Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Aug, 2025

By Tyler Hammel

|

A sailboat rests in a yard after it was washed ashore when Hurricane Milton passed through the area on Oct. 10, 2024, in Punta Gorda, Florida. The National Oceanic and Atmospheric Administration is forecasting 13 to 19 total named storms for the Atlantic hurricane season, with six to 10 expected to become hurricanes. |

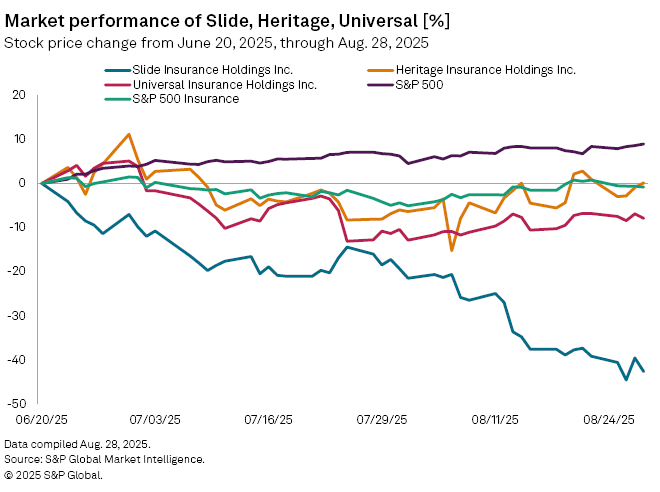

Slide Insurance Holdings Inc.'s stock has fallen more than 35% since the company launched its IPO in June, as mixed second quarter results and the ongoing hurricane season have weighed on the company's share price.

The Tampa, Fla.-based insurer, founded in 2022, opened at $21.00 on June 20, its first day of trading, $4 higher than its IPO price of $17.00. However, the stock closed at $13.36 a share on Aug. 28, down 36.38% from launch.

Fellow Florida domiciled insurers, such as Heritage Insurance Holdings Inc. and Universal Insurance Holdings Inc., fared better during the same period, declining just 0.9% and 6.9%, respectively. During the same period, the S&P 500 rose 8.95%, while the S&P Insurance Index fell 0.82%.

Part of Slide's decline is common of Florida property and casualty insurers during hurricane season, according to Tommy McJoynt, an insurtech analyst with Keefe Bruyette & Woods.

"Typically, we see the stocks a bit weak starting in May and all the way through hurricane season into September and even a little bit into October," McJoynt said. "Then, to the extent that hurricane season ends up being pretty benign, they see a very strong recovery."

Q2 earnings

However, Slide's decline in recent weeks may have more to do with its second quarter earnings figures, which McJoynt said came in light of expectations in terms of future premium revenue and were a little heavy in terms of attritional losses.

"Typically, when you have a new public company, the hope is that the first quarter they were playing it a bit conservative with some of the guidance and end up making it nicely above expectations on pretty much all metrics," McJoynt said. "That just wasn't the case here and I think that prompted some sell-off."

Slide also announced on Aug. 28 that it had authorized the repurchase of up to $75 million of the company's common stock.

The move reflects the company's confidence in its "strategic direction, superior underwriting capabilities and well-capitalized balance sheet," said CEO Bruce Lucas in a news release. A spokesperson for Slide later reiterated the statement and declined to comment on the stock price.

"The stock repurchase program is indicative of management's strong confidence in Slide's business strategy, superior and disciplined underwriting and well-capitalized balance sheet," the spokesperson said.

The repurchasing announcement was a bit surprising, according to Piper Sandler analyst Paul Newsome, although he said he remains bullish on the future of Slide and other Florida insurers.

"It's an interesting situation because they just went out and raised all this capital and now they're using it to repurchase shares," Newsome said. "That makes it feel like perhaps the shares are undervalued, or at least that's my impression."