Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Aug, 2025

By Gaby Villaluz, Zuhaib Gull, and Alex Graf

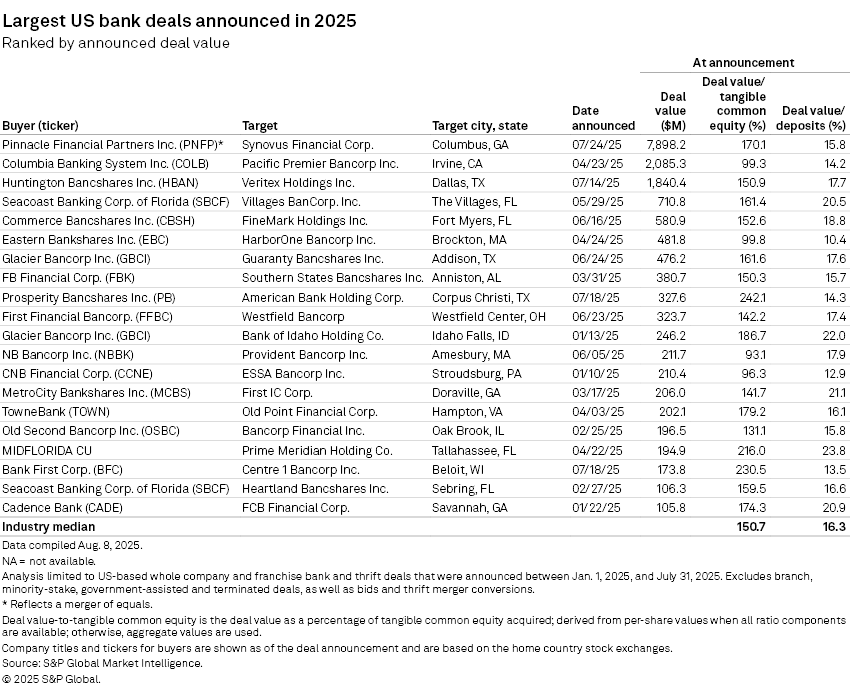

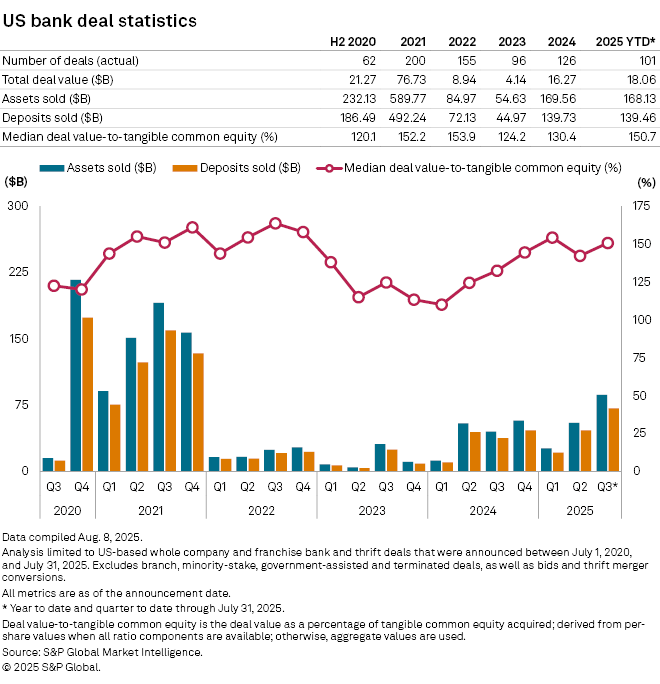

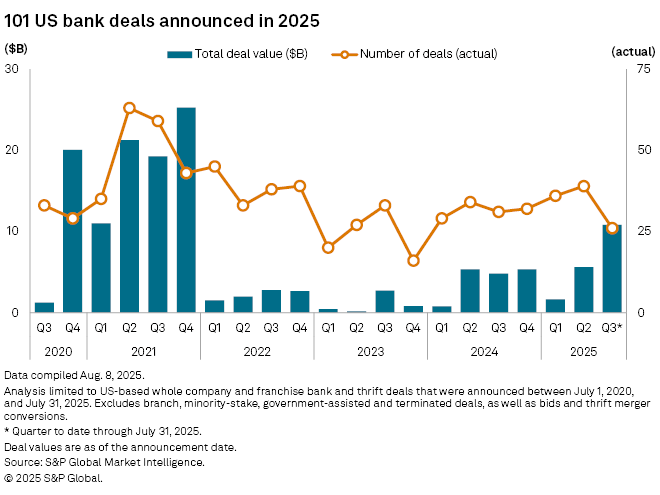

Twenty-six US bank deals were announced in July, marking the highest monthly number of deals since June 2021, when the industry disclosed 27 transactions. The aggregate deal value of $10.83 billion for the month is also the largest since December 2021, when $16.46 billion of deals were disclosed, according to S&P Global Market Intelligence data.

Four of the 20 largest deals in 2025 were announced in July.

About 73% of July's aggregate deal value is attributed to Nashville, Tennessee-based Pinnacle Financial Partners Inc. and Columbus, Georgia-based Synovus Financial Corp.'s $7.90 billion merger of equals. The transaction, announced July 24, is the largest US bank M&A deal announced since 2021.

Among deals worth over $5 billion, the transaction inflated the month's total deal value to the highest point since BMO Bank NA's $16.30 billion purchase of Bank of the West, which accounted for the bulk of December 2021's combined deal value.

Priciest bank deals

On July 18, Houston-based serial acquirer Prosperity Bancshares Inc. announced the purchase of Corpus Christi, Texas-based American Bank Holding Corp., with a deal value-to-tangible common equity ratio of 242.1%. The transaction was the most expensive US bank M&A deal announced since 2021 and Prosperity's second-most expensive buy of its last 10 whole-bank acquisitions. The $327.6 million price tag was also the ninth-largest deal announced in 2025.

Equity analysts said American Bank's strong deposit base was likely a factor in the elevated price.

On the same day, Manitowoc, Wisconsin-based Bank First Corp. announced the acquisition of Beloit, Wisconsin-based Centre 1 Bancorp Inc. for $173.8 million with a deal value-to-tangible common equity ratio of 230.5%, making it the second-most expensive US bank M&A deal announced since 2021.

Texas leads as the most targeted state

Texas was the state with the most bank deals, with five announcements.

On July 1, Baton Rouge, Louisiana-based Investar Holding Corp. announced its acquisition of Wichita Falls, Texas-based Wichita Falls Bancshares Inc. for $83.6 million. The transaction marks Investar's second purchase in Texas and its first in the north Dallas area, helping it expand its footprint in the state.

Columbus, Ohio-based Huntington Bancshares Inc. announced July 14 its purchase of Dallas-based Veritex Holdings Inc. for $1.84 billion, making it the third-largest US bank M&A deal announced so far in 2025. With more than $200 billion in total assets, Huntington Bancshares is the largest US bank to strike a bank deal since 2021, when transactions involving large banks garnered additional regulatory scrutiny during the Biden administration.

Texas is this year's most targeted state with 12 target banks, while Midwest is the most targeted region with 39 target banks.

Bank deals announced in Georgia

M&A activity is picking up steam in Georgia as four of its seven 2025 deals were announced in July.

Lexington, South Carolina-based First Community Corp. announced July 14 it would acquire Sandy Springs, Georgia-based Signature Bank of Georgia for $41.6 million. The deal is expected to close in the first quarter of 2026.

Meanwhile, Fitzgerald, Georgia-based Colony Bankcorp Inc. announced July 23 its planned purchase of Thomasville, Georgia-based TC Bancshares Inc. for $87.3 million.

The Southeast had a total of 20 target banks so far in 2025, making it the second-most targeted region in the US.

|

– Access a list of pending and completed M&A deals announced since Jan. 1, 2015. – Access the S&P Capital IQ Pro M&A summary page for US financial institutions – Read more M&A news. |

M&A outlook

With the recent upswing of deal announcements, bank executives suggested this may be the signal of a much-anticipated wave of US bank M&A.

The surge in deal activity was the product of pent-up demand, improving bank stock valuations and a regulatory regime that is increasingly receptive to M&A, sources said in interviews with S&P Global Market Intelligence.

"Bank M&A has come back quite a bit and one of the biggest reasons is bank stocks have recovered substantially," McQueen Financial Advisors President and CEO Charley McQueen said, adding that low valuations in recent years have made dealmaking difficult, resulting in a backlog of potential sellers.

Faster regulatory approval timelines are also driving deal activity, according to financial services lawyer Chip MacDonald, managing director of MacDonald Partners LLC.

"Bank regulators are not going to drag their feet and may actually approve deals quicker than they have under the prior administration," MacDonald said.