Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Aug, 2025

By Tom Jacobs and Noor Ul Ain Adeel

|

Mark Faber surveys the damage left behind from a large tornado that destroyed his house, garage and other structures in Bennett, Colorado, on May 19. |

Major US insurers with personal auto lines reported improved underwriting results and lower combined ratios in the second quarter of 2025 as frequency and severity levels eased.

All 12 companies in an S&P Global Market Intelligence analysis of leading US property and casualty (P&C) and multiline insurers reported increases in operating earnings per share and pre-tax net income.

Companies such as The Progressive Corp. and The Allstate Corp. reported solid results in their personal auto lines. Progressive booked $16.8 billion in net written premiums for vehicles, a 14.2% improvement rise from a year ago, while Allstate had a 2.7% rise to $9.53 billion for its auto lines.

"Personal auto underwriting profitability is strong, and that's a reflection of the earn-in of significant rate increases and benign overall loss trends," said Keefe, Bruyette and Woods analyst Meyer Shields. "That implies intensifying competition, with most car insurers very able to absorb higher claim costs stemming from tariffs applying to cars and/or car parts."

Income on the up

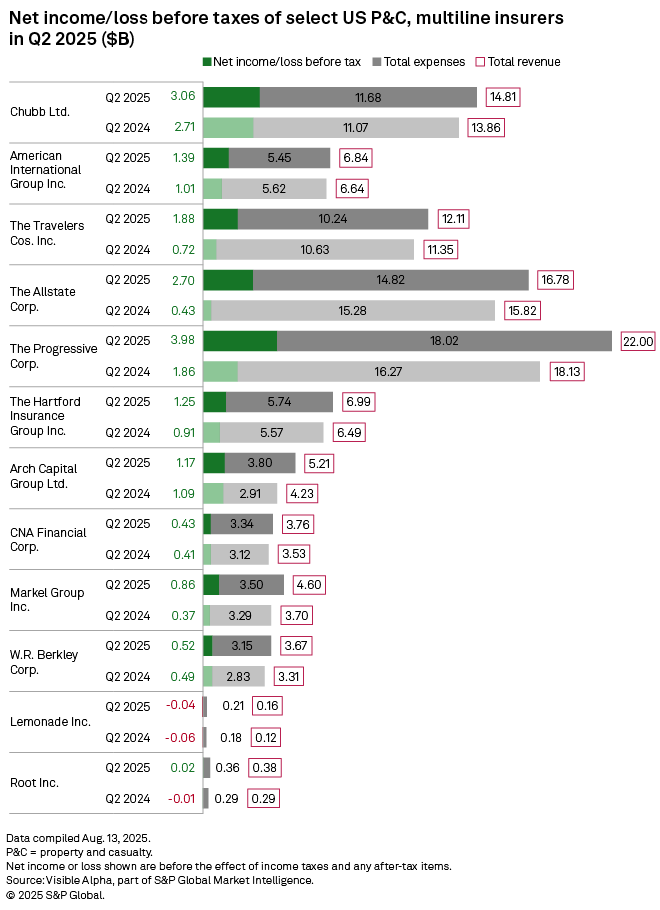

Progressive and Allstate were two of three companies in the analysis that took in over $2 billion in pre-tax net income. Progressive logged the highest total, $3.98 billion, more than double the $1.86 billion it took in a year ago, while Chubb Ltd. logged $3.06 billion and Allstate had $2.70 billion, up from $430 million in 2024.

Four carriers had over $1 billion in pre-tax net income in the quarter: The Travelers Cos. Inc., $1.88 billion; American International Group Inc., $1.39 billion; The Hartford Insurance Group Inc., $1.25 billion; and Arch Capital Group Ltd., $1.17 billion.

The top four companies in terms of total revenue were Progressive, $22.0 billion, Allstate, $16.78 billion, Chubb, $14.81 billion, and Travelers, $12.11 billion.

While there were, overall, a lot of "attractive numbers" put up in the quarter, CFRA Research analyst Cathy Seifert said that may not be the case in upcoming quarters. She said that the pace of pricing has decelerated, so top-line growth for a lot of carriers was a challenge.

"Insurers' results are no longer broadly and universally growing or improving year-over-year," Seifert said. "It's now become very much a company-specific environment where some companies have put up some attractive numbers, so underwriting results are starting to vary by carrier."

Lemonade Inc. was the lone company in the analysis that had a pre-tax net loss. The insurtech's loss of $42.6 million was, however, an improvement from a loss of $55.1 million a year ago. ,

Root Inc., which had its fourth straight profitable quarter, had pre-tax net income of $22 million, up from a loss of $7.8 million in 2024.

EPS improvement

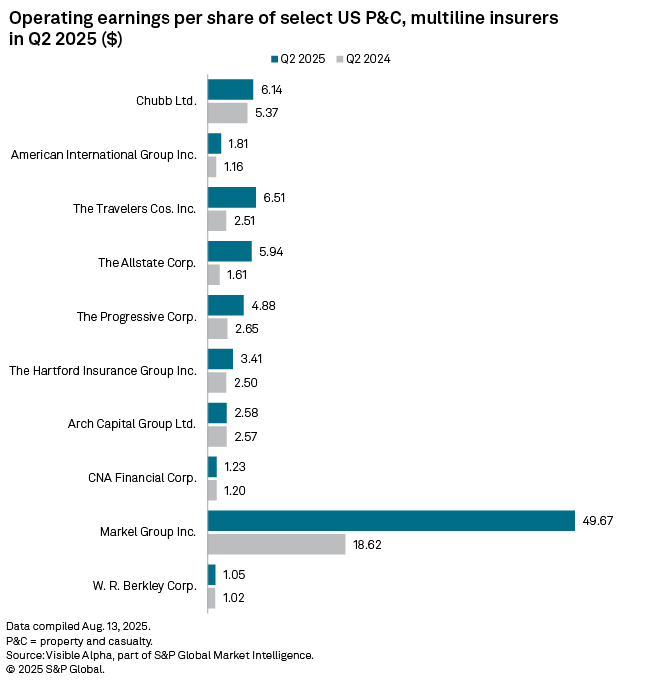

Operating EPS improved for all 12 companies in the analysis, led by Markel Group Inc., which saw its EPS soar to $49.67 from $18.62 a year ago. It easily beat the S&P Capital IQ consensus of $30.44.

Janney Montgomery Scott analyst Robert Farnham said in a research note that the beat was powered by net investment income and income from Markel Ventures Inc., Markel's private equity subsidiary, which makes investments outside of the specialty insurance market.

Allstate's operating EPS jumped to $5.91 from $1.61 in 2024, while Travelers' improved to $6.51 from $2.51. Chubb saw its operating EPS rise to $6.14 from $5.37, while Progressive booked an improvement to $4.88 from $2.65.

$2B in cat losses for Allstate

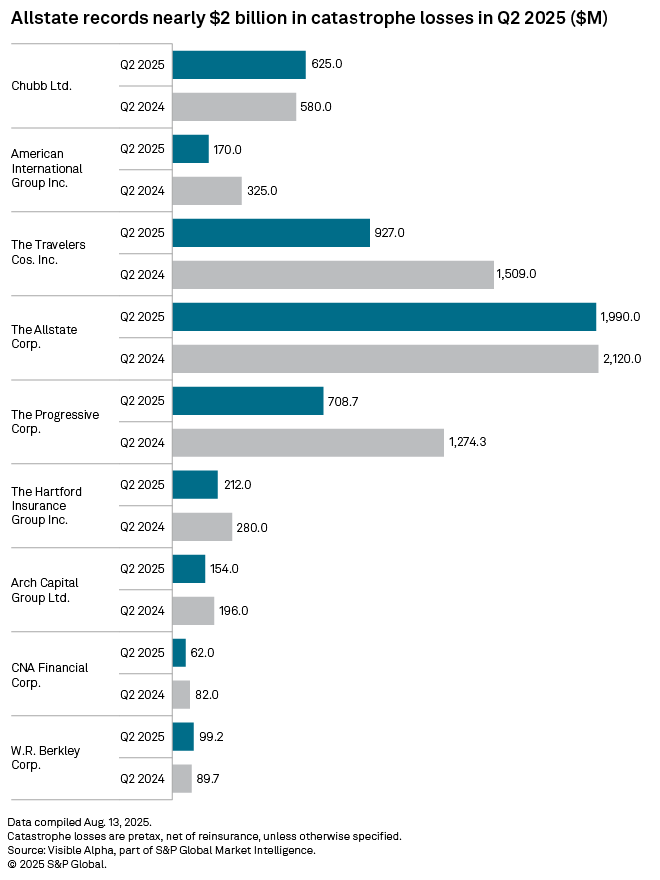

Allstate, $1.99 billion, Travelers, $927 million, Progressive, $708 million, and Chubb, $625 million, had the highest pre-tax catastrophe losses in the analysis. However, the losses for Allstate, Progressive and Travelers were lower compared to a year ago.

Of Allstate's losses, $1.33 billion, or 66.8%, were attributed to eight wind-and-hail events, as were the majority of Travelers' losses. Chubb reported that $372 million of its second-quarter cat losses were incurred by its North America P&C Insurance segment.

There were 12 billion-dollar events related to severe weather in the first half of 2025, according to Gallagher Re's H1 2025 Natural Catastrophe and Climate Report, which said that there were at least $33 billion in insured losses from those events, the fourth-highest first-half total on record.

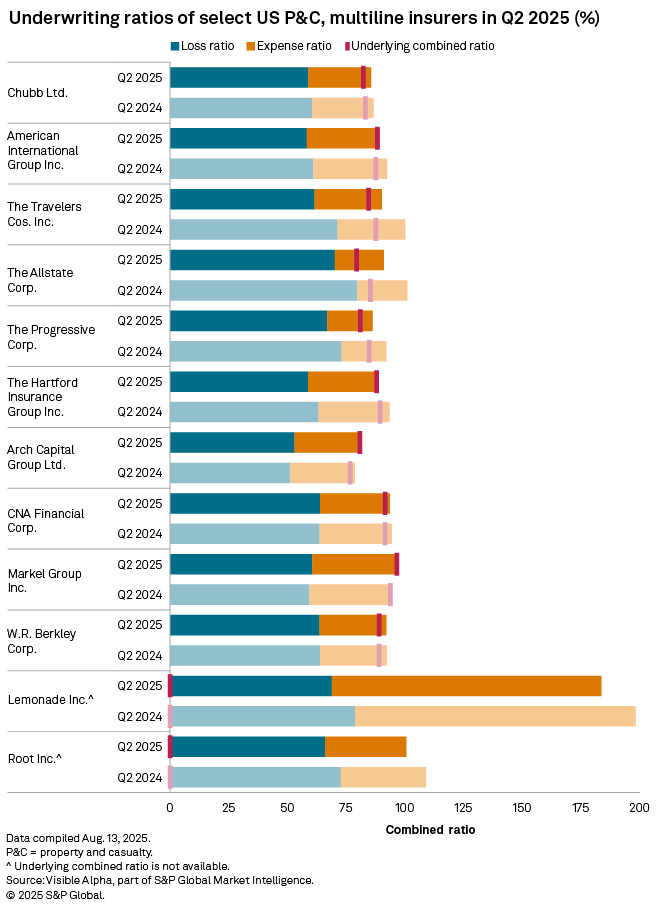

Ten of the 12 insurers in the analysis saw year-over-year decreases in their combined ratios in the second quarter, with Travelers and Allstate reporting two of the biggest improvements.

Allstate's ratio of 91.1% was 10 percentage points lower than the 101.1% recorded last year. The Illinois-based carrier's underlying combined ratio for the quarter, which excludes catastrophes, was 79.5%, the lowest in the analysis.

Travelers had a combined ratio of 90.3%, 9.9 points lower than 100.2% in 2024, and its underlying combined ratio was 84.7%.

The lowest combined ratios in the analysis belonged to Arch Capital, 81.2%, Chubb, 85.6%, Progressive, 86.2%, The Hartford, 88.6%, and AIG, 89.4%.

The top underlying combined ratios behind Allstate were from Arch Capital, 80.9%, Progressive, 81.1%, and Chubb, 82.3%.