Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Aug, 2025

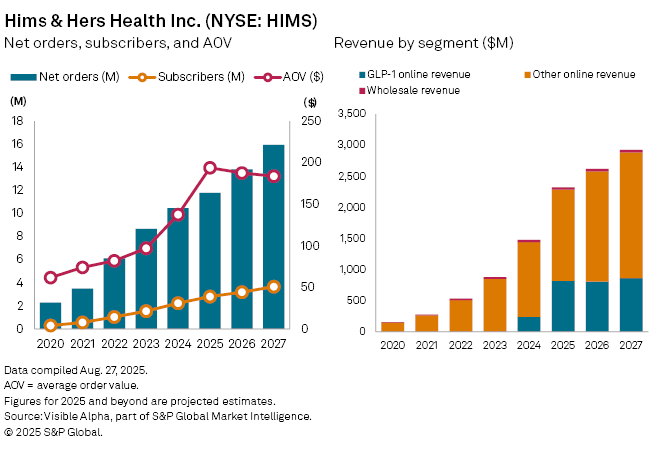

Hims & Hers Health Inc. (NYSE: HIMS) is forecast to post rapid growth in 2025, though regulatory challenges threaten to cloud its expansion story. Visible Alpha consensus estimates point to a 59% year-on-year jump in total revenue to $2.3 billion, supported by rising subscriber numbers, new product categories, and international expansion following its $200 million acquisition of European telehealth provider Zava in June.

The company’s core online sales, which represent nearly all of its business, are projected to climb 59% to $2.2 billion. By contrast, wholesale revenue is expected to shrink 7% to $36 million. Within the online channel, revenue from GLP-1 weight-loss therapies — a fiercely competitive and tightly regulated category — is forecast at $817 million, while non-GLP-1 products, such as hair loss and mental health services, are estimated at $1.5 billion.

Analysts expect the company’s customer base to expand to 2.8 million subscribers in 2025, up from 2.1 million last year. That should translate into 11.6 million orders, up from 10.5 million, with average order value rising to $194 from $137, an improvement that highlights the company’s ability to upsell and broaden patient spend.

But Hims & Hers’ growth trajectory has been overshadowed by its fraught relationship with Novo Nordisk, maker of Wegovy, the leading GLP-1 treatment for obesity. Novo terminated its partnership with Hims & Hers in June, citing the US group’s continued sale of compounded semaglutide — a “personalized” version of the drug that the Danish pharmaceutical company has labelled unsafe and illegal. The fallout triggered a near-35% drop in Hims & Hers’ share price.

– Learn about Visible Alpha | S&P Global.

– Explore Visible Alpha Add-On for CapIQ Pro.

– Learn about Visible Alpha BioPharma.