Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Aug, 2025

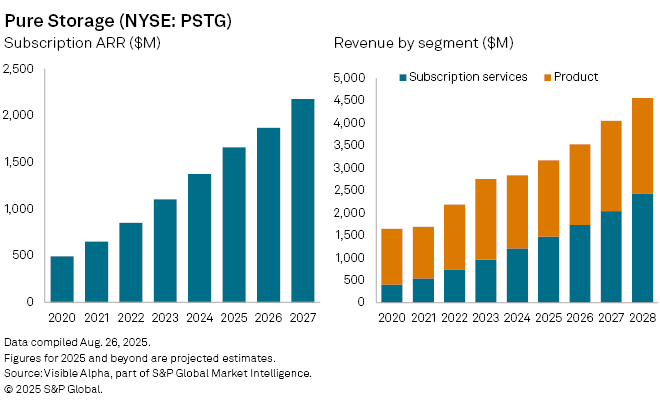

Pure Storage Inc. (NYSE: PSTG) is deepening its pivot towards subscription-based revenues, seeking to capitalize on the surge in demand for AI-ready infrastructure. Subscriptions are forecast to account for 49% of total sales in fiscal 2026, up from 46% in 2025 and only 25% in 2020, according to Visible Alpha consensus.

Subscription ARR or the annual recurring revenue from subscriptions is expected to climb 13% to $1.9 billion in fiscal 2026, compared with $1.7 billion a year earlier and $493 million in 2020. The rising contribution highlights the company’s progress in transforming itself from a hardware-focused storage provider into a software- and services-led business with a more recurring revenue base.

The company reports fiscal Q2 2026 results on Wednesday, August 27, with analysts expecting revenue to rise 11% year-on-year to $846 million. Subscription services are projected to drive the growth, climbing 17% to $424 million, while product sales are anticipated to grow 5% to $423 million. For the full year, consensus estimates point to revenues of $3.5 billion.

Pure Storage has positioned itself as a key supplier of high-performance storage systems tailored for AI workloads. Its recently launched FlashBlade//EXA platform is designed for large-scale data environments, while partnerships with Meta, Nutanix, and Nvidia reinforce its role in the next generation of storage architecture. However, growing competition from incumbents such as Dell and NetApp, as well as execution risks in scaling its subscription business, remain key watchpoints.

– Learn about Visible Alpha | S&P Global.

– Explore Visible Alpha Add-On for CapIQ Pro.

– Access Visible Alpha estimates on Pure Storage.

– To receive email alerts for future Visible Alpha articles, select Visible Alpha Data Snapshots under the Authors section.