Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Aug, 2025

By Tim Siccion and Shambhavi Gupta

The value and volume of global rounds of funding backed by private equity and venture capital decreased month over month in July.

The total transaction value in July amounted to $23.66 billion, down from $27.25 billion as adjusted in June, according to S&P Global Market Intelligence data. The number of rounds decreased to 1,049 from an adjusted total of 1,283 in the previous month.

Year over year, funding rounds were also down in July. Deal value declined from $33.11 billion across 1,450 transactions in July 2024.

However, the year appears to be shaping up. In the first seven months of 2025, deal value increased to $217.03 billion compared with $188.05 billion for the same period in 2024.

Aggregate transaction values and volume may not match figures reported for preceding periods due to subsequently acquired disclosures and updates.

– Download a spreadsheet with data featured in this story.

– Read our latest In Play reports featuring rumored deals.

– Explore more private equity coverage.

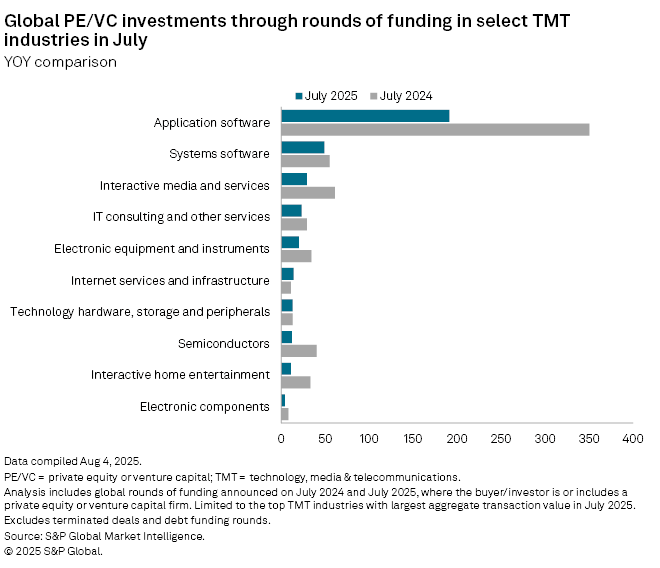

The technology, media and telecommunications (TMT) sector had the highest transaction value in July, accounting for 40.7% of total investments. The sector raised $9.64 billion across 382 rounds of funding. The healthcare sector followed, pulling in $3.77 billion.

Application software remained the most favored subsector within TMT, recording 191 deals, followed by system software with 49 transactions. Deal volume across almost all of the 10 TMT subsectors was down compared with July 2024.

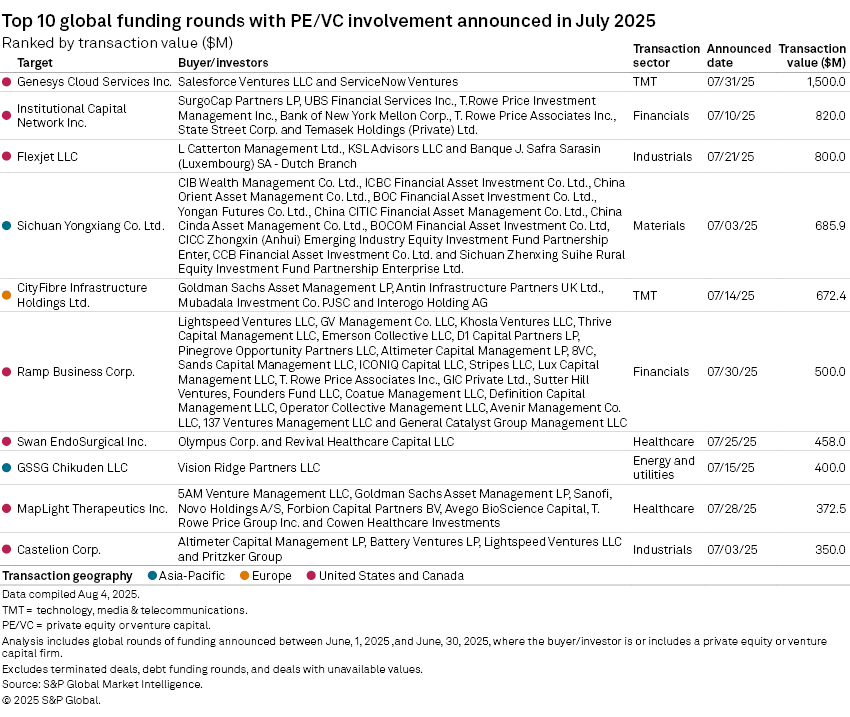

Top funding rounds

The largest venture capital transaction in July was Salesforce Ventures LLC and ServiceNow Ventures' $1.5 billion investment in US-based cloud platform developer Genesys Cloud Services Inc. Genesys will use the proceeds to buy back shares from the company's existing shareholders.

The second largest was an $820 million funding for New York-based fintech company Institutional Capital Network Inc. from an investor group including Temasek Holdings (Pvt.) Ltd. Doing business as iCapital, the company will use the funds to accelerate geographic expansion and technology innovation.

The third largest was an L Catterton Management Ltd.-led $800 million investment in US private jet lessor Flexjet LLC. Flexjet will use the funds mainly to expand its fleet.