Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Aug, 2025

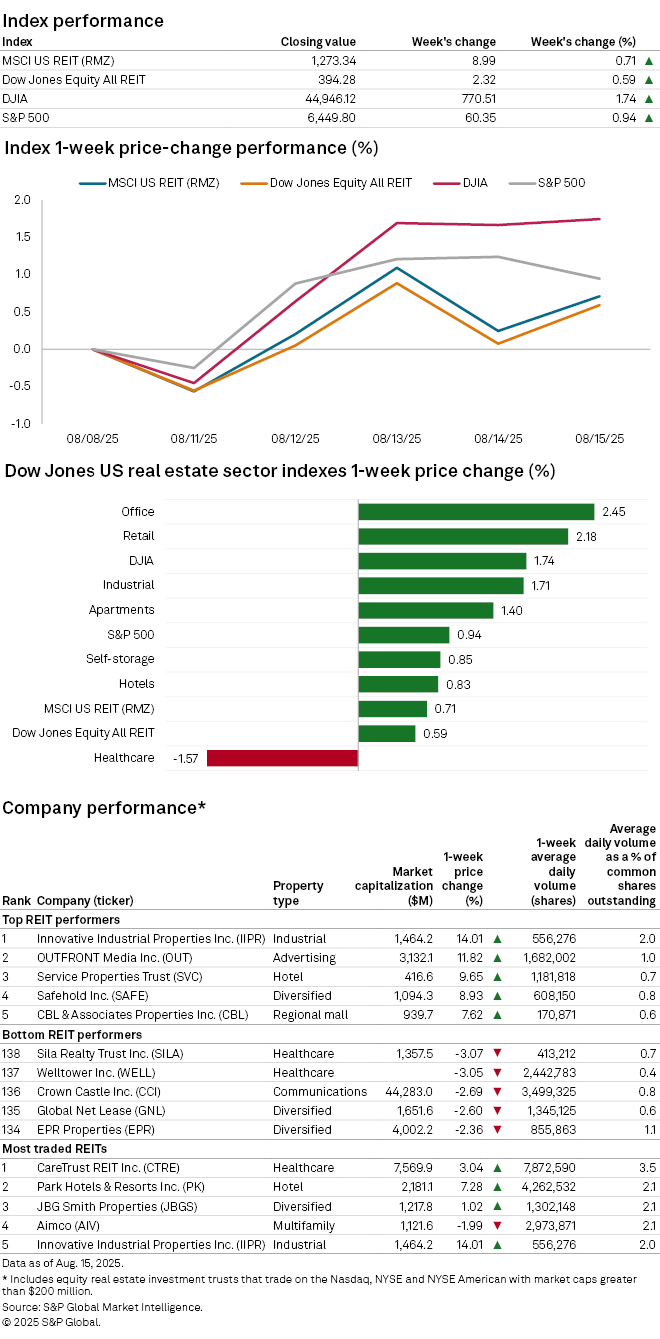

US real estate investment trust indexes increased during the week ended Aug. 15.

The Dow Jones Equity All REIT index grew 0.59% during the recent week, while the MSCI US REIT (RMZ) index increased 0.71%. The broader stock market indexes logged larger gains during the week, with the S&P 500 increasing 0.94% and the Dow Jones Industrial Average up 1.74%.

Nearly all Dow Jones US real estate sector property indexes recorded increases over the past week. The office REIT index logged the largest gain, up 2.45%, followed by the retail and industrial REIT indexes with increases of 2.18% and 1.71%, respectively.

The healthcare REIT index was the sole Dow Jones US real estate sector property index to close the recent week in the red, down 1.57%.

Cannabis-oriented Innovative Industrial Properties Inc. was the top-performing REIT stock above a $200 million market capitalization for the recent week, with a share-price gain of 14.01%. Advertising REIT OUTFRONT Media Inc. ranked next with a share-price increase of 11.82%, while hotel-focused Service Properties Trust rounded out the top three with a share-price increase of 9.65% for the week.

On the other end, two healthcare REITs logged the largest share-price declines for the week. Sila Realty Trust Inc.'s share price fell 3.07% over the week, followed by Welltower Inc. with a 3.05% decline. Communications REIT Crown Castle Inc. followed next with a share-price decline of 2.69%.