Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Aug, 2025

| A miner prepares to be transported to the longwall face at Core Natural Resources' Enlow Fork coal mine in Pennsylvania. US coal miners are reporting renewed optimism in their outlooks as the Trump administration offers support to the industry Source: S&P Global Commodity Insights. |

President Donald Trump's second term is already netting tangible benefits for coal companies, executives reported on second-quarter earnings calls.

Despite challenging market conditions, the US coal sector is optimistic about increasing electricity demand from the president's artificial intelligence initiatives, efforts to keep coal-fired power plants from shutting down, royalty cuts on federal lands and new tax incentives for the metallurgical coal used in steelmaking.

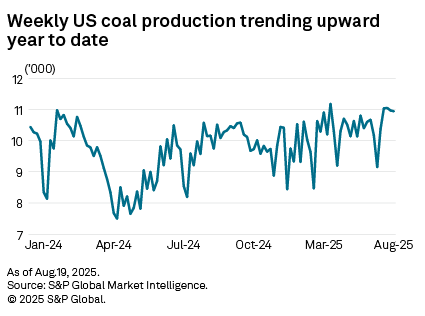

While low prices remain a struggle for many producers, weekly US coal production has been trending upward as high summer electricity load and rising natural gas prices have proved favorable in recent months, according to S&P Global Market Intelligence data.

"The world is turning towards coal," James Grech, Peabody Energy Corp. president and CEO, said on a July 31 earnings call, noting that global coal demand set a new record in 2024. "And US coal is clearly in comeback mode as it should be. The US has more energy in its coal reserves than any nation has in any one energy source."

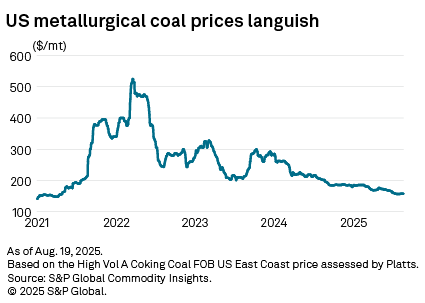

Platts assessed the price of high-vol A coking FOB US East Coast at $157 per metric ton on Aug. 19, just shy of the index's four-year low.

In April, the president signed four executive orders aimed at supporting the US coal industry. The orders designated metallurgical coal as a critical mineral, promoted the use of coal to fuel AI datacenters, prioritized coal leasing on federal lands, called for a Justice Department investigation into state policies discriminating against coal and initiated regulatory actions to lower the barriers to mining coal.

Encouraging federal coal leasing

More recently, the president's budget law — dubbed the "One Big Beautiful Bill" — passed in July with measures that Grech said deliver "long overdue relief to American coal producers." One way it does so is to reduce the royalty rate mining companies pay to mine publicly owned, federally managed coal reserves from 12.5% to 7%.

In the Powder River Basin, federal lands are the dominant source of much of the coal used by domestic power plants to generate electricity in the United States. Grech said Peabody estimates it will net $15 million to $20 million in benefits from the royalty change in the second half of 2025 alone.

Core Natural Resources Inc. is another major operator in the region with access to large swaths of federally leased coal lands. CEO Paul Lang said on the company's Aug. 5 earnings call that the reduction in royalty rate will reduce the cash cost of its western US coal operations and improve competitiveness for the fuel.

"We applaud the president and Congress for their leadership and foresight in taking these historic steps," Lang said. "Steps that will help ensure that US coal remains a key element of America's future energy supply as well as a stabilizing force in both domestic and global energy markets."

For years, coal executives have watched their customer base dwindle as US power generators shutter their coal-fired power plants to lower greenhouse gas emissions. However, in July, the US Energy Department released a report warning that the "status quo is unsustainable" and that the retirement of power plants amid the demand growth spurred by AI vastly increases the risk of power outages. At the same time, the administration has led efforts to phase out renewable energy tax credits.

"From a macro perspective, the ongoing shift in our country's energy policy has been a complete reversal from the prior administration," said Joseph Craft, CEO of coal miner Alliance Resource Partners LP, on the company's July 28 earnings call. He added that Alliance is expecting its customers to start utilizing more of the existing capacity at their coal plants as datacenters demand more power.

While domestic thermal coal markets have been relatively quiet through the start of summer, Malcolm Roberts, Peabody's chief marketing officer, said that coal plants are already running harder this year as a buildup in inventories depletes and plants with retirement plans defer those closures.

Steelmaking coal's tax break saving miners millions

Many coal producers increasingly turned to the metallurgical-grade coal used to make steel as domestic power customers shuttered coal capacity. Prices have been persistently low in the past several months, in part due to the uncertainty around Trump's tariff and trade conflicts.

However, Trump's budget bill also provides a 2.5% production tax credit for domestic metallurgical coal. The coal, which generally has a higher heat content than the coal used for generating electricity, was classified as a "critical mineral" in the bill, making it eligible for the credit starting Jan. 1, 2026, and extending through 2029.

Coal mining executives with metallurgical resources estimate the credit will offer several million dollars in benefits per year. Ramaco Resources Inc. executives estimated savings in the range of about $15 million per year. Peabody said its Shoal Creek metallurgical coal mine in Alabama would benefit by about $5 million per year.

Warrior Met Coal Inc., which has two active mines in Alabama and another set to come online in 2026, said that, depending on prices, the credit could provide net benefits of $30 million to $40 million per year or even higher. Alpha Metallurgical Resources Inc. estimated the benefit could be worth $30 million to $50 million to its operations.

Rare earths in coal

Ramaco is also working to tap into valuable rare earth metals used in a wide array of technologies, from defense to energy and electronic applications. The miner has credited the Trump administration, particularly the DOE, for helping it locate and develop the rare earth materials found in its Wyoming-based Brook mine.

"Our operations now embrace production of not only met coal, but also rare earths and critical minerals and their refinement ultimately to oxides," said Randall Atkins, Ramaco's chairman and CEO, on an Aug. 1 earnings call. "This transition has also resulted in a fundamental reset in our share price as the market has begun to view us in this new light."

The success of Ramaco has seemingly inspired others. Asked by an analyst about whether Peabody is exploring rare earth materials in light of the Trump administration's support and Ramaco's developments, Grech said the company is advancing into a "second phase" of evaluating rare earth resources at its Powder River Basin coal operations.

"Initial indications that we have seem to show that we have ... the same or better concentrations than others are reporting" in the basin, Grech said. "I will say one thing that is important to note as we move forward with this: The rare earth elements that are sitting in these clays are very accessible to us because we're already uncovering them in the coal mining process."