Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Aug, 2025

By John Wu and Marissa Ramos

Dividends from Chinese banks should increase in 2025, driven by outsized growth in payouts from second-tier lenders.

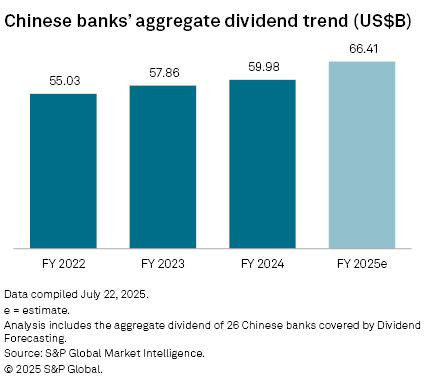

Lenders in the world's second-largest economy will pay an aggregate $66.41 billion in dividends in the 2025 financial year, up 10.7% year over year, according to data compiled by S&P Global Market Intelligence. The total payout figure includes an estimated aggregate interim dividend of $28.76 billion.

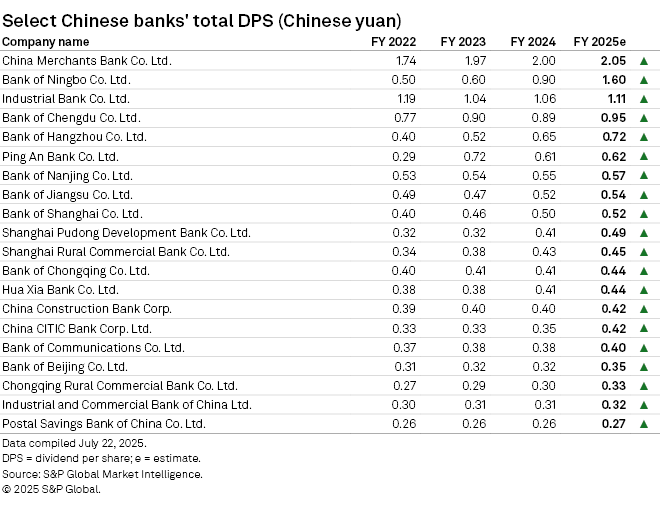

Zhejiang-based Bank of Ningbo Co. Ltd. should pay 1.60 yuan per share, an increase of 77.8%, the biggest among peers. The bank's payout jumped 50% in 2024 to 90 Chinese fen per share, according to Market Intelligence data. Shanghai Pudong Development Bank Co. Ltd.'s dividend per share could increase by 19.5% to 49 fen, while China Citic Bank Corp. Ltd.'s will likely grow by 18.4% to 42 fen.

"The Dividend outlook of the Chinese banking sector remains complex, with a mix of risks and challenges coming from the forecasts of the amounts as well as the ex-dates of those dividends," Sophy Zhao, senior research analyst at S&P Global Market Intelligence, said in a July 28 report. Further growth of 7.4% in 2026 dividends was also forecast.

"While the initiation of interim dividends marks a positive trend, the sustainability of these dividends will largely depend on the banks' ability to navigate economic pressures and maintain profitability," Zhao said.

Challenging environment

Chinese banks, especially the four state-owned megabanks, are operating in a challenging environment of low interest rate. China reported 5.3% GDP growth for the first half, which likely puts the economy on course to meet the full-year aim of 5.0% growth. A trade deal with the US remains elusive and is likely to affect the outlook of the trade-reliant economy.

The People's Bank of China cut its one-year loan prime rate to 3.0% from 3.1%, and the five-year rate to 3.5% from 3.6% on May 20. The one-year loan prime rate, a common reference for general lending, and the five-year rate, the benchmark for mortgages, are now both at their all-time lows.

Major banks announced payouts in their 2024 interim results following an April 2024 request for improved dividends from all listed companies by the State Council, China's top executive body. The China Securities Regulatory Commission also issued guidelines to enhance investment value and shareholder returns.

"Most banks in China have already initiated interim dividends in 2024 and are expected to sustain these payments into 2025, reflecting a focus on the stability and continuity of shareholder returns," Zhao told Market Intelligence.

"This sector-wide trend is likely to gain further momentum, with notable examples such as China Merchants Bank Co. Ltd., which did not initiate interim dividends in 2024 but has passed an annual general meeting resolution to introduce them in 2025," Zhao said.

As many as 19 of the 26 Chinese mainland-based banks covered by the Market Intelligence paid interim dividends in 2024, the July 28 report said.

Benign outlook

Industrial and Commercial Bank of China Ltd., the world's largest lender by assets, is expected to increase its payout by 3.2% to 32 fen per share, according to Market Intelligence data.

China Construction Bank Corp., another of the four largest banks, will likely increase its payout by 4.2% to 42 fen, the report said, and both Bank of China Ltd. and Agricultural Bank of China Ltd. could increase by less than 2%.

The big four banks will announce their first-half results in late August.

China Merchants Bank, which ranked eighth globally by assets and paid an annual cash dividend of 2.0 yuan per share in 2024, is expected to increase its total payout by 2.5% to 2.05 yuan.

As of Aug. 4, US$1 was equivalent to 7.18 Chinese yuan.