Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Aug, 2025

By Ben Dyson

Brookfield Wealth Solutions Ltd.'s planned £2.4 billion acquisition of UK life insurer Just Group PLC indicates a significant shift in the competitive landscape of the UK pension risk transfer market.

Brookfield Wealth Solutions (BWS) plans to merge Just Group with its fledgling UK pension risk transfer operation, Blumont Annuity Company UK Ltd., and run the combined entity under Just Group's brand and management team. The deal will also provide Just Group access to the asset origination capabilities of alternative asset manager Brookfield Asset Management Ltd., BWS' partner within Brookfield Corp.

"[W]e see that there will likely be greater competition as a result of the transaction for larger schemes leading to some potential margin pressure," UBS analysts wrote in a research note shortly after the deal was announced July 31.

Deal comparison

The deal follows life consolidator Athora Holding Ltd.'s announcement of plans to buy Pension Insurance Corp. Group Ltd (PIC), also a major player in the UK's pension risk transfer market, for £5.7 billion. Alternative asset manager Apollo Global Management Inc., one of Athora's co-founders, provides asset management expertise to Athora. PIC will be able to draw on Apollo's asset origination capabilities, Athora said in its deal announcement.

"Both transactions bring additional asset management firepower to support the growth and investment strategies of the acquired insurers," UK pension consulting firm XPS Group said in an August report. The company said that insurers' asset sourcing strategies are "more important than ever" to enable competitive pricing.

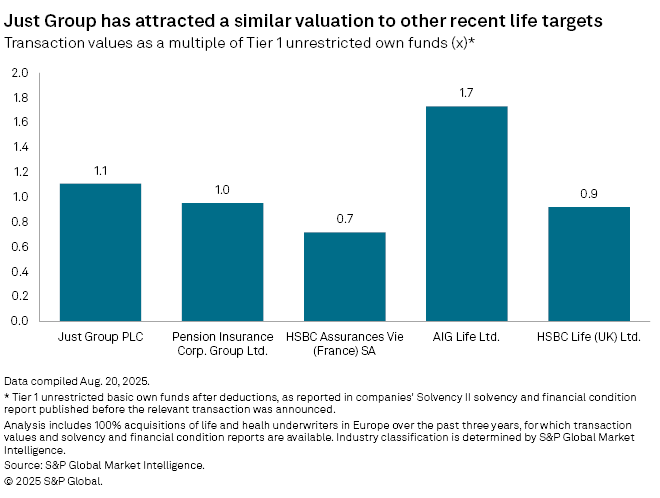

Athora's acquisition values PIC at 1.0x its unrestricted Tier 1 basic own funds after deductions, a measure of a company's share capital under the Solvency II regime, according to S&P Global Market Intelligence calculations. BWS' acquisition of Just Group, meanwhile, values the company at 1.1x own funds. This puts the valuations broadly in line with several other European life insurers whose acquisitions have been announced in the past three years — although HSBC Assurances Vie (France) SA, AIG Life Ltd. and HSBC Life (UK) Ltd. are not active in the UK pension risk transfer market.

Heating up

Competition to insure defined benefit pension scheme liabilities is intensifying, with M&G PLC, The Royal London Mutual Insurance Society Ltd. and Utmost Life and Pensions Ltd. joining or rejoining the core of existing players over the last year.

Bermuda-domiciled, New York Stock Exchange-listed BWS, previously Brookfield Reinsurance, was spun out from Brookfield Corp. and listed in 2021. It has built up a portfolio of predominantly US life insurers through acquisition and had total assets of $148.9 billion as of June 30, according to an earnings release.

While much of its activity has been focused on the US, BWS aims to enter the UK pension risk transfer market, where tens of billions of pounds of defined benefit pension liabilities are passed to insurers every year in so-called bulk purchase annuity transactions.

BWS announced in March that the UK's Prudential Regulation Authority had granted a license to Blumont UK. Blumont UK is thought to have written at least two bulk purchase annuity transactions since its launch, broker Aon said in a recent report.

Existing players say they can take the additional competition for pension risk transfer business in their stride. "People have come in and out of this market many times before, and we do not feel concerned about the competition," Amanda Blanc, CEO of Aviva PLC, told journalists on an earnings call.

On the competition for asset origination from the newcomers, Blanc said: "The real assets team has been in place for a very long time. It is incredibly well connected within the UK." She added that writing bulk purchase annuities is just one part of Aviva's overall business.

Legal & General Group PLC CEO António Simões was equally unconcerned, telling analysts on an earnings call that sophisticated investors wanting in "does validate the fact that this is an attractive market that continues to grow with good returns."

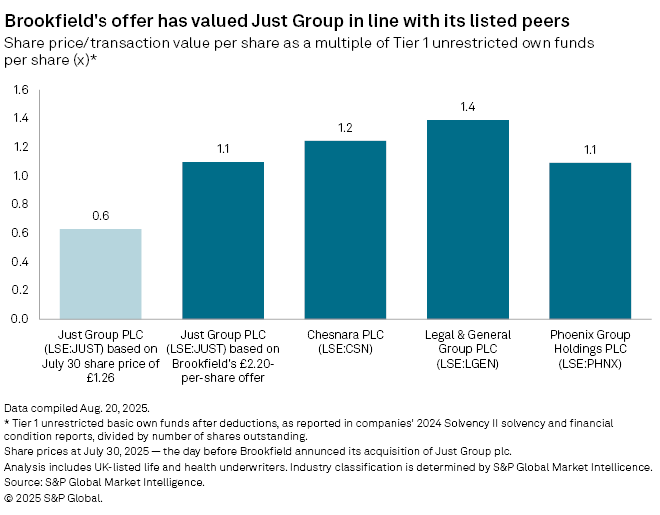

Value boost

While insurers face growing competition, Just Group's shareholders have got a good deal, according to analysts. Just Group's share price of 126 pence before the transaction was announced valued the company at 0.6x its Solvency II unrestricted Tier 1 own funds. The 1.1x own funds valuation implied by BWS' 220 pence-per-share offer brings Just Group more into line with the stock market valuation of other UK-listed life insurers.

The 220 pence-per-share price is "an attractive offer" compared to Barclays' 185 pence price target for Just Group's shares, Barclays analyst Larissa van Deventer said in a research note.

Just Group's stock market valuation before the announcement had led some to believe it was a takeover target. The company was trading at a "large valuation discount" to the rest of the UK life sector, driven by concerns of a slowdown in growth of new business sales at the company, Panmure Gordon analyst Barrie Cornes said in a research note two weeks before the Brookfield acquisition was announced. "We maintain our view that if public markets continue to ignore the long-term value within the group then the business will be acquired," Cornes added.

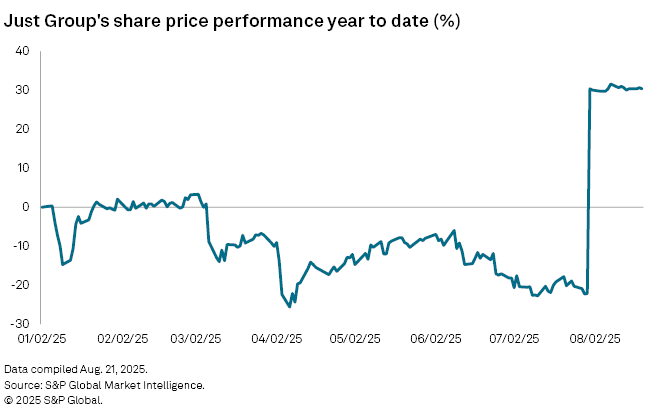

Just Group's share price jumped to 211 pence on the day the acquisition was announced.

Fuel for growth

For BWS, the deal speeds up its push into the UK pension risk transfer market, and also boosts its overall insurance position. "With this acquisition, our insurance assets are expected to grow by approximately $40 billion, significantly accelerating the growth of our business and advancing a short-term path towards $200 billion of insurance assets," Brookfield Corp. CFO Nicholas Goodman said on an earnings call.

BWS' existing UK operation may also help the Just acquisition along. As UK watchdogs have already approved Blumont's activities, "we do not foresee any significant regulatory issues with this transaction," Deutsche Bank analyst Amalie Zdravkovic wrote in a research note.

BWS declined to comment on the record.