Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Aug, 2025

By Garrett Hering and Susan Dlin

Developers of large-scale US battery storage stations added capacity at a record pace in the second quarter of 2025, helping to meet rising demand for electricity while keeping the industry on track to continue its multiyear ascent.

Independent power producers, utilities and their partners completed 3,902 MW of battery storage capacity at over 40 projects or major phases in the period, pushing total installed US nonhydroelectric storage resources to roughly 35.4 GW, according to S&P Global Market Intelligence data.

That marked the US battery storage sector's strongest quarterly result to date, representing a 19% rise from a year ago and a 92% increase from the first three months of 2025, the data show. The surge came amid significant supply chain and policy uncertainty, though President Donald Trump's sprawling budget law, enacted July 4, ultimately maintained valuable tax credits for large-scale battery systems into the mid-2030s.

California and Texas continued to pad their big battery portfolios in the second quarter, but Arizona led the way with the addition of more than 1,300 MW of new capacity.

Many of the new and existing projects charge their lithium-ion batteries from colocated solar farms and are designed to discharge energy for up to four hours.

At the forefront of Arizona's expanded battery fleet are Copia Power's 300-MW/1,200-MWh Harquahala 2 BESS Project, coupled with a 300-MW solar farm, and Canadian Solar Inc.'s 300-MW/1,200-MWh Papago Battery Storage Project, to be paired with a 150-MW solar project under development.

Both sites are in Maricopa County, Arizona, and their output is under contract with Arizona Public Service Co. (APS), the state's largest utility and a subsidiary of Pinnacle West Capital Corp. The sites are among several APS-connected storage projects that entered commercial operation in the second quarter, according to Market Intelligence data.

Copenhagen Infrastructure Partners Holding P/S completed its 170-MW/680-MWh Scatter Wash 1 Battery Storage Project and its 85-MW/340-MWh Scatter Wash 2 Battery Storage Project in Maricopa County in the quarter. AES Corp. energized another 119.7-MW phase of its now nearly 200-MW Westwing 1 Battery Plant, also in Maricopa County.

Longroad Energy Holdings LLC's Serrano Battery Storage Project in Pima County, Arizona, added 214 MW/855 MWh to the APS system. It charges from the 220-MW Serrano Solar Project.

'Solar after sunset'

APS now has more than 4,000 MW of renewables and battery storage on its grid.

"This allows us to provide solar after sunset — capturing energy when solar is abundant, storing it, then releasing it in the evening hours when customer demand is the highest," an APS spokesperson said in an email. "Batteries support an already diverse resource mix and serve as an affordable component in maintaining reliability."

The utility's renewables and battery fleet is roughly equal to the size of the Palo Verde nuclear generating station, of which APS owns the largest share.

The utility plans to rely on its integrated resource planning process and all-source solicitations "to support reliability through best-fit least-cost resources, including dispatchable resources such as natural gas, plus solar and storage," Ted Geisler, president and CEO of APS and its parent company, told analysts during an earnings call in August.

In Yuma County, Arizona, AES completed its 185-MW/740-MWh McFarland C Battery Project in the second quarter. It is underpinned by a long-term resource adequacy agreement with Southern California Edison Co. (SCE) and is part of a larger solar and battery complex.

Other states, particularly in the Southwest, also added more battery resources in the second quarter.

Hanwha Corp. subsidiary 174 Power Global Corp. completed its 279-MW/1,116-MWh Silver Peak Battery Storage Project in Clark County, Nevada, in the period. It is under contract with SCE, an affiliate of Edison International.

NextEra Energy Inc. in April started commercial operation of its 200-MW/800-MWh Silver State South Storage Project at the site of the existing 260-MW Silver State South Solar Project in Clark County. It also has a long-term resource adequacy agreement with SCE.

In addition, SCE has a contract for the output of Arevon Energy Inc.'s 200-MW/400-MWh Peregrine Battery Storage Project, which started commercial operation in San Diego County, California, in the second quarter.

In Brazoria County, Texas, the 304-MW/441-MWh Jarvis Energy Storage Project (Ironman), operated by UBS Asset Management AG, started commercial operation in June.

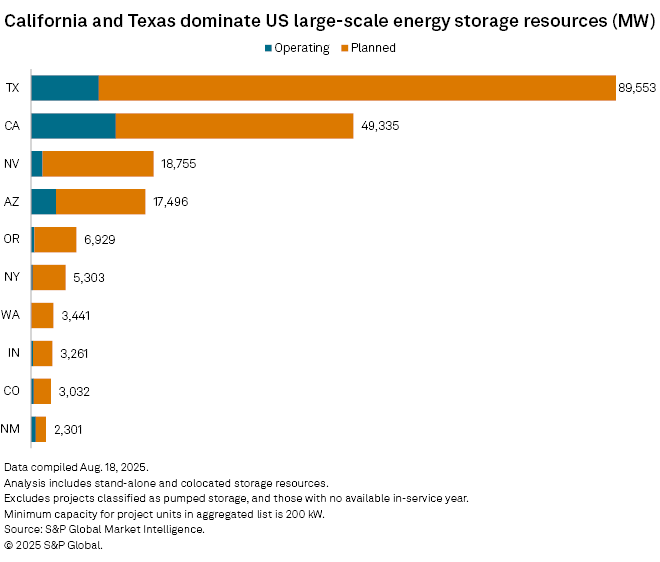

Including battery capacity added through Aug. 18, California leads the US with over 13 GW of total installed battery power storage capacity, followed by Texas with 10.4 GW, Arizona with 3.8 GW and Nevada with 1.8 GW, according to Market Intelligence data.

Texas continues to have the most battery power storage capacity under development, with over 79 GW. California has 36.3 GW under development, Nevada has 17 GW and Arizona has 13.7 GW. Significant volumes are also under development in New York, Oregon, Washington, Indiana, Colorado and New Mexico.

Large-scale battery storage appears poised to reach record levels in 2025, with more than 6.9 GW added through Aug. 18, and another 11.7 GW under construction and planned to come online this year, Market Intelligence data show.

Overall, nearly 22 GW of battery power storage capacity is under construction and planned to come online, mostly over the next two years. Another 4.2 GW is in advanced development.

The deeper development pipeline tracked by Market Intelligence totals more than 176 GW planned to come online through 2030, though developers are frequently ambitious with their timelines and many projects are never built. In addition to the projects already under contraction and in advanced development, the battery storage pipeline includes 93.6 GW in early development and 57.4 GW of announced capacity.

Market Intelligence considers a project as announced when it has a listing in an interconnection queue with an accompanying public announcement or permitting action. A project is considered in early development after permitting begins. For a project to be considered advanced development, it must meet two out of five criteria: Financing is in place, power purchase agreements are signed, equipment is secured, required permits are approved or a contractor has signed on to the project. A project is under construction when building activity begins; site preparation does not qualify a project for this status.