Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Aug, 2025

By RJ Dumaual and Malik Ozair Zafar

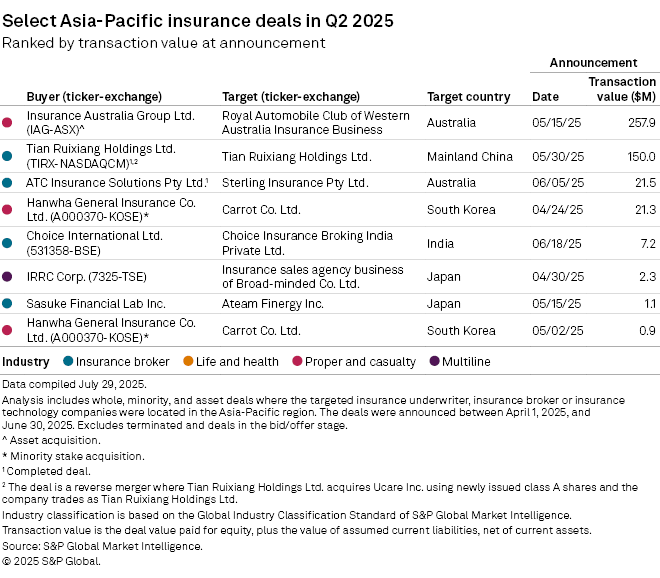

A multifaceted transaction between Insurance Australia Group Ltd. and The Royal Automobile Club of Western Australia Inc. was the biggest insurance M&A deal by value in Asia in the second quarter, according to an S&P Global Market Intelligence analysis.

IAG on May 15 announced a A$1.35 billion deal that will see it buy the insurance business of The Royal Automobile Club of Western Australia (RAC) and enter into a 20-year exclusive distribution agreement for RAC-branded home, motor and niche insurance products. The transaction involved A$400 million to acquire 100% of RAC Insurance shares and an upfront payment of A$950 million for the exclusive distribution agreement. The deal is the latest in a recent trend of Australian insurers acquiring motor clubs to boost distribution.

The second-largest insurance deal in the quarter was a reverse merger arrangement where Tian Ruixiang Holdings Ltd. acquired Ucare Inc. using newly issued class A shares. The all-stock deal was valued at $150 million.

Other notable deals included ATC Insurance Solutions Pty. Ltd. acquiring Sterling Insurance Pty. Ltd. in Australia and Hanwha General Insurance Co. Ltd. absorbing Carrot Co. Ltd. in South Korea.

Deal count

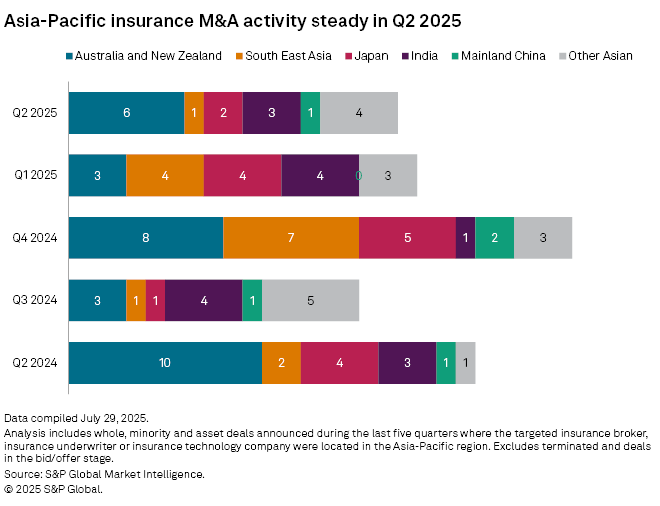

There were six M&A deals recorded in Australia and New Zealand during the second quarter, three in India, two in Japan, and one each in Southeast Asia and China. In India, Choice International Ltd. agreed to acquire the remaining 50% stake in Choice Insurance Broking India Pvt. Ltd. that it does not currently own for approximately 630 million rupees, according to the S&P Capital IQ Transaction Database.

In Japan, IRRC Corp. agreed to acquire Broad-minded Co. Ltd.'s insurance sales agency business, according to the Capital IQ Transaction Database. Sasuke Financial Lab Inc. is acquiring insurance broker Ateam Finergy Inc.

|

– Use the screener to access M&A data on the S&P Capital IQ Pro platform. – Click here to – Read about potential M&A activity in the global insurance sector on In Play Today and a summary of recently announced deals on M&A Replay. |

In the first quarter, there were four deals each in Southeast Asia, Japan and India, and there were three in Australia and New Zealand.

Ten deals were logged in Australia and New Zealand in the second quarter of 2024, followed by four in Japan, three in India and two in Southeast Asia.