Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Aug, 2025

By John Wu

Hong Kong's exchange operator is counting on increasing mainland fund flows to support future growth.

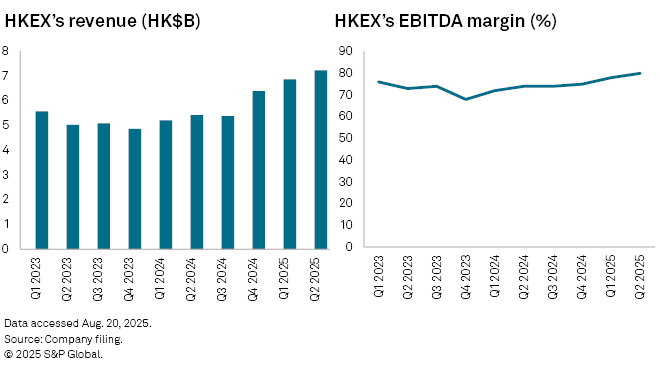

Hong Kong Exchanges and Clearing Ltd.(HKEX) earned a record HK$4.44 billion in net profit in the second quarter of 2025, increasing 40.8% from a year ago and 9.0% from the prior quarter.

The result was driven by a one-third year-over-year jump in revenue to HK$7.22 billion. The volume of average daily trading (ADT) — HKEX's main income source — nearly doubled on top of an earnings before interest, tax, depreciation and amortization (EBITDA) margin of 80%, which is 6 percentage points higher than a year ago.

In an email interview ahead of the earnings announcement, Laura Li Zhiyi, research analyst at CGS International Securities Hong Kong, told S&P Global Market Intelligence she expected the main driver for EBITDA improvement in the second quarter to be the sustained increase in revenue from the high-margin cash trading segment.

Hong Kong's exchange has benefited from southbound flows under Stock Connect, a mutual market access program that allows Mainland China investors to trade Hong Kong-listed securities and vice versa.

Meanwhile, surging IPO activities in Hong Kong by mainland Chinese companies who seek listing abroad to avoid regulatory constraints in Shanghai and Shenzhen, also boosted mainland investors' appetite.

ADT of southbound trading under Stock Connect increased 154% year over year in the second quarter to HK$112.0 billion, accounting for more than half of the HK$220.3 billion total cash trading volume compared to 39.4% a year ago, according to HKEX.

"We expect southbound net inflows to slow slightly in 2026 but not to reverse or turn into outflows," Li said.

Due to the unique nature of stocks available through the Stock Connect program, due to which southbound investors struggle to find substitutes in mainland A-shares, mainland capital will maintain a structural, long-term demand for Hong Kong stocks, according to Li.

Robust IPO

IPOs on the mainland bourses declined following the China Securities Regulatory Commission's increased scrutiny of IPO applications since March 2024, which was aimed at enhancing the quality of new listings.

"After receiving a record number of listing applications over a six-month period, we enter the second half of 2025 with new initiatives that are underway to further enhance the competitiveness and attractiveness of our markets," HKEX CEO Bonnie Chan said in an earnings release.

That includes preparations for a shorter cash market settlement cycle, the expansion of its paperless listing regime, as well as implementing enhanced IPO price discovery requirements and the first phase of reduced minimum spreads, according to Chan.

The CEO said the IPO pipeline "is really robust," with 230 applications.

CGS' Li said the biggest challenge for HKEX is convincing the market of the potential and sustainability of its IPO market. The analyst said concerns remain that a recovery in the mainland bourses' A-shares and the potential easing of IPO restrictions could have a negative impact.

Hong Kong shares have gained in 2025 year to date, with the benchmark Hang Seng Index hitting a near-four-year high early August and closing up 28.2% at 25,165 by Aug. 20, according to Market Intelligence data.

As of Aug. 20, US$1 was equivalent to 7.80 Hong Kong dollars.