Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Aug, 2025

By Tim Siccion and Shambhavi Gupta

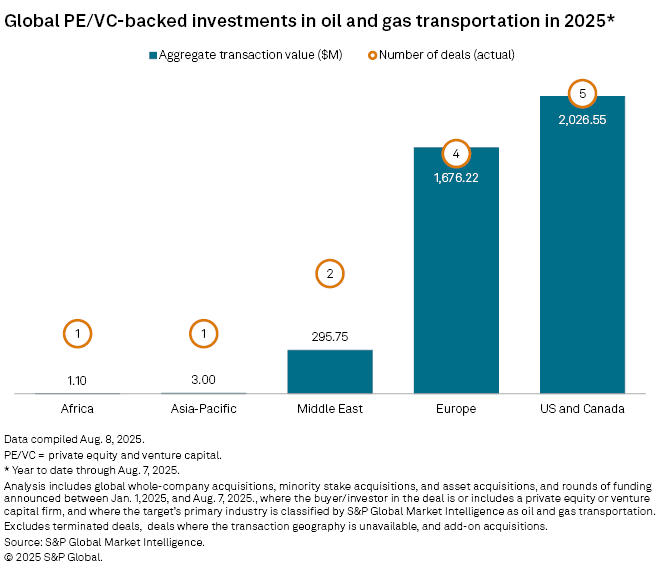

Global private equity and venture capital investments in oil and gas transportation are on track to exceed levels reached in the prior year as the industry undergoes consolidation in a strategic realignment, according to industry sources.

Private equity investments in the oil and gas transportation sector — which includes crude oil and natural gas pipelines, refined fuel distributors and shipping companies — amounted to $4.0 billion across 13 deals between Jan. 1 and Aug. 7, surpassing the $3.36 billion that 12 deals amassed in the first eight months of 2024, according to S&P Global Market Intelligence data.

Private equity firms invested heavily in the overall oil and gas industry in full year 2024 amid opportunities to acquire noncore assets from major oil and gas companies.

The oil and gas industry is in the throes of a "a strategic reset" as consolidation continues, according to a PWC midyear report on energy. "After a wave of large-scale upstream deals, 2025 so far has seen a shift toward midcap and infrastructure-focused transactions aimed at achieving scale, unlocking synergies and easing logistical constraints."

– Download a spreadsheet with data featured in this story.

– Catch up on private equity entries in July.

– Read up on venture capital rounds in July.

North America drives private equity deals

Oil and gas transportation companies in the US and Canada received the most private equity investments with about $2.03 billion across five deals. Europe followed with roughly $1.68 billion from four deals.

US domestic pipelines are attractive to private equity companies because the assets are not exposed to international trade risks, Cogitare Advisors managing director Peter Durante said in a Troutman Pepper Locke report in June.

Other factors are in play in the US. Policy changes such as deregulation of the oil and gas industry and support for domestic energy production have contributed to investment interest, while datacenters to power AI have stepped up overall energy demand.

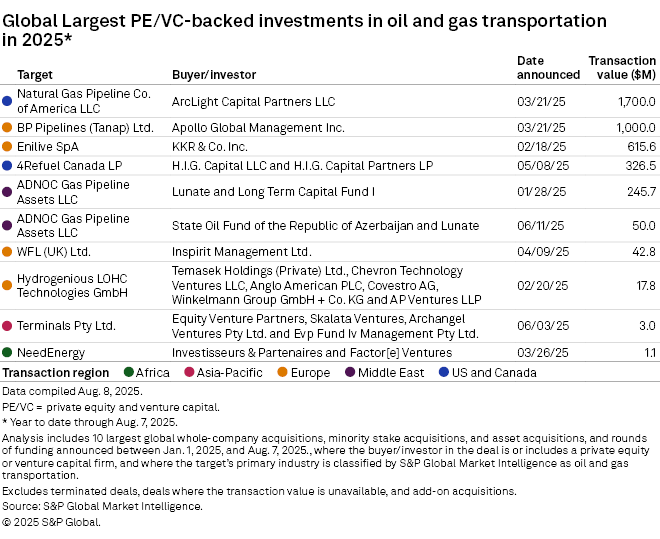

Largest deals

The largest private equity-backed transaction in oil and gas transportation in 2025 so far was ArcLight Capital Partners LLC's $1.7 billion acquisition of a 25% minority stake in Natural Gas Pipeline Co. of America LLC from Brookfield Asset Management Ltd.

The second-largest deal was Apollo Global Management Inc.'s $1 billion purchase of a 25% stake in UK-based BP Pipelines (Tanap) Ltd. from BP PLC.

Third was KKR & Co. Inc.'s $615.6 million purchase of a 5% stake in Italy-based Enilive SpA from Eni SpA. The acquisition adds to the 25% stake in Enilive that KKR agreed to acquire in 2024.