Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Aug, 2025

By Hailey Ross and Jason Woleben

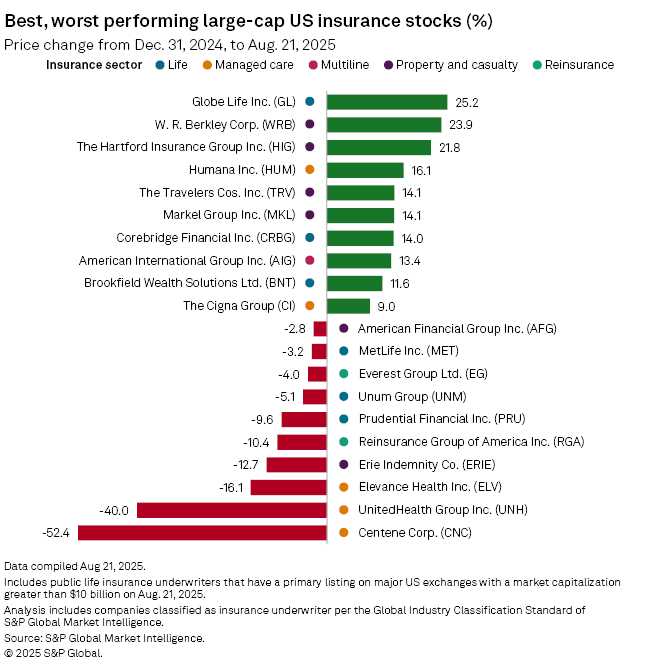

Globe Life Inc., W. R. Berkley Corp. and The Hartford Insurance Group Inc. are among the top performing US insurance stocks year-to-date, with all seeing double-digit increases above 20%.

From the start of the year through close of business Aug. 21, Globe Life leads US insurers as the highest performing stock, an apparent signal that investor confidence toward the insurer is returning after it faced a number of scandals including a federal inquiry and claims of misconduct by short-sellers in 2024. Globe Life shares are up 25.2% year-to-date through market close Aug. 21.

Globe Life's independent audit review found "no merit" to the short-seller allegations and in July 2025, both the SEC and the Justice Department concluded their investigations with no enforcement actions recommended.

"With both investigations now resolved, we expect the valuation overhang to abate, and see strong momentum on a number of fronts," TD Cowen analyst Andrew Kligerman said in a July 28 note.

More winners

Reinsurer W. R. Berkley was the second-highest industry performer year-to-date and Keefe, Bruyette & Woods analyst Meyer Shields rates the stock at "market perform," which is equivalent to hold.

"We think WRB's current valuation reasonably reflects its investment prowess and the steady addition of talented underwriting teams within niche sectors," Shields said in an Aug. 13 note.

Jefferies analyst Andrew Anderson also pointed out in a July 22 note that the insurer has a short-duration investment portfolio, which he believes means "there is considerable near-term upside to net investment income on higher yields and longer term should the company extend duration."

W. R. Berkley, which was also the fourth-largest domestic US E&S underwriter in 2024, has seen its shares grow 23.9% from the start of the year through close of business Aug. 21.

The Hartford also took a spot among the biggest winners year-to-date. The property and casualty insurer reported second-quarter net income of $990 million, which reflected a 35% increase from $733 million in the year-ago period. Core earnings were also up 31% at $981 million, from $750 million a year ago. During The Hartford's second-quarter earnings call, CEO Chris Swift said he was encouraged by progress being made to tackle social inflation and expressed optimism over the impact of tariffs with some of the recent trade agreements the US has made with other countries.

S&P Global Ratings upgraded the long-term local-currency issuer credit ratings of The Hartford to A- from BBB+, and also upgraded the financial strength and issuer credit ratings for The Hartford's core subsidiaries to AA- from A+ this week.

S&P Global Ratings said in its report that the upgrade is due to The Hartford's "sustained improvement in underwriting performance" which it found to be comparable to its peers with higher ratings.

"We regard the company's strong underwriting governance, effective risk selection, and sophisticated pricing strategies as having a positive influence on underwriting performance which has been consistently evidenced through various business cycles and believe it will perform similarly while maintaining lower volatility relative to peers over our forecast horizon," S&P Global Ratings said.

The Hartford shares increased 21.8% since the start of the year through close of business Aug. 21.

Losers

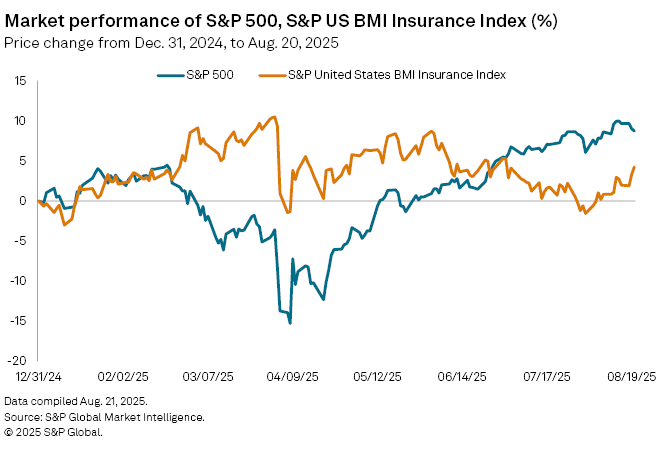

Overall, listed US insurers have underperformed the wider market so far this year. The S&P 500 is up about 8.3% year-to-date while the S&P 500 US BMI Insurance Index has seen gains of roughly 4%.

Several of the biggest industry underperformers this year have been managed care companies as the sector has been plagued with elevated Medicare costs and ongoing federal efforts to slash funding for low-income-focused Medicaid.

Centene Corp. and UnitedHealth Group Inc. are among the hardest hit insurance stocks this year with shares falling 52.4% and 40%, respectively, year-to-date. UnitedHealth was recently revealed as Berkshire Hathaway Inc. head Warren Buffett's mystery stock pick as the renowned investor disclosed with Berkshire's second-quarter 13-F that he had picked up a hefty $1.57 billion stake.

Meanwhile The Cigna Group and Humana Inc. have managed so far to avoid the worst of US managed care troubles as both stocks are trading in the green year-to-date.