Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Aug, 2025

China's regulatory overhaul of lithium operations in Jiangxi have helped prices rally from June lows, but mining executives urged caution during second-quarter earnings calls over the prospect of a long-term price rally.

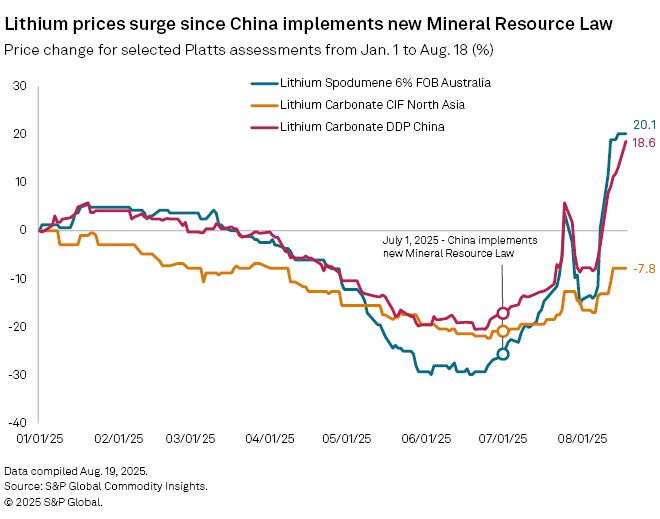

Lithium prices have been down since the collapse of a 2022 rally, yet few miners have curbed production as executives believed surging demand from the global clean energy transition would eventually revive the market. Prices started to increase after China implemented a revised Mineral Resources Law on July 1. The law amendment prompted regulatory and permitting reviews of mines and refineries in the lithium hub in Yichun, Jiangxi, and drove the shutdown of at least one producing lithium asset.

The Platts-assessed lithium carbonate DDP China price, a benchmark for battery-grade lithium carbonate, rose 43.1% between July 1 and Aug. 18 to 88,000 yuan per metric ton, after dropping to a five-year low of 59,000 yuan/t on June 20. Similarly, the Platts-assessed lithium carbonate CIF North Asia price rebounded 16.6% from $8,150/t on July 1 to $9,500/t on Aug. 18. Platts is part of S&P Global Commodity Insights.

The Platts-assessed lithium spodumene 6% FOB Australia price had a more extreme correction, gaining 61.5% from $610/t on July 1 to $985/t on Aug. 18, after plunging 27.5% in the prior two months.

However, most lithium mining executives expressed doubt that the rally is rooted in market fundamentals.

"It is essentially a paper market not backed by physicals of either nature, which just shows how susceptible to news and susceptible to sentiment the market has become," Ana Cabral-Gardner, co-chairperson and CEO of Sigma Lithium Corp., said on an Aug. 15 earnings call.

"We saw a very sharp price increase, very sudden, basically a result of news of mine closures, which weren't even attached to volume, but they were attached to an overall concept of there is a limit to loss-making within the supply chain," Cabral-Gardner said.

Sentiment over fundamentals

Lithium miners have long warned that a low price environment has rendered much of the world's lithium production unprofitable. Commodity Insights estimated that 40% of lithium operations would incur losses in 2025 if prices stayed at the level of the June lows, analysts said in the lithium and cobalt Commodity Briefing Service report released June 18.

China's regulatory review triggered a string of production halts. Contemporary Amperex Technology Co. Ltd., the world's largest battery producer and commonly known as CATL, suspended operations at the Jianxiawo lepidolite mine after failing to renew its mining permit by the Aug. 9 expiry. Zangge Mining Company Ltd.'s Qarhan Lake brine operation halted production July 14, and Jiangxi Special Electric Motor Co. Ltd.'s Yichun lepidolite mine began a 26-day maintenance period on July 25.

Some analysts have suggested that more lithium mines could be at risk of closure or temporary suspension as authorities ramp up regulatory oversight. The market sentiment was noted by various executives.

"The recent price rally, which began late in the June quarter and accelerated into July, follows this pattern — a sentiment-led rebound triggered by perceived supply risks," Dale Henderson, CEO and managing director of Pilbara Minerals Ltd., said on the company's July 29 earnings call.

An immature market and inefficient pricing mechanisms might have contributed to the sharp rebound.

"The volatility is not incidental," Henderson said. "It reflects a still nascent market with limited liquidity, few futures mechanisms, and undeveloped trading infrastructure; pricing remains inefficient. In this environment, short-term moves are often driven by sentiment, policy signals or speculative flows rather than durable shifts in supply and demand."

Some executives suggested that the mine closures signal a fundamental change in the way Chinese producers will operate.

"We are beginning to see signs of a policy shift to halt the irrational competition, or involution as it's termed," Grant Donald, chief commercial officer of Liontown Resources Ltd., said on a July 29 call.

"Local authorities have also been directed to discourage overinvestment in redundant projects, and this is built through a number of audits or restrictions placed on lithium producers in China, which is impacting the supply side," Donald said. "You can see the very tangible impact of these stories on futures exchange in China."

Following the suspension of the CATL lithium mine, the most active lithium carbonate contract on the Guangzhou Futures Exchange closed at 81,000 yuan per metric ton on Aug. 11, or $11,278/t. The contract hit the highest price level seen since Nov. 22, 2024, up 8% from the previous settled price and hitting the daily limit.

Sociedad Química y Minera de Chile SA, the world's second-largest lithium producer and commonly known as SQM, expects China's supply curtailments to have a direct impact on the company's sales volumes and revenues beginning in the September quarter.

"Since our sales volumes are concentrated in China and our realized prices remain mainly linked to price indices, we expect that with the recent price recovery in China, our sales price in Q3 should be higher than Q2," Felipe Smith, senior commercial vice president of lithium at SQM, said on an Aug. 20 call. "So the good news here is that we will have a better volume next quarter and a better price next quarter."

More supply needs to come offline

Albemarle Corp., the world's largest lithium producer, has cautioned against drawing premature conclusions from the recent developments in the Chinese market.

"The China market is very speculative," Kent Masters, chairman, president and CEO of Albemarle, said on a July 31 earnings call. "We're watching that very closely, but we've not read a ton into it."

"We continue to think that more capacity needs to come out of the market. It doesn't — and I don't think it's changed dramatically this quarter versus previously. There have been a couple [of mines] that have come offline in China. It's not clear exactly why they've come offline," Masters said.

As of Aug. 21, US$1 was equivalent to 7.18 Chinese yuan.