Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Aug, 2025

By Gaurav Raghuvanshi and Cheska Lozano

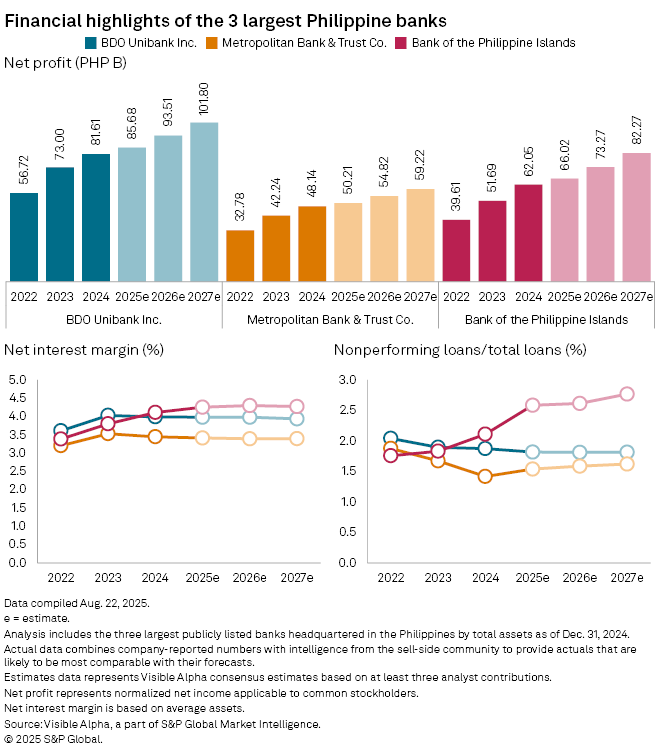

The biggest banks in the Philippines are likely to grow their net income in the coming years, thanks to stable net interest margins and favorable domestic economic conditions.

BDO Unibank Inc., the biggest Philippine lender by assets, may grow its net income to 85.68 billion pesos in 2025, from 81.61 billion pesos in the previous year, according to consensus estimates based on at least three analyst contributions on Visible Alpha, a part of S&P Global Market Intelligence. Similarly, Metropolitan Bank & Trust Co. is expected to grow its net income by 4.3% to 50.21 billion pesos in 2025, and Bank of the Philippine Islands by 6.4% to 66.02 billion pesos, the data show.

All three lenders are expected to increase their income in the coming three years, after posting steady growth in the previous three. Net interest margins are expected to hold steady in a growing economy amid strong deposit growth. Nonperforming loans, too, may largely remain steady in the next three years, though Visible Alpha analysts expect Bank of the Philippine Islands and Metropolitan Bank to report a decline in asset quality in 2025 over 2024.

The Philippines' economy grew 5.5% year over year in the second quarter of 2025, compared with a 6.5% growth in the April-June quarter of 2024. The pace of economic growth, however, edged higher in each of the last three quarters, data from the Philippine Statistics Authority show. The central bank has reduced its benchmark overnight rates three times in 2025, seeking to support the $460 billion economy.

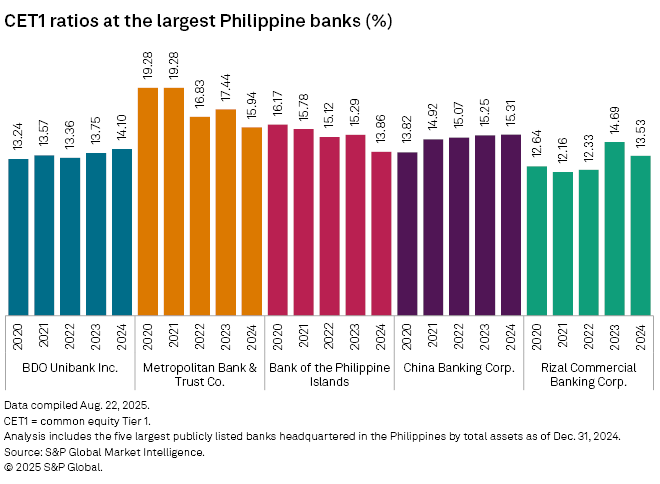

Most banks in the Philippines maintained strong capital and liquidity buffers in recent years, according to Market Intelligence data.

The common equity Tier 1 (CET1) ratio at Metropolitan Bank was at 15.94% as of Dec. 31, 2024, the highest among the five biggest lenders in the Philippines. The lender's CET1 was as high as 19.28% in 2021.

BDO Unibank, China Banking Corp. and Rizal Commercial Banking Corp. have steadily increased their CET1 ratios over the last five years, while Metropolitan Bank and the Bank of the Philippine Islands have posted declines, according to the data.

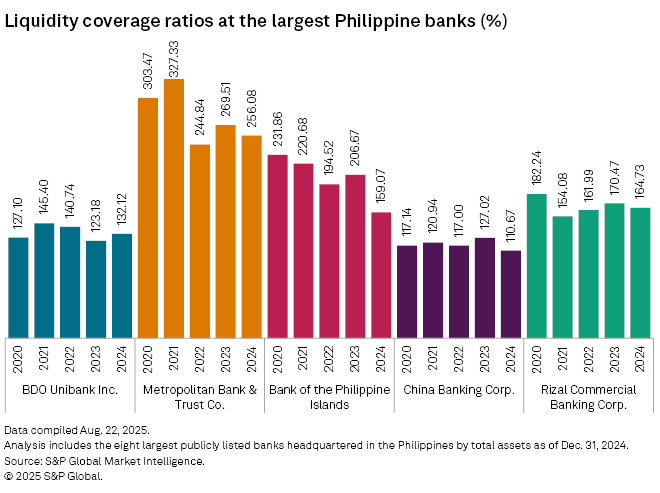

Some Philippine lenders have seen their liquidity coverage ratios drift lower in recent years, though all of them maintain sufficient cushions.

According to data, Metropolitan Bank saw the highest liquidity coverage ratio among peers at 256.08% in 2024, compared to more than 300% in 2021. China Banking had the lowest liquidity coverage ratio among the five banks in the sample, at 110.67%.