Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Aug, 2025

By John Wu and Uneeb Asim

China's four state-owned megabanks, the biggest lenders in the world by assets, are expected to post mixed results amid stagnant interest margins.

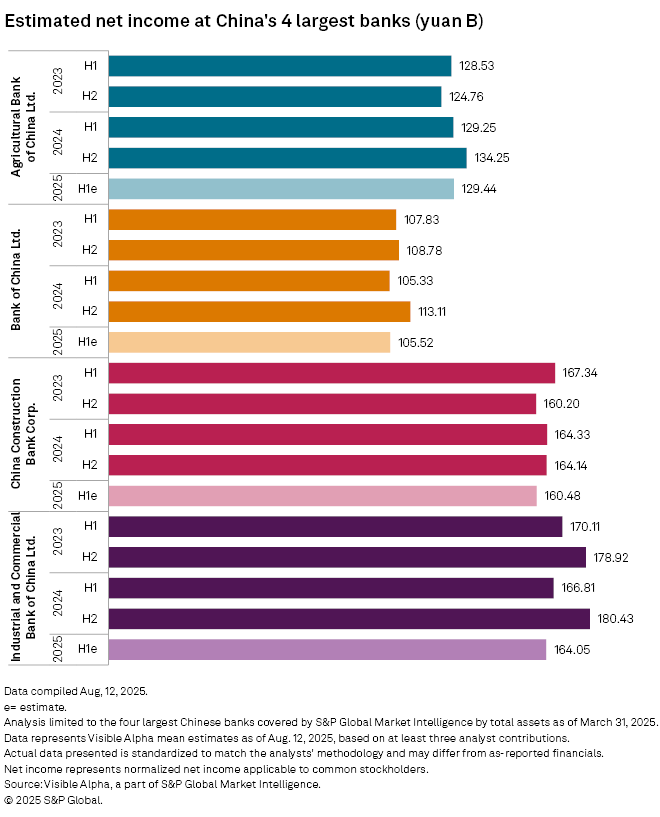

The largest lender, Industrial and Commercial Bank of China Ltd., is expected to see its net income slip by 1.7% year over year to 164.05 billion Chinese yuan in the January-June period this year, according to the mean estimate of analysts who shared their forecasts with Visible Alpha, a part of S&P Global Market Intelligence.

China Construction Bank Corp. could post an income decline of 2.3% to 160.48 billion yuan.

Data show that the remaining two, however, are expected to keep their earnings almost unchanged. The Agricultural Bank of China Ltd. will likely report net income of 129.44 billion yuan in the first half, while Bank of China Ltd. will likely report 105.52 billion yuan.

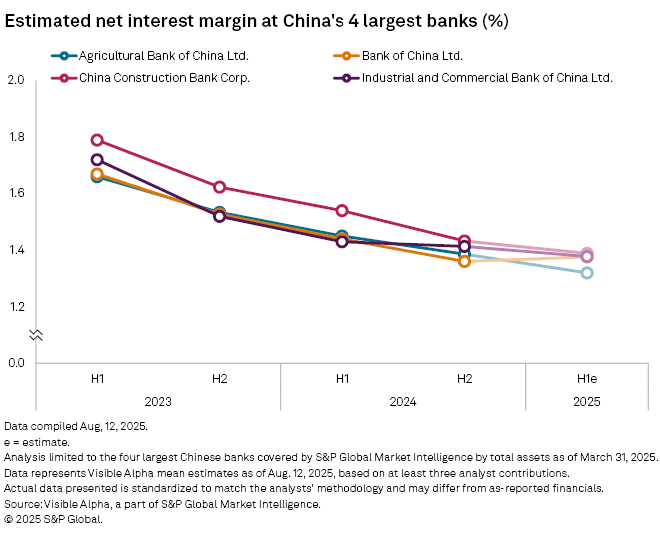

Net interest margins (NIMs), a key component of interest income which is the main revenue source for lenders, in three of the big four will likely continue to contract, though the pace of decline may slow. Bank of China is expected to grow its NIM by two basis points to 1.38%, according to estimates.

"Banks' year-over-year decline in NIM will significantly narrow in the second quarter versus the first, as deposit rate cuts in May exceeded loan rate cuts," Iris Tan, senior equity analyst at Morningstar, told Market Intelligence in an Aug. 19 email interview.

"The biggest challenge for banks remains sluggish credit demand, as evidenced by the first monthly contraction in yuan loans in July since August 2005," Tan said. "The recently announced consumer loan subsidy and recovery in A stock market sentiment are likely to boost credit demand to some extent, but it largely depends on the introduction of pro-consumption policies, the US-China trade deal and the business outlook in the second half."

Still, "the improved stock market sentiment and recovery in bond yield in the second quarter should also lead to higher fee income and investment income," Tan added.

China set its 2025 GDP growth target at about 5.0%, similar to the previous two years. The world's second-biggest economy grew 5.3% in the first half of 2025. The benchmark CSI 300 index is up more than 12% so far this year. Still, a real estate downturn and the impact of global trade tensions remain key challenges.

Data from the National Bureau of Statistics, including industrial production, retail sales and fixed asset investment, showed a deceleration in July, said Lu Ting, chief China economist at Nomura, in an Aug. 15 note. "Underlying the poor headline activity data, we see widespread evidence lending support to our view of a demand setback in the second half," Lu said.

Stable credit quality and dividend

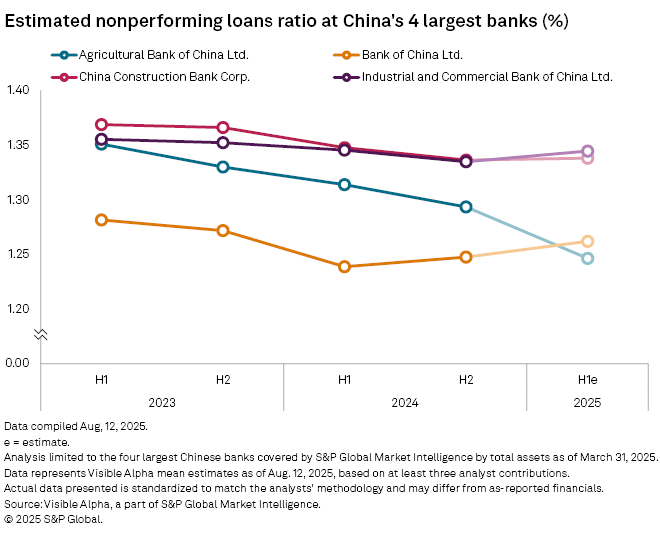

The ratio of nonperforming loans (NPLs) to total loans, a key measurement of credit quality, at all four megabanks will likely remain steady, data show. China Construction Bank's NPL ratio will likely stay at 1.34%, as in the previous six months, while NPL at Agricultural Bank of China could decline by 4 basis points to 1.25%. Industrial and Commercial Bank of China and Bank of China could see their NPL ratios tick one basis point higher each.

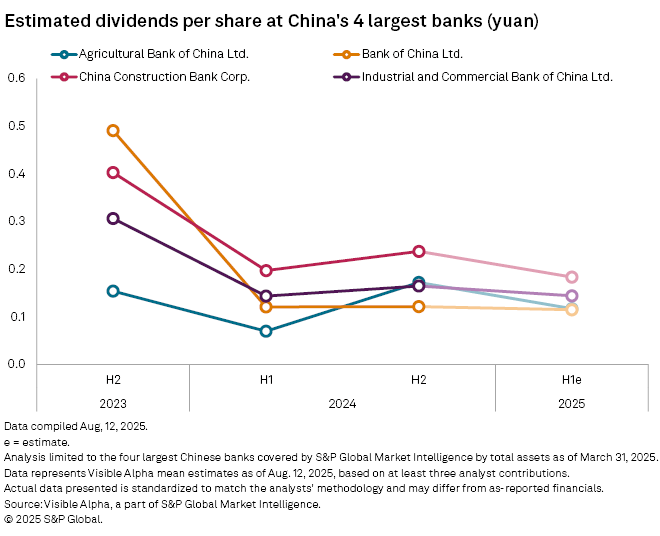

Industrial and Commercial Bank of China is expected to pay an interim dividend of 14 fen per share, unchanged from a year ago. Agricultural Bank of China's interim dividend could surge roughly 70% to 12 fen per share.

As of Aug. 22, US$1 was equivalent to 7.17 Chinese yuan.