Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Aug, 2025

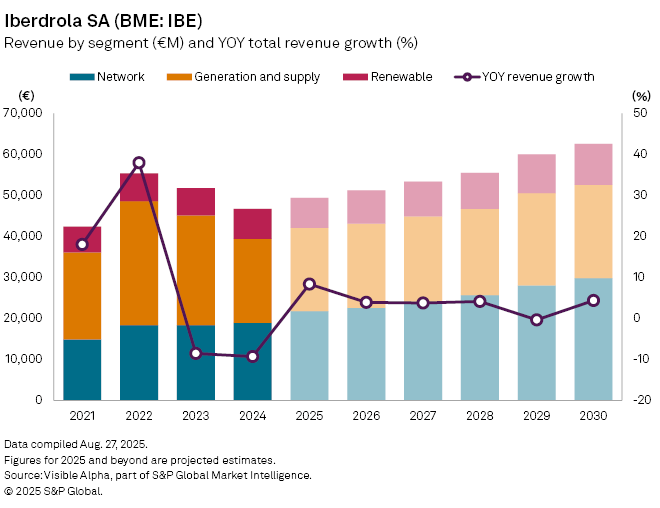

Iberdrola SA (BME: IBE) is on track for a renewed revenue upswing in 2025, poised to recoup losses from last year. According to Visible Alpha consensus estimates total revenue is expected to rise by 8.3% to €48.5 billion, following a sharp 9.3% year-on-year decline in 2024.

The turnaround is expected to be driven by robust performance in the regulated networks segment. Revenue in this business line is projected to climb 15% to €21.8 billion, drawing on resilient grid demand and regulatory support across key markets.

Meanwhile, the electricity generation and supply division is set to stabilize. After a steep 23% drop in 2024, revenues are forecast to fall by a relatively modest 0.9% in 2025 to €20.3 billion, suggesting the worst is likely behind the segment.

However, momentum may remain subdued in renewables. Analysts expect a marginal revenue contraction of 0.1%, to approximately €7.3 billion—highlighting continued headwinds in that segment.

– Learn about Visible Alpha | S&P Global.

– Explore Visible Alpha Add-On for Cap IQ Pro.

– Access Visible Alpha estimates on Iberdrola.

– To receive email alerts for future Visible Alpha articles, select Visible Alpha Data Snapshots under the Authors section.