Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Aug, 2025

By Yuzo Yamaguchi and Yuvraj Singh

Mizuho Financial Group Inc. revised its full-year earnings target after the Japanese megabank and its peers got off to a steady start to the fiscal year, and the trade deal with the US helped alleviate a key economic uncertainty.

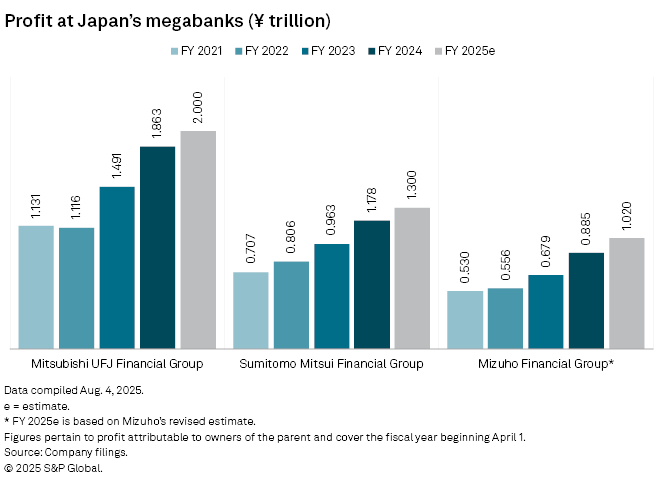

Mizuho set a new net income goal of ¥1.02 trillion for the current fiscal year ending on March 31, 2026, after the lender reached about 30% of its previous estimate of ¥940 billion in the quarter that ended on June 30. Mizuho's net income rose 0.4% year over year to ¥290.5 billion in the fiscal first quarter, according to its earnings statement released on July 31.

"That [the earnings revision] was surprising," said Toyoki Sameshima, senior analyst at SBI Securities Co., given that a revision to an earnings outlook in the fiscal first quarter is not common. "Overall, they [the megabanks] would get support from the trade deal."

The US announced on July 22 that it would impose 15% reciprocal and auto tariffs on imports from Japan, lower than the 25% that US President Donald Trump proposed in April. The trade deal is expected to ease pressures on the Japanese economy and potentially enable the Bank of Japan (BOJ) to resume its monetary policy normalization.

Policy normalization

The BOJ maintained its policy rate at 0.5% for the fourth consecutive meeting on July 31. On the same day, the central bank raised its inflation outlook to 2.7% from the previous estimate of 2.2% in a quarterly report.

"Overall, the megabanks will get support as the BOJ is on a rate hike path," said Hideo Oshima, senior economist at Japan Research Institute.

"We will focus on risk of higher prices," said BOJ Governor Kazuo Ueda after expressing concerns about the impact of US tariffs on other economies during a press conference after the policy meeting. On the bank's baseline scenario of sustainably achieving its 2% inflation target, Ueda said, "I believe the certainty of the forecast coming true has increased a little."

"Chances are higher" that the BOJ will take action to raise rates, said Hiroshi Minegishi, general manager at Mizuho's financial planning department, during an online earnings conference. Minegishi said the bank expects to earn ¥225 billion in interest income from the current interest rate of 0.5% for the full year through March of 2026.

Steady earnings

Sumitomo Mitsui Financial Group Inc. posted a 1.5% gain in net income to ¥376.9 billion for the April-to-June quarter, achieving 29% of its full-year earnings target of ¥1.3 trillion, according to a statement on July 31.

SMFG kept its loan loss reserve at ¥300 billion for the full-year, although the bank has not seen any negative effects from the US tariffs it anticipated in May. The bank expects a potential rate hike of 25 basis points to add ¥100 billion to its annual net interest income.

Mitsubishi UFJ Financial Group Inc. reported on August 4 that its net income declined 1.8% year over year to ¥546 billion in the three months to June. That represents 27% of the lender's full-year income target of ¥2.0 trillion.

The lower net income reflected a change in earnings period time for its banking unit in Thailand, MUFG said.

"We haven't seen any impact of the US tariffs emerge so far but we will see if it could arise it in the latter half of the year," said a MUFG spokesman during an online earnings conference.