Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Aug, 2025

By Nick Lazzaro and Annie Sabater

Inflation data for July revealed no tariff-related surprises for markets that already expect the US Federal Reserve to resume interest rate cuts in September, though the need for such a move by the central bank is debated.

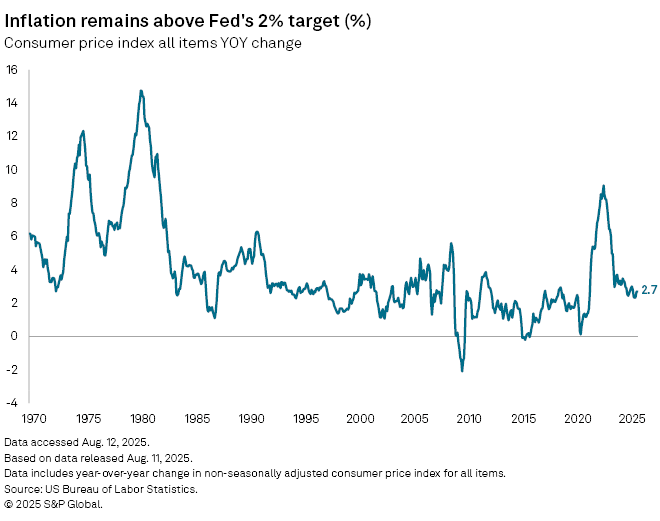

Observers are gauging whether the central bank needs to adjust to an environment of sticky prices. The consumer price index, the market's preferred inflation metric, increased 2.7% year over year in July, coming in below an expected 2.8% rise and matching a 2.7% annual increase in June, according to data from the US Bureau of Labor Statistics (BLS) released Aug. 12 and economist projections compiled by Econoday.

The softer headline index data was partially offset by the core index, which removes volatile energy and food prices and climbed 3.1% year over year. This was higher than a projected 3% increase and a 2.9% rise in June.

Though headline inflation numbers have yet to show significant shocks from the US tariff policy that the Fed and market observers have feared since at least April, inflation data has still resisted a steady downward trend toward the Fed's 2% target level. Meanwhile, the core inflation index has now shown year-over-year increases for two straight months.

"Although it sounds like the Fed has made up its mind to cut interest rates in September, this report doesn't help make the case," Donald Calcagni, chief investment officer at Mercer Advisors, told S&P Global Market Intelligence. "With inflation still above the Fed's target, it's hard to see what the justification would be for a rate cut."

Still, with inflation numbers for July coming in near expectations, traders were pricing in a more than 94% chance that the Fed would issue a 25-basis-point cut to its benchmark interest rate at its September meeting and a more than 90% chance of at least one more cut by the end of 2025, according to midday CME Fedwatch Tool data on Aug. 12.

"The benign print should pave the way for a 25-basis-point rate cut in September and suggests we may finally transition from the one-time recalibration cuts of 2024 toward a sustained easing cycle," Isaac Wheeler, managing director of balance sheet strategy at Derivative Path, told Market Intelligence.

A new reality

The S&P 500 closed up over 1% on Aug. 12 as markets reacted positively to headline inflation data that came within projections. The optimism indicates that markets may be growing comfortable with an environment of elevated inflation.

"Today's report came in lower than expected, but it's important to note that analysts were already expecting inflation to come in higher than the Fed likes it," Katie Klingensmith, chief investment strategist at Edelman Financial Engines, told Market Intelligence. "Given that it wasn't even higher allows the Fed to be more focused on signs that the economy is softening."

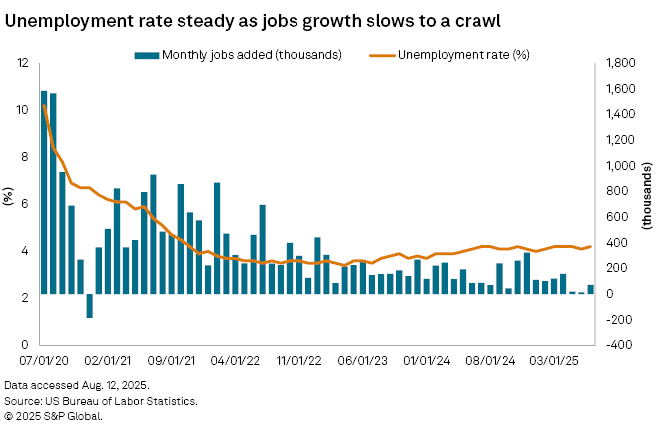

Markets and the Fed are still digesting BLS labor data released Aug. 1 which shows that job growth over the summer was much slower than originally reported, signaling the potential for a slowing economy.

"The Fed is caught in a new reality of rising prices and lower growth," Klingensmith said. "This is 'stagflationary,' and there's no clear-cut answer for what the Fed should do next — cut rates to stimulate the economy and contribute to rising prices, or keep rates higher for longer to try and nip inflation in the bud by essentially making the economy slower, and feel the pain in terms of employment and growth?"

Yet, even given current conditions, some observers note that the Fed does appear to have room for a dovish approach.

"The reality is their overnight rate of 4.25%-4.5% is above the current rate of inflation, and while progress to the 2% level has slowed, recent data on the job market would seem to weigh in favor of a downward adjustment to policy," said Steve Wyett, chief investment strategist at BOK Financial. "At 4%-4.25% for a fed funds target, they would still be restrictive but could provide a bit of a cushion against further deterioration in the all-important job market."

Tariff impact

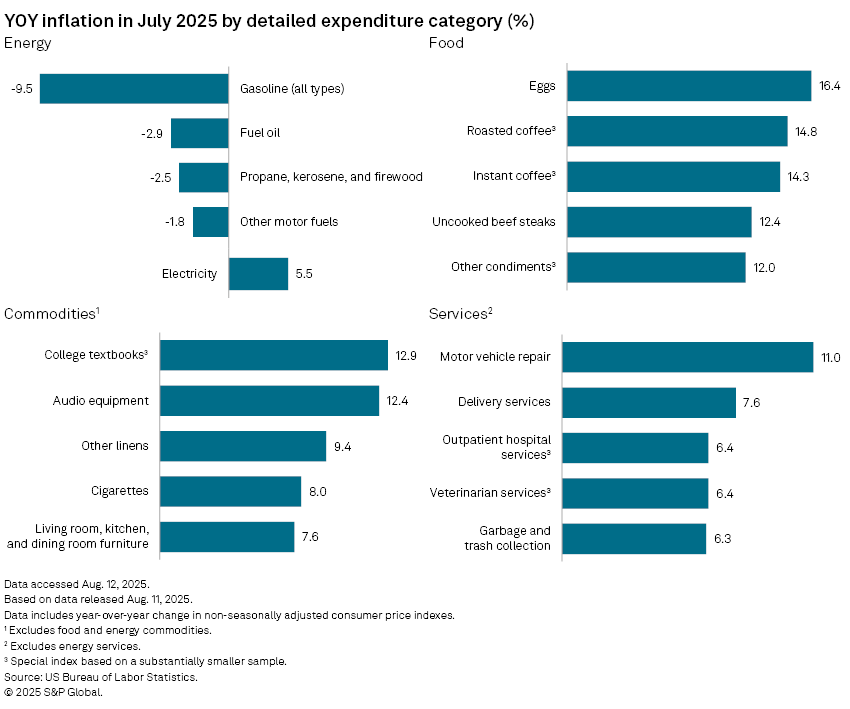

The year-over-year increase in the July headline inflation data was likely tempered by downward price movement in volatile categories such as gasoline, which was down 9.5%. Otherwise, service inflation climbed in many categories, and several categories of goods are showing signs of price increases influenced by tariffs.

"Categories specifically influenced by tariffs are showing the impact most clearly," said Eric Winograd, chief US economist at AllianceBernstein, in an email. "Each of appliances, furniture, furnishings and motor vehicle parts has moved higher since tariffs were announced in April; both the magnitude and the consistency of price increases across the categories are pretty clear evidence that tariffs matter."

The Fed will still have one more employment and labor report to review in the coming month before its next rate cut decision, so Winograd said the July CPI release is "certainly not determinant."

"That said, I don't think tariffs will stop rate cuts forever," Winograd said. "Given the weakening of the labor market, I still expect the Fed to cut by 25 basis points at each of its remaining three meetings this year."