Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Aug, 2025

By Tim Siccion and Shambhavi Gupta

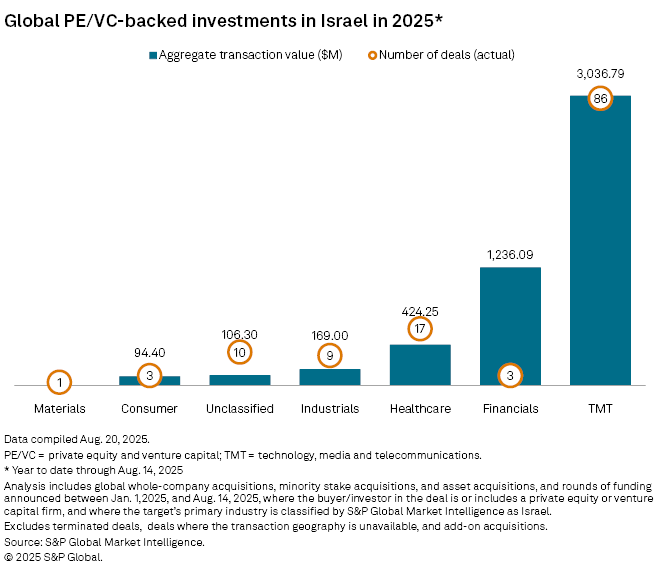

Global private equity and venture capital investments in Israel are on the rise, totaling $5.07 billion across 129 deals between Jan. 1 and Aug. 14, surpassing the $4.79 billion that 214 transactions amassed in the full-year 2024, according to S&P Global Market Intelligence data.

Private equity flows in 2025 have steadily risen each quarter, and year-end deal value is poised to continue the rebound from 2023 levels.

Israel's private equity inflows continued to grow despite its ongoing involvement in a regional military conflict because Israeli companies remain highly attractive for global investors, Jefferies wrote in a July report, citing the nation's culture of innovation and a highly skilled workforce as some of the factors driving investor interest.

The report singled out the technology sector. "Israel stands out as a regional tech powerhouse – leveraging its world-class startup ecosystem, cutting-edge defense technologies, and growing influence in the fields such as AI and cybersecurity."

– Download a spreadsheet with data featured in this story.

– Read up on private equity penetration in the US.

– Learn about private equity trends in oil and gas transportation.

The nation has one of the strongest venture capital markets across the 38 countries in the Organization for Economic Co-operation and Development group due to significant backing from the Israeli government, according to the OECD.

Israel has 696 domestic private equity and venture capital firms, the largest number among all countries in the Middle East, according to Market Intelligence data.

The most active venture capital firm in Israel in 2025 so far was the domestic firm Entrée Capital Ltd. with seven funding rounds totaling $22.7 million, Market Intelligence data showed. US-headquartered Lightspeed Ventures LLC and Insight Venture Management LLC were tied at second place with six deals amounting to $65.0 million and $46.2 million, respectively. Among the firms tied at third place with five deals, US-based Intel Capital Corp. and the Israeli firm Pintago Venture Capital had the highest deal values with $117.4 million and $104.4 million, respectively.

The technology, media and telecommunications (TMT) sector attracted the most private equity and venture capital, with 86 deals totaling about $3.04 billion. It was followed by the financials sector with roughly $1.24 billion from three deals.

Largest deals

The largest private equity-backed deal in Israel was Advent International LP's planned $1.22 billion acquisition of a 56.5% stake in an insurance-focused software provider Sapiens International Corp. NV.

The second-largest was a $300 million series D round for AI developer AI21 Labs Ltd. with participation from Ahren Innovation Capital LLP and b2venture AG. AI21 will use the proceeds from the round to expand enterprise AI offerings and build its own large language models.

Third was an ION Crossover Partners Ltd. and Vitruvian Partners LLP-led $239 million series G round for cloud network company Cato Networks Ltd. Cato will use the funds to advance AI security, among other functions.