Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Aug, 2025

By John Wu and Beenish Bashir

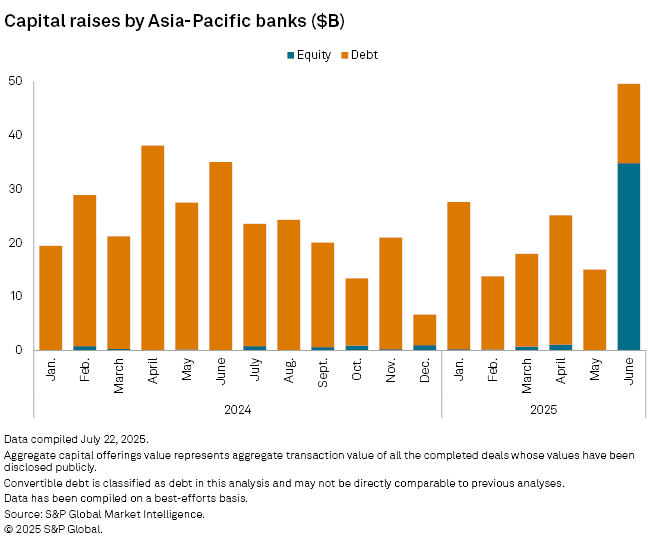

Capital raising by banks in Asia-Pacific jumped in June, primarily due to two mega share sales by Chinese lenders seeking to bulk up their capital.

Lenders in the region raised an aggregate capital of $49.55 billion, the highest since at least January 2024. This was a 41.5% increase from a year ago and more than twice the amount raised in May, according to S&P Global Market Intelligence data. Equity issuances by state-owned Postal Savings Bank of China Co. Ltd. and Bank of Communications Co. Ltd. totaled $34.81 billion, or 70.3% of the total capital raised in the month.

Aggregate debt capital raising fell 57.9% year over year to $14.74 billion, data shows.

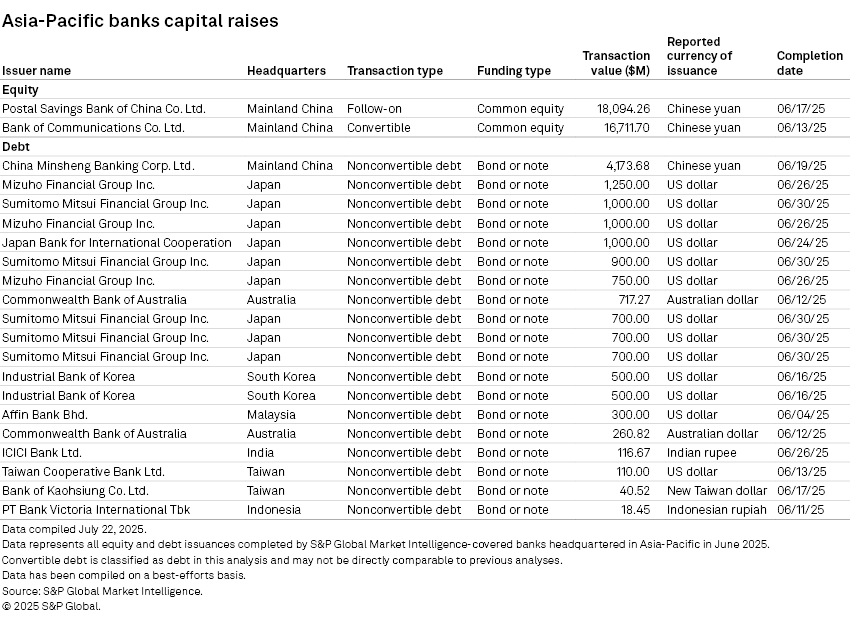

Postal Savings Bank raised $18.09 billion in common equity, while Bank of Communications raised $16.71 billion, comprising the entire equity fundraising in the region. Both lenders said the proceeds would be used to replenish their core Tier 1 capital.

"The bank's profitability and core competitiveness are expected to be further enhanced, with an improvement in operating results and retained earnings," Postal Savings Bank said in a June 20 statement on the equity fundraising. The lender ranked 11th globally by assets as of Dec. 31, 2024. Bank of Communications was in the 13th position.

Trade uncertainties

Fundraising in Asia-Pacific has remained clouded for months amid uncertainties over the US tariffs on imports from its major trade partners and concerns about global interest rates. In recent weeks, the US reached a series of tariff and investment agreements with Japan and the EU, though talks on a deal with China are still ongoing.

Meanwhile, the US Federal Reserve has held steady since December 2024. Rate cuts in the Asia-Pacific slowed as most Asian central banks weigh the next steps in their monetary policy cycles. The Reserve Bank of India was an exception, with a 100 basis points cut in its key repo rate this year, including the latest 50 basis point reduction to 5.50% in early June.

On the debt side, Beijing-based China Minsheng Banking Corp. Ltd. raised $4.17 billion in nonconvertible debt. The proceeds will be used to replenish other Tier 1 capital, according to the lender's news release on June 23.

Japanese banks remained active issuers. Sumitomo Mitsui Financial Group Inc. raised an aggregate $4.0 billion in five nonconvertible debt issues, according to Market Intelligence data.

Mizuho Financial Group Inc. followed, raising an aggregate $3.0 billion in nonconvertible debts in three transactions. Tokyo-based Japan Bank for International Cooperation, a government-owned policy lender, raised $1.0 billion.

Australian lenders were largely absent from the market, except the Commonwealth Bank of Australia, which raised an aggregate $978 million of nonconvertible debt in two issues.