Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Aug, 2025

By Nick Lazzaro

European Central Bank President Christine Lagarde and Vice President Luis de Guindos arrive at a press conference to discuss the eurozone's monetary policy at the central bank's headquarters in Frankfurt, Germany, on July 24. The ECB held its benchmark interest rates steady at the meeting, after four separate cuts in the first half of the year, influenced in part by stabilizing inflation trends. European Central Bank President Christine Lagarde and Vice President Luis de Guindos arrive at a press conference to discuss the eurozone's monetary policy at the central bank's headquarters in Frankfurt, Germany, on July 24. The ECB held its benchmark interest rates steady at the meeting, after four separate cuts in the first half of the year, influenced in part by stabilizing inflation trends.Source: Daniel Roland/AFP via Getty Images. |

The US Federal Reserve appears more concerned with inflation than other central banks in developed economies as monetary policymakers approach key decisions for 2025 and 2026.

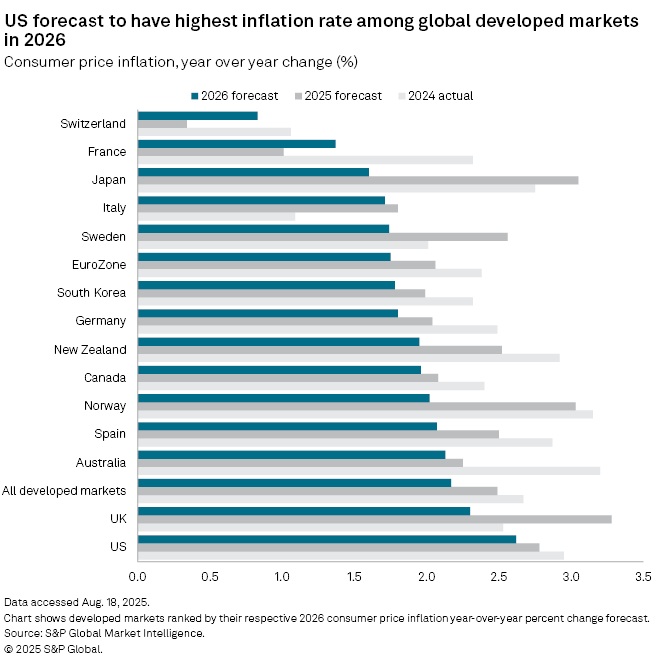

S&P Global Market Intelligence economists expect US consumer prices to rise 2.62% year over year in 2026. While this is drastically slower than the peak during the COVID-19 pandemic, this growth is faster than most major developed economies, many of which are assessing the potential impacts of US tariff policy.

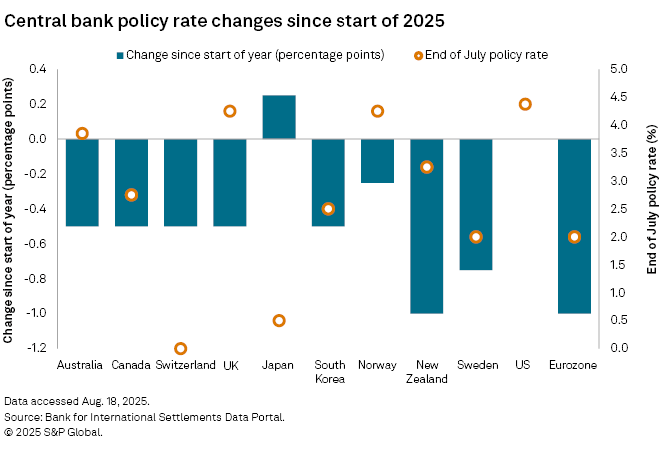

The Fed has held rates steady this year, largely due to uncertainty over the impacts of tariffs. Meanwhile, other major central banks have lowered rates as inflation in those regions has fallen. The contrast adds to the growing divergence between the Fed and its international peers after years of moving in near lockstep.

"While slowing growth is a global concern right now, especially with many countries reevaluating their exports to the United States, inflation concerns are more US-specific than in some previous cycles, like during COVID when supply shortages hit the whole world, or when energy and food prices push up prices across countries," Katie Klingensmith, chief investment strategist at Edelman Financial Engines, told Market Intelligence.

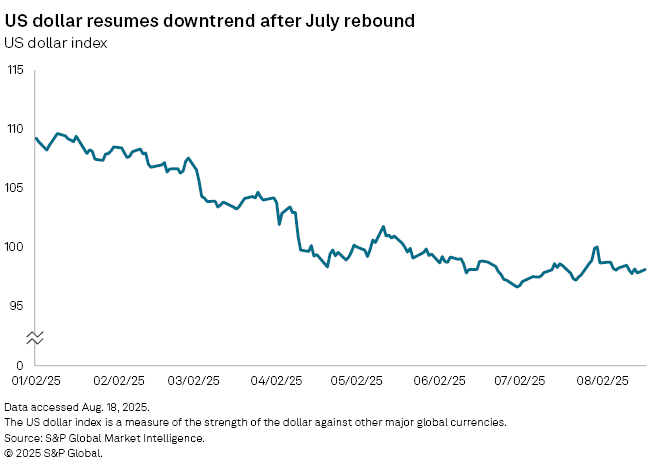

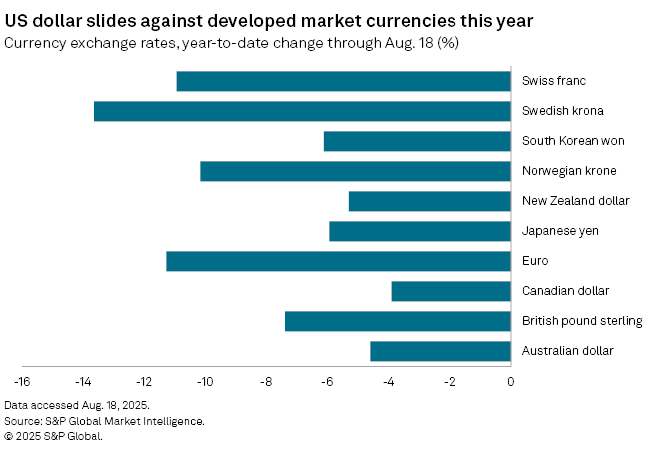

Major central banks outside the US may have more room to cut rates on improving inflation prospects, though currency weakness could limit the extent of those moves, Ken Wattret, vice president of global economics at Market Intelligence, said in an Aug. 18 research report. Still, the extent of those constraints may be limited if the US dollar's recent downturn persists amid weaker economic growth expectations and other economic uncertainties.

The US dollar index, a measure of the dollar against a basket of other major global currencies, rallied to 100.04 on July 31 from a year-to-date low of 96.65 as of July 1. It has since retreated to 98.15 on Aug. 18 and is well below a two-year high of over 109 set in January.

G7 inflation dynamics

Among the Fed's peer central banks representing leading industrialized nations, the European Central Bank has been most active in adjusting monetary policy this year. The bank has slashed its benchmark rate by a full percentage point amid disinflationary trends in the EU. Meanwhile, key nations in the bloc, such as Germany, have introduced stimulative fiscal spending packages. These factors may allow the ECB to slow its rate cuts.

"The ECB is in more of a go-slow approach, waiting to see how what they've done so far will affect inflation and the economy there," said Gary Pzegeo, co-chief investment officer for CIBC Private Wealth, in an interview.

A strong euro relative to the US dollar has also helped cool inflationary pressures in Europe. The dollar-to-euro exchange rate has climbed to over $1.15 in August from $1.04 at the start of the year.

In North America, the Bank of Canada is likely to maintain its benchmark interest rate in the near term amid a stable labor market, low inflation and fiscal stimulus measures that may offset US tariff impacts, according to an Aug. 15 report from Royal Bank of Canada Assistant Chief Economist Nathan Janzen and Senior Economist Claire Fan.

Unlike its G7 peers, the Bank of Japan has held its policy rate at a low 0.5% to promote inflation after years of low or negative inflation. Switzerland's Swiss National Bank faces a similar situation and has reduced its benchmark rate to 0% this year amid low inflation forecasts.

The Bank of England's challenges in the UK are most comparable to the Fed's in the US, with a similar inflation focus.

"The UK may be experiencing the closest conundrum to the US right now, with rising inflation concerns and a weakening labor market," Klingensmith of Edelman Financial Engines said. "The [Bank of England] has cut rates five times in the last year, with the last vote split 5-4, marking the challenge for policymakers in prioritizing concerns over inflation versus growth."

Fed catching up

Markets were pricing in a nearly 84% probability of a 25-basis-point Fed rate cut in September and a 47% chance of a second cut by year-end, according to CME FedWatch data on Aug. 18. The moves would represent a resumption of dovish monetary policy that, if not for the uncertainty from US tariffs, could otherwise have been warranted given stabilizing labor and inflation conditions.

"The Fed's recalibration of extremely tight policy to a more neutral setting was interrupted by elevated uncertainty resulting from ongoing changes to US trade policy," Market Intelligence Senior US Economist Lawrence Nelson said in an email. "As the dust settles, there is room for that recalibration to continue because interest rates are still widely thought to be in restrictive territory."

The consumer price index, the market's preferred inflation metric, increased 2.7% year over year in July, below economist projections and matching June's increase, according to data from the US Bureau of Labor Statistics released Aug. 12. Although above the Fed's 2% target, markets welcomed the report as a sign of moderating inflation and a justification for a Fed interest rate cut in September.

Regarding the labor market, part of the Fed's dual mandate for maximum employment and stable prices, initial unemployment insurance claims in the week ended Aug. 9 decreased by 3,000 from the previous week's revised level, while continuing claims dipped by 4,157, US Labor Department data showed Aug. 14. The data alleviated investor fears stemming from an Aug. 1 Bureau of Labor Statistics report that significantly revised job growth estimates downward.

While the Fed did not adjust interest rates in July, two members of the rate-setting Federal Open Market Committee (FOMC) advocated for a 25-bps rate cut, saying that tariffs were unlikely to have a persistent impact on inflation and that downside risks to employment were meaningfully increasing, according to the minutes of the July FOMC meeting released Aug. 20.

"The Fed has more room to cut rates than all other developed market central banks except for the Bank of England," Ryan Swift, chief US bond strategist at BCA Research, told Market Intelligence. "I expect the Fed to be cutting rates by more than most other developed market central banks, but only once we see more meaningful signs of deterioration in the US labor market."