Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Aug, 2025

By Hailey Ross and Jason Woleben

Questions around what Berkshire Hathaway Inc.'s newest mystery stock pick might be were answered when it was revealed that the conglomerate made a major bet on beleaguered UnitedHealth Group Inc.

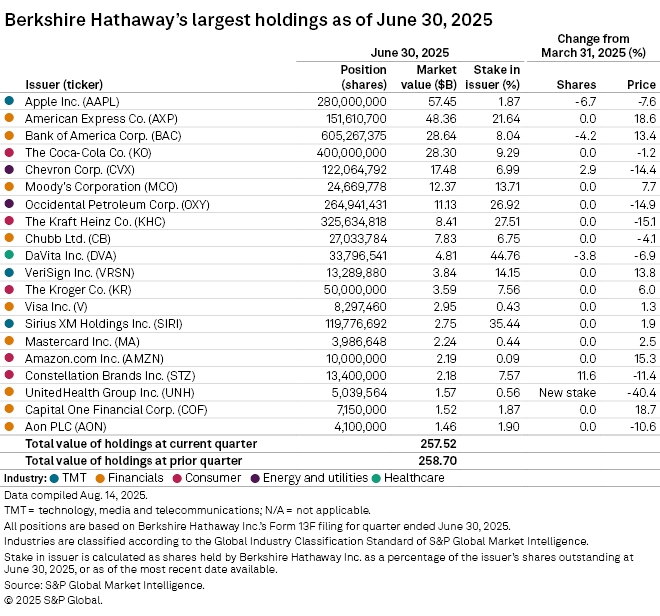

According to its latest Form 13-F filing, Berkshire picked up 5,039,064 shares of UnitedHealth in the second quarter, which were valued at about $1.57 billion as of the end of the period.

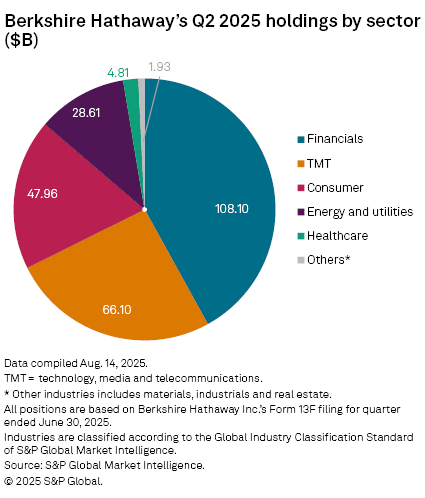

The total value of Berkshire's holdings at the end of the second quarter was roughly $257.52 billion, down from $258.70 billion at the end of the previous quarter.

UnitedHealth's struggles

UnitedHealth has been plagued with issues of late, from elevated Medicare costs to ongoing federal efforts to slash funding for low-income-focused Medicaid. The managed care giant lowered its full-year 2025 earnings outlook as it combats what its CEO Stephen Hemsley called "unprecedented medical costs trends" due to the "intensity of services used, as well as unit prices and more aggressive care provider coding and billing technologies."

Hemsley recently took the helm at UnitedHealth after Andrew Witty stepped down in May after an "unusual and unacceptable" first quarter. The health insurer said in July that it is cooperating with the US Department of Justice regarding a criminal and civil investigation related to its Medicare program.

The most shocking event the company has endured in the past year was the targeted killing of UnitedHealthcare Inc. CEO Brian Thompson in December 2024. Thompson was fatally shot on his way to a investor conference in Manhattan.

UnitedHealth's stock lost roughly 40% of its value in the second quarter.

More Buffett moves

Berkshire decided to exit its investment in T-Mobile US Inc. in the second quarter, dropping nearly 4 million shares, which were valued at just over $1 billion as of the end of the first quarter. The Warren Buffett-led conglomerate slashed its holdings in Apple Inc. and Bank of America Corp., offloading 20 million and 26.3 million shares, respectively, during the second quarter.

The cuts to Berkshire's position in Bank of America reflect a continuation of a strategy seen in the first quarter, when the company exited its position in Citigroup Inc. and reduced its holdings in Bank of America and Capital One Financial Corp.

Berkshire took a new position in steel producer Nucor Corp. worth approximately $856 million as of the end of the second quarter. The conglomerate picked up new stakes in D.R. Horton Inc., Lamar Advertising Co. and Allegion PLC, an Irish-domiciled provider of security products. The stake for each of the three companies was valued at less than $200 million as of the end of the second quarter.

In early May, Buffett surprised investors when he announced he would step down as Berkshire's CEO at the end of this year. Buffett will remain chairman of the board of directors, which unanimously voted to have Greg Abel succeed Buffett as CEO and president. Abel has been serving as the vice chair of Berkshire's non-insurance operations.