Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Aug, 2025

By Nick Lazzaro

|

|

Long-term US Treasury bond yields may not ease alongside the US Federal Reserve's anticipated interest rate cuts later this year, leaving consumer and corporate debtors to face elevated borrowing costs in 2026.

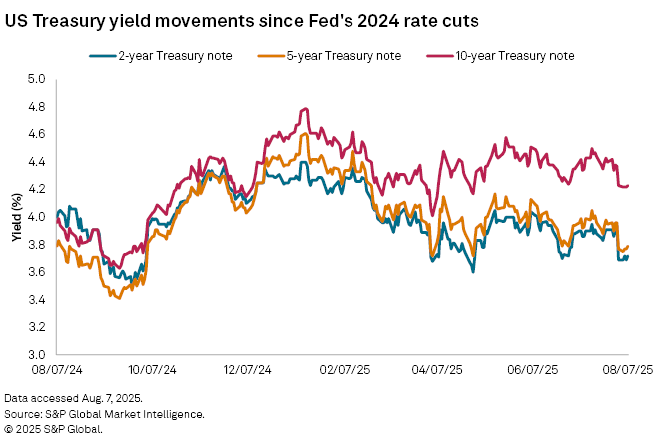

The 10-year US Treasury note yield, which moves opposite to the bond's price, settled at 4.23% on Aug. 7, according to S&P Global Market Intelligence data. While this is down from a year-to-date high of nearly 4.8% in January and in line with fluctuations around 4% since late 2022, it breaks with past precedent. In the decade prior to 2022, the yield never exceeded 4%. The 5-year US Treasury note yield has similarly hovered at higher levels in recent years relative to the previous decade. Both yields are key benchmarks for fixed mortgage, auto loan, and corporate debt security rates.

Markets widely expect the Fed to start cutting rates this fall, with traders pricing in a more than 90% chance that the benchmark rate will come down 50 to 75 basis points by the end of the year, according to CME Fedwatch data as of Aug. 7. However, market observers doubt whether long-term Treasury yields will decline, given the atypical trends observed when the Fed cut rates in 2024.

"It's not unusual to see the yield curve steepen when the Fed is cutting. In fact, it's expected," said Gary Pzegeo, co-chief investment officer for CIBC Private Wealth, in an interview. "What was unusual when the Fed first started cutting last year is that long rates went up. This is not your usual cycle, and different segments of the market shouldn't expect them to behave as they have historically."

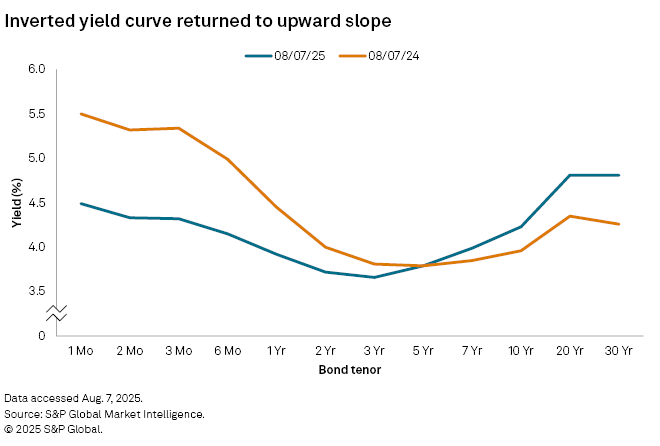

When the Fed began cutting its benchmark rate from a 20-year high in September 2024, many Treasury yields rose at varying rates rather than falling. The movement ultimately allowed the Treasury yield curve to return to a normalized upward slope after two years of inversion, an unusual occurrence and a bearish economic indicator in which short-term yields are higher than long-term yields.

Considering 2024's deviation from expectations, a similar abnormality with yield direction may occur again this year, although the yield curve should maintain an upward slope.

"Rates may not go up at the long end, but I don't think they'll follow in a one-for-one pattern with short-term rates when the Fed is cutting," Pzegeo said. "Steeper curves should be the expectation."

Steeper yield to mute benefits for consumers

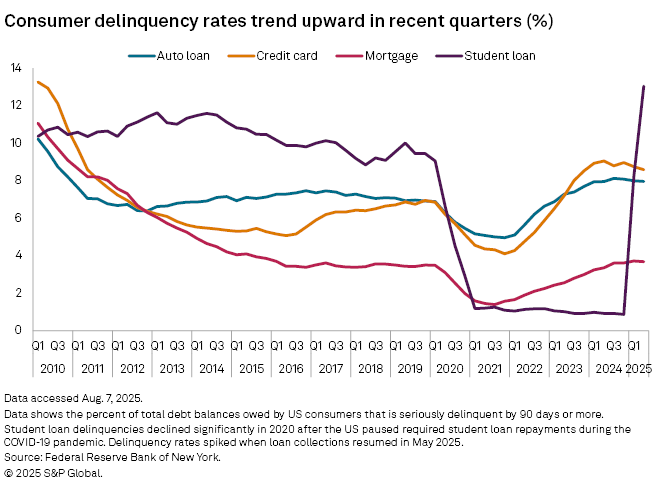

If long-term Treasury yields stay elevated as the Fed resumes its monetary policy easing this year, higher consumer interest rates may persist at a time when credit delinquencies are rising.

Auto loan and credit card delinquencies reached 5% and 12.3%, respectively, in both the first and second quarters of this year, according to the latest data from the Federal Reserve Bank of New York. Delinquencies on auto loans are at their highest since 2020 while those for credit cards are at their highest since 2011.

Student loan delinquencies have spiked in 2025 after the US ended its pandemic-era repayment pause. In contrast, delinquency rates on mortgages have hovered at historically low levels since 2020, mostly because of homeowners locking in low fixed rates during the pandemic.

"A Federal Reserve rate cut would typically lower borrowing costs and boost markets, but its impact may be limited if Treasury yields remain elevated," Arnim Holzer, global macro strategist at Easterly EAB, told Market Intelligence. "The yield curve may remain steep, muting benefits for small and medium-sized borrowers."

Corporate borrowers with weaker balance sheets and significant upcoming debt maturities may also feel the squeeze. Among large public and private companies, bankruptcy filings through July are already on pace to reach a 15-year high.

Factors influencing long-term yields

The longer-term Treasury yields are influenced by several factors beyond Fed policy.

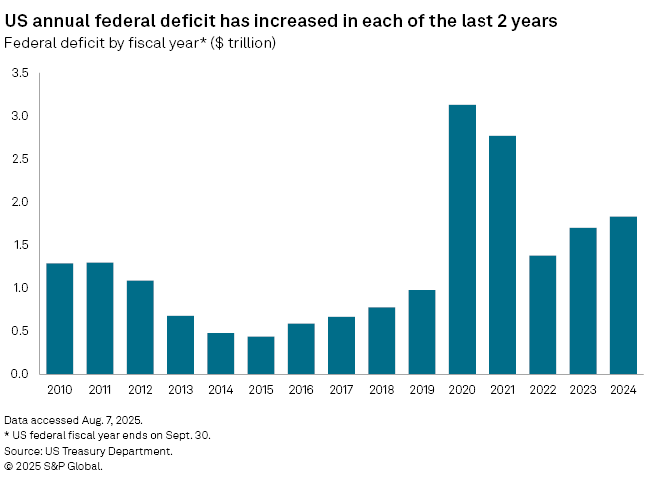

"These include supply and demand dynamics in the Treasury market, inflation and inflation expectations, fiscal policy, and the value of the dollar, particularly for non-US buyers of Treasuries," said John Canally, chief portfolio strategist at TIAA Wealth Management. "A weaker US dollar and an expected rise in US debt levels have also kept long-term rates elevated."

President Donald Trump's recently passed budget bill is projected to add $3.4 trillion to the US budget deficit from 2025 to 2034, according to the Congressional Budget Office.

Meanwhile, the US dollar index, a measure of the dollar against a basket of other major global currencies, has weakened this year to 98.08 on Aug. 7 from 109.25 at the start of the year.

Specific currency exchanges can also affect yield movement.

"Rising Japanese government bond yields and a strengthening yen may further pressure US yields upward by unwinding the yen carry trade, where investors borrow in yen to invest in higher-yielding US assets," Easterly EAB's Holzer said.

The yen-to-dollar exchange rate fell to 147.29 yen Aug. 7 from 157.19 yen at the start of the year, indicating a stronger yen relative to the dollar.

Rising inflation expectations

Persistent inflation may also lead investors to seek a higher premium from longer-dated Treasury securities via higher yields.

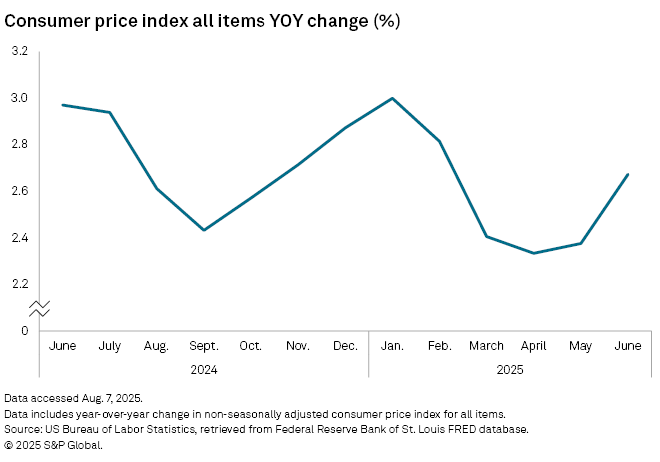

The US consumer price index, a key gauge of inflation, increased 2.7% year over year in June, according to US Bureau of Labor Statistics data. The figure increased in May and June, reversing a downward trend from January to April. July's inflation data will be released Aug. 12.

Surveyed consumers in July reported a median inflation expectation of 3.1% for the next year, 3.0% for the next three years and 2.9% for the next five years, according to the Federal Reserve Bank of New York's Survey of Consumer Expectations report released Aug. 7.

"If the Fed is cutting and the market gets concerned about what that means for prices, you should expect to see some upward force on those longer rates," CIBC's Pzegeo said. "Sometimes it's offset by Fed expectations. In the most recent case [2024], it was not. I would expect that will be a similar pattern going forward."