticipated decline in individual membership among Medicare plans.

Medicare Advantage, expanded versions of the government-subsidized plans offered via a partnership with private insurers, has been an issue for Humana in recent years as a post-COVID increase in utilization led to higher costs. Trends were in line with expectations during the second quarter, according to CFO Celeste Mellet, and there was no apparent escalation.

The sharpest miss in operating income from the consensus estimate during the same period was from Centene Corp., which fell 93.2% below analyst estimates.

Centene dropped its earnings guidance significantly, to adjusted diluted EPS of $1.75 from an adjusted diluted EPS of greater than $7.25 for the year. The health insurer withdrew its original guidance in July, in the face of significantly higher aggregate market morbidity compared to the assumptions underpinning the guidance in its marketplace business.

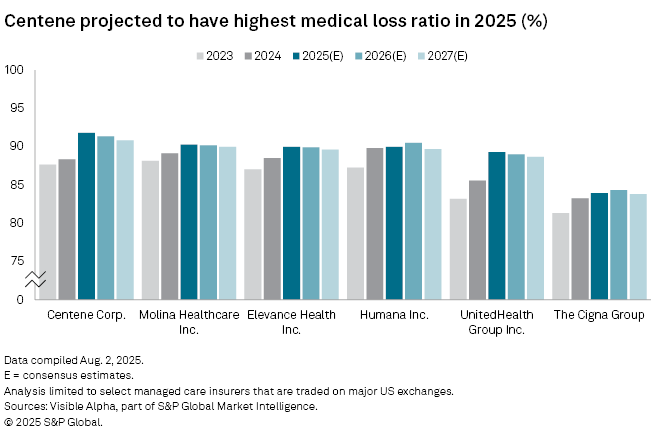

In addition to the significant drop in EPS and consensus operating income, Centene is also projected to have the highest medical loss ratio in 2025, topping out at around 91.8%.

Ongoing woes

Managed care companies such as UnitedHealth Group Inc. have faced various issues throughout 2025, including high costs associated with the senior-aimed Medicare plans that have plagued the managed care sector, as well as ongoing federal efforts to cut funding for low-income-focused Medicaid plans.

Amid these and other challenges, Andrew Witty stepped down as CEO of UnitedHealth Group in May following an "unusual and unacceptable" first quarter and was immediately succeeded by Stephen Hemsley, the company's chairman. The second quarter saw these woes continue, with UnitedHealth's consensus operating income falling 43.2% from January to August.

Much of the blame for the poor quarter in the sector was laid at the feet of Medicaid rates, which are inadequate to address shifting morbidity trends, Centene CEO Sarah London said in a July 25 earnings call.

The shift in morbidity trends, which were as much as 16% or 17% in some states, meant the business was underpriced, London said. As of the morning of July 25, the company had filed for 2026 price increases in 17 states and expected to submit filings in up to 12 additional states in the next week, she said. Centene expects state certification of the new rates over the next month.

"Based on what we know today, we continue to believe that we will be able to reprice the 2026 portfolio to account for a substantial majority of our Marketplace membership, and our goal is to reprice 100% of the book," London said.

EPS on the decline

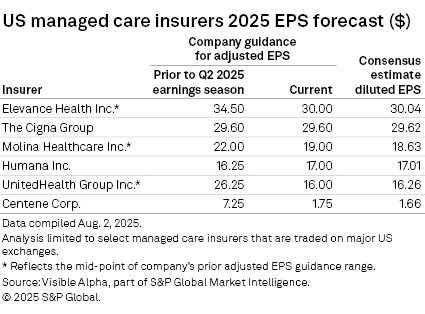

Four of the six largest publicly traded US managed care insurers forecast adjusted diluted EPS estimates lower than in the previous quarter.

Elevance Health Inc.'s EPS estimate remains the largest of the group, sitting at $30 a share, just 4 cents lower than the consensus estimate and down from $34.50 prior to the second-quarter earnings release.

While this adjustment may be disappointing to some shareholders, President and CEO Gail Boudreaux said during a July 17 earnings call that it reflects the same pressures that others in the sector have now confirmed, particularly elevated medical cost trends across the Affordable Care Act and slower-than-expected Medicaid rate alignment.

"Importantly, this decision is anchored in our view that the elevated trends we are now observing will persist and reflects our updated visibility into the second half of the year," Boudreaux said. "It is not based on assumptions of a near-term recovery."

The Cigna Group was the only managed care insurer to maintain its diluted estimate, at $29.60 a share.

Molina Healthcare Inc., which lowered its EPS forecast from $22 a share to $19 a share, believes it has reached a "floor," President and CEO Joseph Zubretsky said in an earnings call.

Molina believes that the cost trend could moderate "from this conservative indication and produce earnings upside," Zubretsky said.

"Even in this broadly challenging environment, we have the confidence and clarity to provide a specific earnings-per-share guidance floor with upside potential," the CEO said. "We continue to grow premium this year at 9% and 19% over the past few years."