Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Aug, 2025

By Brian Scheid

After weeks of indecision, retail investors fully bought into the US stock market rally in July.

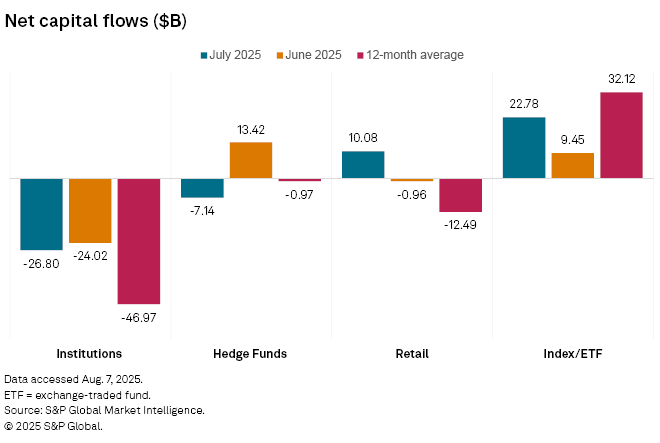

Retail investors bought a net $10.08 billion in stocks throughout July, reversing the group's trend of selling a net average of $12.49 billion each month over the past year, according to the latest S&P Global Market Intelligence data. The sudden surge in buying took place as the S&P 500 reached new all-time highs and climbed about 2.2% from the end of June. The July buying spree came after retail investors alternated from buying to selling and sold a net $965 million throughout June.

Retail investors boosted their exposure in communication services, healthcare, IT and energy throughout July after selling or buying stocks relatively little within these sectors in June, the data shows.

"The group began buying in July as they sought to capitalize on the market rally," said Matthew Albert, a principal associate for issuer solutions at S&P Global Market Intelligence. "This behavior mirrors a similar trend we observed back in May during the recovery rally."

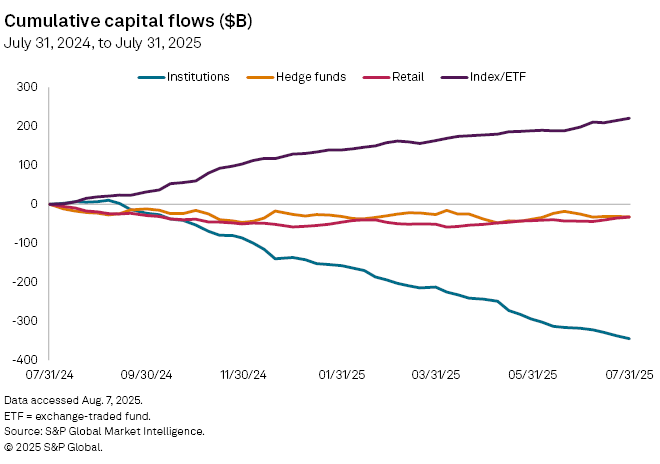

Institutions sold a net $26.80 billion of US stocks in July, up from the $24.02 billion this group sold in June but well below the net $46.97 billion sold each month over the past year.

While equity investing by institutions has slowed, the group is unlikely to start buying in the near term, Albert said.

"For us to witness a significant shift among long-only accounts, we would likely need broader market catalysts and favorable economic tailwinds," Albert said. "Currently, the presence of conflicting macroeconomic data makes it difficult to say that institutions will transition to buying anytime soon."

– For more information on capital flows data from Issuer Solutions, contact Thomas McNamara at thomas.mcnamara@spglobal.com.

As institutions sold, index and exchange-traded funds (ETFs) continued their buying trend. Index and ETFs bought a net $22.78 billion of stocks in July, up from $9.45 billion bought in June. Net buying by this group has averaged $32.12 billion over the past year.

The rise in net buying among index and ETFs is not unusual considering the inflows across all stock sectors in July. This expansive buying indicates that investors are again favoring broad exposure to US equities at a time when the macroeconomic landscape is uncertain, particularly as the Federal Reserve's interest rate policy remains unclear, Albert said.

"Essentially, market activity is significantly influenced by the macroeconomic environment," Albert said. "Investors are closely monitoring the Federal Reserve's dual mandate of promoting maximum employment and maintaining stable prices."